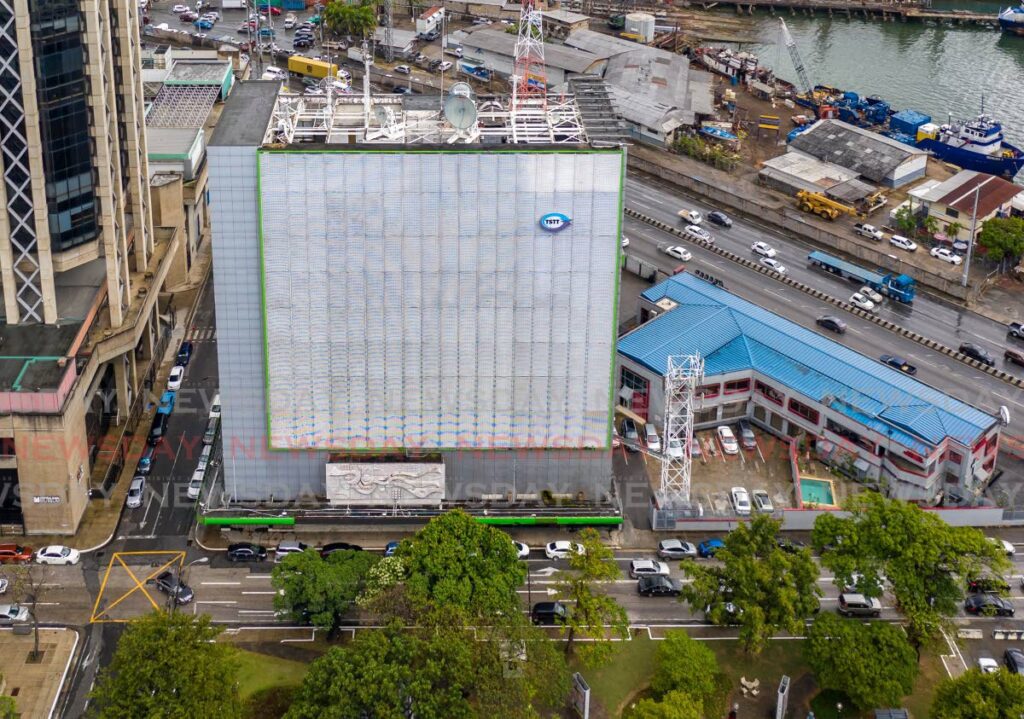

TSTT working on single pension plan to cover retirees, employees

TSTT is working to create a single pension plan to cover the needs of retirees and current employees, the company said in a statement on Wednesday.

The state-owned telecommunications provider gave this response to an appeal by TSTT retirees and those of its predecessor, Telephone Company (Telco), for increased pension payments.

It said it has been in discussions with the Communications Workers Union (CWU) and awaited feedback on the single plan.

The company said there are "limitations" on what it can do about the applicable pension plans which are managed under a "robust regulatory framework."

"We have been working towards the development of one pension plan that will eliminate the unfortunate duplication of costs, and forgone consolidated assets maximisation," it said.

"This approach is set to increase efficiency, optimise performance and address concerns, (inclusive of an enhancement of pensioners’ benefits) as best as is practical, that are faced by former employees."

Ian Clarke, a former manager, had written to TSTT on behalf of 1,500 pensioners and their families seeking the increased pensions. Clarke said there were Telco/TSTT pensioners who were classified as senior staff and who receive monthly pensions of over $10,000, but some former junior staff, by contrast, were receiving less than $1,000 a month.

He said a pension valuation exercise by the actuaries of the plan, Bacon Woodrow and de Souza, on March 31 showed the plan had a surplus of more than $771.1 million. RBC is the plan’s trustee.

Discussions earlier this year between TSTT and the CWU, he said, led to agreement on three critical matters:

· The payment of minimum pension levels to retired employees.

· The reinstatement of three per cent of monthly pension and a one-off payment to retirees for for 2009-2020 to compensate for the company’s stopping annual pension increases.

· The reimbursement of 1.5 per cent of monthly salary deducted by mistake from employees’ contributions to the pension plan for 1994-2000.

Clarke said actuaries said the cost of making these changes would amount to approximately $200,000 and would not adversely affect the plan.

TSTT said the three items are "part of a larger holistic conversation" for a memorandum of agreement (MoA) with the CWU.

"They are not mutually exclusive and are dependent on the execution of the MoA by the parties."

TSTT said it remained committed to resolving the pension issues for all stakeholders.

Comments

"TSTT working on single pension plan to cover retirees, employees"