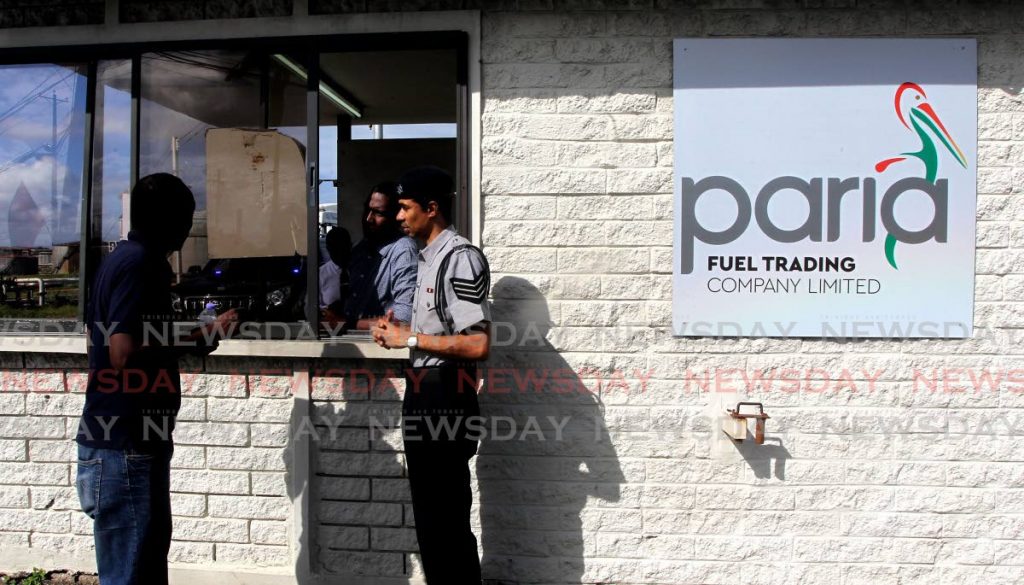

Paria posts $109m profit, $7.3b in revenue

For its first ten months of operation, Paria Fuel Trading Co Ltd earned $7.3 billion in revenue and a profit after taxes of $109 million. The company also managed to maintain a positive cash flow from operating activities of $487.7 million, with $575,000 used in investing activity.

In the company’s audited financial statements for the period ending September 30, 2019, published Thursday, chairman Newman George said the company’s performance “demonstrates its thriving success.”

“The company has exceeded expectations by generating a profit despite the low margins associated with the fuel trading business,” he said. Paria began operations on December 1, 2018, following the dissolution of its predecessor Petrotrin in September that year. Paria took over Petrotrin’s bunkering and fuel trading business, while its sister company Heritage Petroleum took over the exploration and production business. Both fall under the umbrella of Trinidad Petroleum Holdings Ltd (TPHL).

Paria paid $83.7 million in income tax, $291.9 million in VAT and made $72.6 million in corporation taxes and green fund levy payments. Of the 13.4 million barrels of fuel the company sold in the period, 7.2 million went to the local market. The company also facilitated the export of Heritage’s 11.2 million barrels of crude oil. The company also continuously invested in ensuring the asset integrity of its port and terminalling facilities. “As the company manages to lower demand for fuel due to the covid19 restrictions, the board and management have been placing greater emphasis on business efficiency and lowering the cost of operations to ensure sustainable profitability,” George said.

Of note, the company’s operations were classified in the summary statement of comprehensive income (the income statement) as “discontinued operations” because the company, and its sister, Guaracara Refining Co Ltd, are now considered “assets held for sale” after the announcement last September that Patriotic Energies and Technologies Co Ltd had won the bid to purchase the Pointe-a-Pierre refinery’s assets, which include Paria’s infrastructure.

Comments

"Paria posts $109m profit, $7.3b in revenue"