Imbert: Kamla‘unpatriotic’ about NIF

Finance Minister Colm Imbert has dismissed Opposition Leader Kamla Persad-Bissessar’s claims that the National Investment Fund (NIF) is a Ponzi scheme, calling her unpatriotic.

“How on earth could asset backed bonds be a Ponzi scheme? We are not using money from new investors to pay old investors. We have $8 billion in blue chip companies, which earn $400 million in dividends backing $4 billion in bonds. Republic Bank would have to collapse and lose 75 per cent of its value before the bonds could possibly be in jeopardy. (Persad-Bissessar) is trying to undermine the national budget with foolish talk. Terribly unpatriotic,” Imbert told Newsday in a text message.

A Ponzi scheme is a type of investment fraud where older investors are paid returns using funds from new investors.

At the UNC’s Monday Night Forum in Avocat, Persad-Bissessar said the NIF was a scam and something that can collapse upon itself and it was “very frightening” especially when the companies that Government wants to divest through these bonds are “going concerns.” “If those companies collapse for any reason you aren’t getting back your money,” she said.

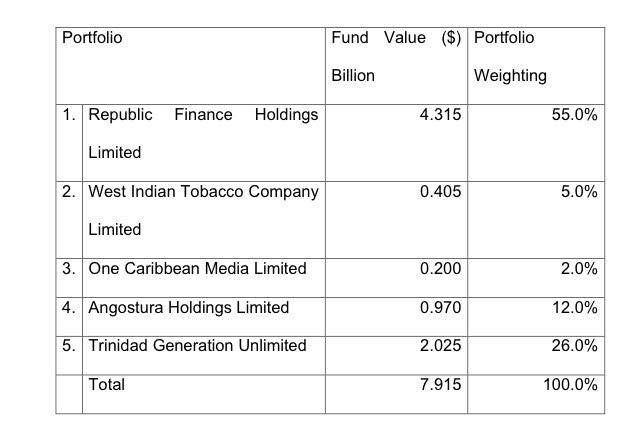

The primary assets of NIF are $4.315 billion worth of Republic Financial Holdings Ltd shares (55 per cent) and $2.025 billion worth of Trinidad Generation Unlimited (TGU) shares (26 per cent). The total asset base of the fund is just under $8 billion. (See table)

In a tweet Wednesday, Imbert referred to these companies as “blue chip,” whose value and earnings are unlikely to decrease over time. Republic shares are the best performing on the local stock market, at $102.76 per share, while West Indian Tobacco Co Ltd, comprising five per cent or $405 million of the NIF, is the second best performing, at $88.02. TGU is 100 per cent owned by Government.

The NIF has received an AA rating from regional credit rating agency CariCris, the second highest available from the firm. In its report, prepared June 22, CariCris cited the high quality of the fund’s underlying asset, which lends to stable and reliable cash flows; adequate debt servicing capacity based on stable investment income; and the likelihood of support from Government, if needed.

On the other hand, CariCris considered NIF’s constraining factors to be discretionary and high in concentration risk; as well as a refinancing risk, given the bond’s structure and refinancing component.

Factors that could lead to a lowering of the ratings or the NIF’s outlook include deterioration in the financial performance of Republic shares and/or TGU shares, which could lead to a 20 per cent or greater reduction in dividend payments, from either of them to the NIF; and a lowering of Government’s credit rating. NIF is expected to be launched by the end of July.

Comments

"Imbert: Kamla‘unpatriotic’ about NIF"