Key moments for Trinidad and Tobago’s energy sector in 2024

Javed Razack

This week’s column aims to summarise the major happenings in the local energy sector for 2024.

TT’s 2025 budget was based on oil at US$85 per barrel (US$92.50 in 2024) and gas at US$5 per mmbtu (US$6 in 2024).

Crude oil plus condensate production averaged just over 50,000 barrels per day for 2024, while gas production was 2.5 bcf/d for the same period.

This continues a downward trend – 2022 was 58,500 and 2.7 bcf/d, and 2023 was 55,000 and 2.6 bcf/d.

There has been significant progress on advancing new gas projects (Cypre, Mento, Coconut and Manatee), but with natural decline of fields, the new production may just keep production flat at best until Manatee comes online in 2027/2028. There has been no final decision on Woodside’s Calypso, the best hope for large new domestic gas. We hope that a decision is made soon, as it will likely take at least seven years to get gas production online.

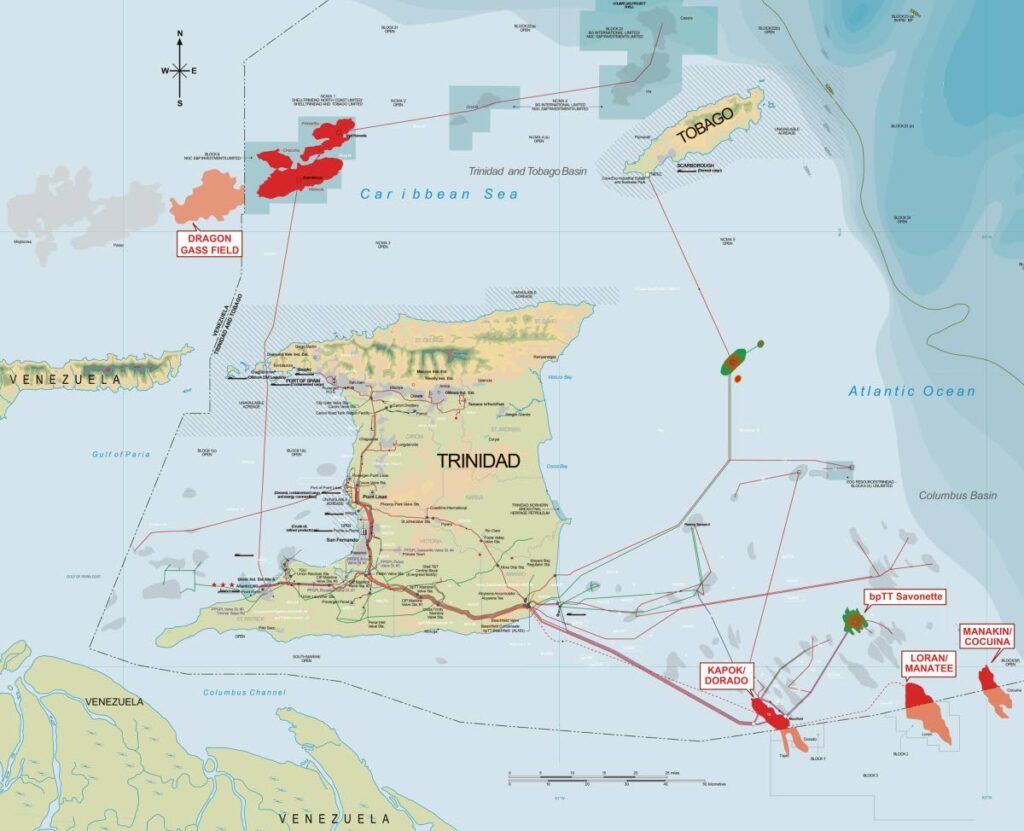

Dragon saw its first technical survey begin at the end of 2024 but continues to be a big wild card after the US election. Many analysts give it a 50/50 chance at best of going forward at this point.

Dragon, Manakin-Cocuina from bpTT and the potential of accessing Loran all depend on the Trump administration’s stance on Venezuela, particularly from US Secretary of State-elect, Mark Rubio, a harsh critic of the Maduro regime.

Some major assets have changed hands this year. Shell’s Central Block will be sold to Touchstone. Meanwhile, Touchstone’s attempt to buy Trinity was thwarted by Lease Operators Ltd, who was successful in its acquisition. bpTT sold several existing fields and undeveloped areas to Perenco, who will now become a significant gas player.

Several blocks have been signed in 2024, ending a long period of little or no success from bid rounds.

A number of onshore and offshore blocks will see seismic and hopefully drilling within the next few years. Getting blocks signed on a continuous basis is key to keep gas supply flowing.

