Scotia leads the way

Four years ago, Scotiabank opened its Operations and Shared Services Company at Ramsaran Park, Chaguanas.

The bank's operations in 12 Caribbean countries were supported by more than 450 employees when it opened in August 2013. Since then, the hub has grown tremendously and now has more than 750 men and women providing support both for the bank's regional operations and for customers in 18 of the 21 Caribbean countries in which Scotiabank has a presence.

The hub was the culmination of a memorandum of understanding (MoU) signed in August 2012 between the Bank of Nova Scotia, the TT International Financial Centre (TT IFC) and TT Free Zones Company Ltd.

Scotiabank TT managing director (MD) Stephen Bagnarol highlighted why Trinidad was deemed the ideal location for a regional hub.

"The infrastructure and telecommunications network are well established, with the capacity to support cross border operations with other regional players. Another important factor was the availability of a diverse and skilled workforce where English is the primary language. Our parent company invested TT$100 million to construct this state of the art building which now houses all our units under one roof."

Bagnarol assured that Scotiabank's "number one priority is to become an even more customer-focused organisation," which the bank is achieving through the development and roll out of our digital transformation agenda.

He said this allows the bank to "simplify, digitise and enhance" its customers’ experience, thereby making it easier to serve them while becoming more efficient.

"The shared services hub facilitates our front-line employees’ focus on providing advice and solutions to customers as the back office functions are carried out separately, here. Furthermore, the hub allows us to provide best in class service and continue in our thrust of continuous improvement in the service delivery platform to all our customers at the lowest cost," Bagnarol said.

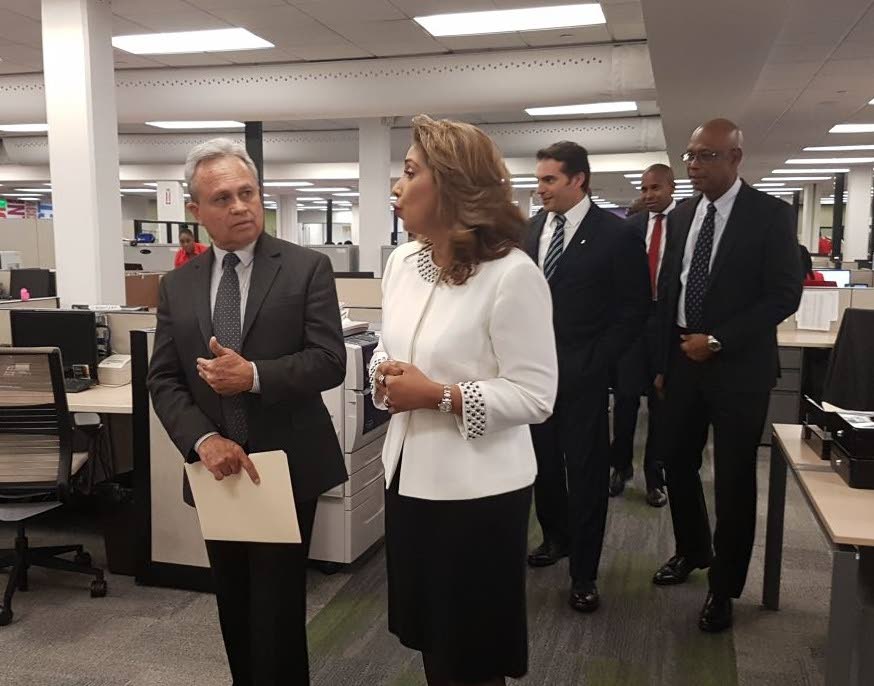

Finance Minister Colm Imbert was given a tour of the facility by its vice president, Carlene Seudat on April 4. The tour delegation included Bagnarol and TT IFC chairman – and former Scotiabank TT MD – Richard Young.

The services provided range from commercial and corporate customer support to account processing, credit recovery support, lending verification and enhanced due diligence.