Heritage has held oil production steady, but its production is still less than what Petrotrin did back in 2018. With its vast acreage onshore and off the west coast, Heritage still has the best chance to significantly increase crude production (and hence earn more US$) of any company in the near term. We hope this materialises from its drilling campaigns in 2025.

Not a lot has changed on the downstream side. Plants continue to operate at reduced capacity due to insufficient gas.

Methanex switched out Atlas for Titan, reducing its overall production. The Atlantic restructure began to bear fruit for NGC, which shipped its first cargoes from Trains Two and Three in December.

Tobago experienced a major oil spill from a vessel under the most unusual circumstances. The whole saga really highlighted how ill-prepared we are for a truly big spill from hydrocarbon operations.

Meanwhile, our Caricom neighbours, Guyana and Suriname, have been very busy in their energy sectors.

Five years ago, Guyana produced no oil and today they are at 650,000 barrels per day. Exxon has several more FPSOs in development, and Guyana is expected to pass one million barrels per day in 2027. Exploration by Exxon continues in Guyana, while new operators have entered the market after their recent bid round. Not to be outdone, Suriname has reached Final Investment Decision (FID) on their first offshore development – Gran Morgu, a 700 million barrel field being operated by Total Energies. The project is estimated to cost a whopping US$10 billion. Petronas is approaching FID in Suriname as well, and its recent bid round also saw new blocks being signed. NGC should be creating opportunities to collaborate with Staatsolie on gas developments in Suriname.

All in all, the region is extremely hot for oil and gas development, with resources moving away from TT towards Guyana and Suriname.

Local service sector costs have already been escalating and this is not expected to stop. Forex shortages in TT have worsened, threatening many energy service providers, who have been hanging on for a few years now and are reliant on forex to keep their businesses running.

On the new energies front, TT’s first utility scale solar project is expected to be online in 2025, despite many delays and challenges thus far.

Hydrogen has made some progress, although it still seems we are moving too slowly on making a pilot project a reality.

Overall, we are seeing major progress on multiple Venezuelan gas fields, but geopolitics can put a stop to that at any time. It is critical we get our deepwater gas to market as well as Manatee, as these are the projects within our realm of control. While these are being developed, the new development projects will attempt to arrest the decline from existing fields. However, all signs indicate that economically 2025 to 2027 will be quite difficult from multiple perspectives. We need to be cognisant about this and plan accordingly as a country.

Bid rounds and upstream acquisitions

• June: Contracts for five onshore blocks have finally been signed, coming out of the 2022 onshore bid round. These include Aripero block, Nabi Construction Ltd and Heritage; Buenos Ayres block, Oilbelt Services Ltd and Heritage; St Mary’s block, A&V Oil and Gas Ltd and Heritage; Cipero block, Touchstone and NGC; and Charuma block, Touchstone and NGC.

• June: Touchstone’s minimum work obligations include reprocessing of 426 km of 2D seismic data for the Cipero block and 784 km for Charuma.

Charuma also requires reprocessing of 61 sq km of 3D seismic data. Exploration drilling commitments include four wells for Cipero and one well for Charuma.

• September: Shell signed a PSC with the Energy Ministry (MEEI) for the Modified U(c) Block, off Trinidad’s east coast. This resulted from the shallow water bid round that opened in October 2023 and closed in May 2024. The MEEI hailed this as a record from bid round to signing a PSC.

• November: bpTT been awarded the NCMA 2 block as part of the Shallow Water 2023/24 bid round that closed in May 2024. The block is off Trinidad’s north coast. It was last operated by Niko Resources who had planned to drill a gas prospect in 2013 but failed to meet its minimum work obligations.

• November: Touchstone and NGC were awarded an E&P licence for the Rio Claro block (80 per cent and 20 per cent respectively).

The licence requires a minimum exploration work programme which includes the drilling of three exploration wells and the reprocessing of at least 130 sq km of seismic data. In May, Touchstone had reached an agreement with Trinity to acquire all of their shares. However, in July, Trinity announced it had received a cash bid from locally owned Lease Operators Ltd to acquire its shares for approximately US$33 million. In November, 99 per cent of Trinity shareholders voted in favour of the acquisition. Trinity produces approximately 3000 bbl of oil plus condensate per day.

• December: Touchstone has entered into an agreement with Shell to acquire their Central Block asset for US$23 million in cash. This is subject to approvals from Shell’s JV partner Heritage (35 per cent) and the MEEI. Current gross production from the Central block is approximately 18 mmscf/d of natural gas and 200 bbls/d of natural gas liquids from four wells in the Carapal Ridge, Baraka and Baraka East fields. Touchstone also said they will look at infill drilling in Central Block to boost production and a deep Cretaceous prospect.

Tobago oil spill

A calamitous event occurred in February – a capsized ship off the coast of Cove, Tobago, was found leaking an oil-like substance which was washing up on the coast.

As the story unfolded, it became stranger and stranger. No distress call was received from the vessel and there were no people on board, nor any bodies found.

The vessel was eventually identified as the Gulfstream barge, allegedly originating in Panama and was secretly carrying diesel from Venezuela to Guyana for the its power plant, a narrative which was heavily disputed by the Guyanese government. The barge had to be towed by a tug, which was ultimately found to be the Solo Creed.

It is assumed the barge ran into problems and the tug took the crew and abandoned the barge.

The tug was eventually tracked down to Angola and was “arrested,” meaning it will not be allowed to leave the country unless a security bond is made in the interest of the TT government.

The status of the legal proceedings is unknown at the time of writing.

There was great damage to the coastline, to marine life, fishing and tourism for several months. The long-term effects are being monitored by multiple agencies.

The government and THA along with other various state agencies came under heavy fire for what appeared to be a slow and disorganised response.

It took months of work led by the Energy Ministry to refloat the barge by August and move it. Oil from the spill travelled as far away as Bonaire.

In all, over 50,000 barrels of oil and over 16,000 cubic meters of waste were cleared from Tobago coastal areas.

The cost to the government for cleanup is expected to exceed US$30 million. The government has said they are attempting to access an international spill fund to help with these costs.

General upstream updates

• January: Energy Minister Stuart Young gave some updates at the Energy Conference, including that deepwater Calypso from Woodside had the potential to produce 700 mmscf/d.

• January: The Valaris 118 jackup rig was undergoing routine maintenance in Chaguaramas ahead of a six-well extension with bp. This extends the original contract from October 2022. The extension was valued at US$51 million.

• February: EOG said that its daily production in TT was set to grow about 50 mmscf/d in 2024. EOG also said it plans to complete the remaining wells in the current drilling programme in the Modified U(a) Block. The company also expects to drill and, if successful, complete two exploratory wells in the SECC block, to re-complete two wells in the Sercan Area, drill one exploratory well in the TSP Area and has plans to complete construction and installation of the platform and related facilities in the Mento Area.

• June: Shell began acquiring 3D seismic data over the deepwater blocks 25(a), 25(b) and 27 with the PXGEO2 seismic vessel.

The survey is expected to take three months. These blocks were awarded to Shell in 2023.

• June: Woodside announced they paid the government US$135.5 million in 2023. This comprised of the government’s share of oil and gas from its producing fields as well as other smaller associated fees.

• July: Trinity’s quarter two operational update had some highlights: Re-complete Jacobin uphole; production averaged at 2,522 barrels per day; and 18 workovers and four recompletions were done for the period.

• July: Shell has contracted the Valaris 249 from approximately May 2026 for an eight-well campaign, with an estimated period of one year at a value of US$66 million. This project is expected to be Manatee. This jack-up is currently with EOG and is planned to go to Perenco for one appraisal well in TSP during the last quarter of 2024.

• August: Shell has completed a nine-month workover and well abandonment campaign at its Dolphin field.

• September: bp announced the completion of its replacement pipeline project Ocelot – its fifth infrastructure upgrade project in six years.

The Ocelot project consists of a new seven inch onshore liquid pipeline that connects bpTT’s Beachfield facility to the Galeota Terminal facility.

• September: Shell will be using the PXGEO2 vessel that acquired 3D seismic over its deepwater blocks and Manakin-Cocuina to acquire 3D data over their newly signed Modified U(c) Block.

• September: Year-to-date, Heritage’s crude oil production has averaged just under 35,000 barrels per day, more or less the same as in 2023 for the same period.

• November: Heritage announced the commissioning of a steam generator aimed at significantly improving oil recovery in the Forest Reserve area.

• November: Shell and McDermott have awarded TOFCO the fabrication contract for Manatee’s jacket and piles, which will kick-off in December 2024.

The topside is being built at Mc Dermott’s Altamira Fabrication Yard in Mexico.

• November: Touchstone announced initial production from the Cascadura C well pad. It is currently conducting production testing operations on the Cascadura-2ST1 well and expects to advance to the Cascadura-3ST1 well after.

• December: Perenco has announced the completion of the acquisition of the mature Cashima, Amherstia, Flamboyant and Immortelle offshore gas fields and associated production facilities, as well as the undeveloped resources from the Parang field (CAFI asset), from bpTT, making it a significant gas producer in TT.