Addressing fellow guests after his tour, Imbert noted that the hub's distributed services unit provides vendor management, contract negotiation, project analysis for all out-sourced functions and real estate management to 12 Caribbean countries, while the operational risk unit supports the bank’s high risk portfolio and United States' Foreign Account Tax Compliance Act compliance for 12 Caribbean countries.

Imbert commended Scotiabank for "taking the initiative" several years ago and "playing a lead role" in the diversification of TT's financial sector.

"As we are all aware, the economic future of our country requires creative and innovative ideas for the generation of additional revenue and the development of new income streams. We are here to celebrate one such innovative idea and the opportunities that can be created by such innovation."

Reiterating Government's commitment to navigating the "turbulent economic tides" to put TT on a sustainable growth path, the Finance Minister declared that having the hub here "sends a clear signal that aspects of the economy of TT are transitioning from the traditional revenues of oil and gas to business process outsourcing for financial services."

Adding that these centralised units provide the backbone of banking operations for Scotiabank regionally and set the scene for TT becoming the regional banking service hub, Imbert said the bank's shared services centre "points the way to the creation of high value employment and development of local expertise."

"It is noteworthy," Imbert said, "that TT was selected as the site for the establishment of this free zone enterprise because of, among other things, its highly skilled and available labour force, well-established infrastructure and robust telecommunications network.

"We believe that these factors, which are critical for the success of this endeavour, are also critical for the success of our nation and as a government, we will continue to support and encourage initiatives which are aligned with our national development strategy."

Highlighting that TT's financial services sector "continues to be one of the highest contributors to GDP (gross domestic product) after oil and gas," Imbert said it was heartening to witness the success of an enterprise "that clearly demonstrates that the sector can evolve and grow – key hallmarks of sustainability."

Declaring the administration's hope that "as Scotiabank takes the lead in the drive towards diversification, (the hub) will provide inspiration for the further development of the sector," Imbert strongly encouraged the private sector to continue seeking out opportunities for continued growth, sustainable development and diversification of the economy.

The minister also declared that the 750-plus hub employees – "all qualified banking professionals, working in a number of diverse areas of financial services, in good and meaningful sustainable jobs, with a defined career path in banking and finance – are at the forefront of the 21st century workforce and integral to TT's development."

Shared services hubs as a driver of economic diversification away from oil and gas revenues was also the subject of remarks that day by the TT IFC chairman.

Young pointed out that "the potential for finance and accounting, business process outsourcing (BPO) in TT is immense, (since) the global outsourcing industry in the Caribbean alone generates as much as US$2 billion.

"Scotiabank is already a part of this (so) it is imperative that we continue to develop our capacity locally, so that TT can become a viable player in the BPO industry. This will redound to added value to our country, our workplace and to ourselves."

Young assured the TT IFC remains committed to development of the country's financial services sector and to institutions like Scotiabank TT, with whom the state agency has already signed two MoUs.

"We signed one in 2012 at start up of the centre and again in April 2015, followed by a contract to provide a recruitment incentive. All of this specifically to support (Scotiabank) in their efforts to create meaningful jobs and earn foreign exchange.

"We encourage other companies to follow the example of Scotiabank’s (hub) to achieve the organisational efficiencies that flow from the creation of centres such as this. As an investment promotion agency, the TT IFC will certainly provide advice and assistance for your efforts."

Young also spoke about feeling "a profound sense of satisfaction and pride" during his tour of the hub.

"Back in 2012, I was instrumental in getting the free zone regulation changed to accommodate Scotiabank’s venture into the shared services industry. I wish to openly thank Michael LesChaloupe, who was the then general manager of the TT Free Zone Company, who saw the opportunity and potential.

"Michael worked to get the regulations changed to provide the incentives to make the centre a reality. Six years later, I stand here extending heartfelt congratulations to the Operations and Shared Services Company on the successful expansion of their shared services centre," Young said.

Comments

"Scotia leads the way"