• December: bp will be cutting costs locally to meet a global mandate to achieve at least US$2 billion in global cash cost savings by end of 2026.

Sick leave will be reduced from 90 to 15 days and some jobs will likely be cut.

• December: Rig collapse – at the time of writing, a terrible incident is unfolding, where Heritage’s jack-up rig, while drilling in Trinmar, collapsed on December 22.This is locally owned by Well Services 110 rig, which has drilled for Petrotrin and now Heritage for many years. The cause of the incident is yet to be determined.

New gas projects

• February: bp spud the first of seven wells on Cypre, a subsea development that will connect gas from the Cypre field to the Juniper platform via two new 14-kilometre flexible flowlines.

This field has a resource base of approximately 500 bcf and is expected to produce 250- 300 mmscf/d, with first gas in 2025.

• July: bp together with NGC has been awarded an E&P licence by the Venezuelan government for the development of the Cocuina gas discovery.

Cocuina is part of the cross-border Manakin-Cocuina gas field. In May, TT was granted an OFAC licence from the US government for the development of this cross-border field – 66 per cent of the field is in Trinidad (Manakin) and 34 per cent in Venezuela (Cocuina). In October, it was reported that 3D seismic acquisition over the field had been completed by the PXGEO2 vessel.

bp is the operator with 80 per cent of the licence and NGC has a 20 per cent stake. The field contains approximately one TCF of gas.

This project’s development now depends on the new US government’s stance on Venezuela and continuance of the OFAC licence.

• July: Shell has announced that it has taken FID on Manatee. First gas is projected end of 2027. The Manatee field is part of the cross-border Loran-Manatee discovery, shared by Trinidad and Venezuela. The field is holds about ten TCF of natural gas, with 7.3 TCF on Venezuela’s side and the remaining 2.7 TCF on Trinidad’s side. Manatee is projected to produce 600 mmscf/d at peak.

McDermott has been awarded the EPCI (Engineering, Procurement, Construction and Installation) contract for Manatee. This is by far the most significant new gas project in TT.

• August: EOG and bpTT have agreed to partner on the Coconut gas development. Coconut will be a 50/50 joint venture with EOG as operator. The FID has been taken by the joint venture partners and first gas is expected in 2027. The Coconut field is located off the southeast coast of Trinidad and was discovered in 2005 by bp. Development cost is in excess of US$1 billion.

• September: Woodside indicated work is progressing. Woodside and bp are the stakeholders in the blocks (70 per cent and 30 per cent respectively).

Calypso has approximately 3.2 TCF of gas. If it goes to development, it would be the country’s first deepwater hydrocarbon project.

Earlier in 2024, the Energy Ministry said revised fiscal terms for Calypso were progressing well. FID to proceed or not is expected by mid-2025.

• October: Energy Minister Stuart Young announced during the budget that deep negotiations are ongoing with the Venezuelan government to allow Shell to also produce from the Loran field.

Until such time, Shell is moving ahead with just the Manatee portion. Loran, located on Venezuela’s side of the border, comprises 7.3 tcf of gas, while Manatee, situated on TT’s side, is estimated to hold 2.7 tcf.

• November: The Mento platform being built at TOFCO has entered the final stages of construction. The new facility will be deployed at the Mento development, a 50/50 joint venture between bp and EOG, with EOG as the operator. The Mento asset will be a 12-slot, manned facility off Trinidad’s southeast coast. First gas is expected in 2025. After previous developments, EMZ (2011), Sercan (2016) and Banyan (2017), Mento will be the fourth joint venture development between bp and EOG. Mento was discovered in 2020 and has been fast-tracked into development.

• Dragon has made significant progress in 2024 with the first two vessels starting geotechnical surveys to acquire data for drilling of wells, placement of subsea infrastructure and the pipeline route to the Hibiscus platform. Shell hired two vessels in October and November – the Dona Jose II and Go Electra – to conduct a mixture of geophysical and geotechnical surveys, projected to end in December 2024. The data is to be studied in 2025 and if all goes well, drilling and pipeline construction would occur in 2026 and 2027. However, the future of Dragon relies heavily on the new Trump administration and their stance on Venezuela. Shell has not taken FID on this project and likely will not until the way forward is clear.

Downstream activity

• Niquan’s situation continued to deteriorate in 2024. In May, Niquan’s 80 employees were terminated as the plant continued to be mothballed.

In October, a receiver was appointed to manage the company’s assets. A plethora of legal challenges continue to plague the company.

• June: Suriname state oil company Staatsolie signed two agreements with National Energy – an MOU for joint study of sustainable energy projects and a letter of intent for capacity building and knowledge exchange.

• August: Proman said TT has the potential to become a methanol bunkering hub as it welcomed its methanol-powered ship, the Stena Prosperous, to be refuelled in Point Lisas.

Methanol powered vessels are gaining traction globally.

• September: Methanex restarted its Titan plant after having signed a two-year gas contract with NGC in 2023. Simultaneously, it announced its Atlas plant will be placed in preservation mode due to the expiry of its 20-year gas contract. Titan has an annual production capacity of 875,000 tonnes of methanol, while the larger Atlas plant has a capacity of 1,085,000 tonnes per year.

This will lead to a fall in methanol production of at least one million tonnes per year.

• July: The TT Iron and Steel Company Ltd has acquired the former Arcelor Mittal steel plant in Pt Lisas. It announced an immediate start to refurbish the plant, with operations to begin in 12 months. The Mittal plant ceased operations in 2016.

• September: The Energy Ministry, NP, National Energy and Paria signed an MoU to collaborate on positioning TT as the Caribbean’s first low-carbon marine bunkering hub.

The MoU commits the three agencies to immediately conduct a feasibility study that will evaluate the potential to supply low-carbon marine fuels (such as methanol) to ships operating on trade routes throughout the Caribbean. That study is expected to conclude by April 2025, after which an implementation plan will be developed, with the goal of making the hub operational by 2026.

• October: Atlantic’s restructure has finally taken effect. Under the original structure, Shell and bp held 54 per cent and 40 per cent stakes, respectively, in Trains Two, Three and Four.

NGC had a ten per cent stake in Train One and an 11.1 per cent stake in train Four but no ownership in Trains Two and Three. However, the new agreement simplifies the ownership structure across all four trains. Shell and bp now each hold a 45 per cent stake, while the NGC’s share is ten per cent. One of the key strengths of the restructure is that it allows third parties to bring gas to Atlantic, whereas previously only shareholders could do this.

• October: Young said a cabinet-appointed committee appointed to evaluate expressions of interest had selected three bidders: CRO Consortium (comprising local company DR Rampersad and Co Ltd, Chemie Tech LLC and Ocala Group), US-based iNca Energy LLC and Nigeria-based Dando PLC.

• November: For the nine months ended September 30, TTNGL has achieved a remarkable 153.2 per cent increase in profit after tax over the same period in 2023.

The company posted an after-tax profit of $82.8 million, up significantly from $32.7 million in 2023. TTNGL’s share price however continued to fall in 2024 and at the time of writing was at an all-time low of $4.00. The IPO price was $21 back in 2015.

• December: Nutrien disclosed they spent US$130 million on TT operations in 2024.

• December: NGC has shipped its first two cargoes of LNG from Atlantic’s Trains Two and Three since the commercial restructure of Atlantic in December 2023.

The shipments left Atlantic’s facility in Point Fortin on November 26 and December 6, bound for Italy and Egypt respectively. Under the new commercial structure of Atlantic.

New energy developments

• Solar: bp and Shell’s Project Lara was planned to be a 112MW project will be split in two sites – at Brechin Castle (92MW) and Orange Grove (20MW).

In January, NGC Green announced it was taking a 30 per cent stake in the project. In the same month, bp announced the Orange Grove land had been repurposed by government and that segment would no longer proceed. The project now entails a 92 MW solar farm split over two sites, totalling 186 hectares and an overhead 2.8 km grid connection line to the existing Brechin Castle Substation. In May, it was reported that the Brechin Castle site had been stalled due to gunmen threatening workers. In December, NGC said works was progressing well and the plant would be operational in 2025.

• April: HDF Energy out of France acquired 70 per cent of KGL’s NewGen project, a planned US$200 million clean hydrogen plant, meant to supply 20 per cent of the hydrogen needed for an ammonia plant in Pt Lisas.

• July: The first ground mounted commercial scale solar park was opened at the Piarco Airport. This was financed through an EU grant of EUR1.5 million. The park has a generation capacity of 0.5MW.

• November: Lidar devices were deployed to Galeota and Orange Valley to acquire wind data for 12-18 months, under the Wind Resource Assessment Programme (WRAP) for TT. The 2023 preliminary study identified these two sites as the best for wind energy in TT.

• December: Young announced that cabinet has approved the first green hydrogen pilot project, which will be completed at Pt Lisas.

He said CAF (Development Bank of Latin America and the Caribbean) will be assisting with this pilot project.

This article was submitted by the GSTT.

Comments

"Key moments for Trinidad and Tobago’s energy sector in 2024"