CAL's flight path to fiscal recovery

Taxpayers must have breathed a sigh of relief when Finance Minister Colm Imbert announced that Caribbean Airlines Ltd (CAL) had reported an operating profit of US$24 million in 2023, minus debt service. Imbert made this announcement at the airline’s customer appreciation event last Thursday at the Hyatt Regency.

BWIA was shut down on December 31, 2006, and CAL commenced operations on January 1, 2007, with a clean balance sheet.

During its initial years, CAL’s operations were profitable. However, subsequent events saw a reversal of its fortunes.

In 2011, CAL decided to replace its ageing Bombardier Dash 8- 300 fleet with ATR 72-600 aircraft, the purchases of which were partially funded by some of the profits.

In that same year, based on an agreement between the governments of TT and Jamaica, CAL operated certain former Air Jamaica routes into North America and lost hundreds of millions.

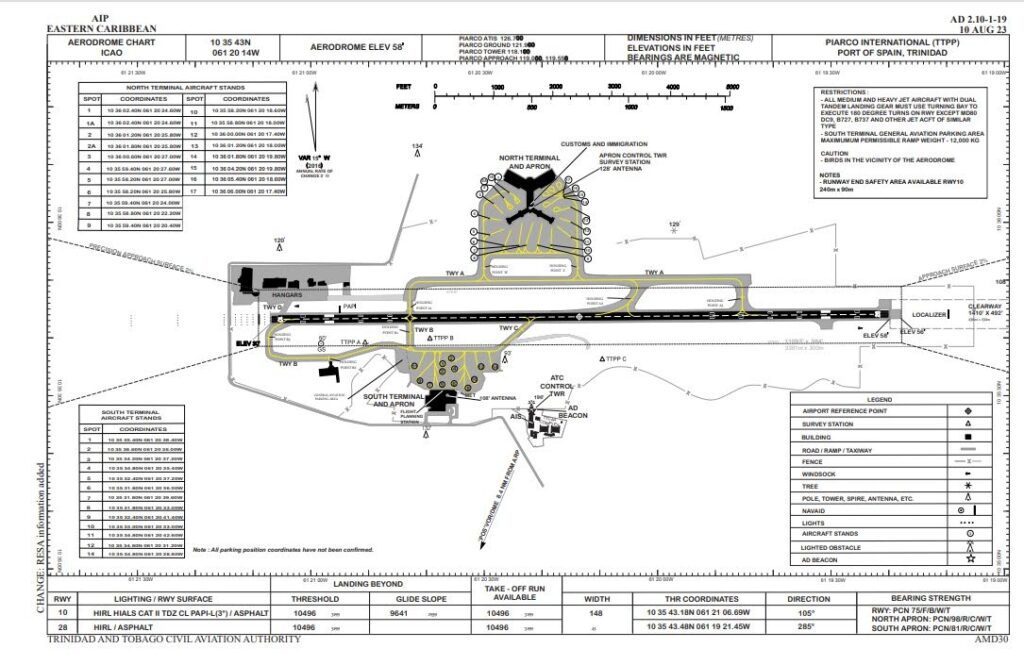

Chart courtesy TTCAA -

In June 2012, CAL started three weekly direct flights between TT and Gatwick, London, using two leased Boeing 767-300 ER aircraft. The rationale was to compete with British Airways, which was operating flights from Gatwick to Piarco, with a stop in St Lucia.

CAL lost millions of dollars on this route and announced, in August 2015, that it was suspending its operations on the London route owing to the heavy losses incurred.

CAL's losses required the Government to provide significant cash bailouts to keep the airline airborne.

In November 2016, a new board was appointed, with local entrepreneur Shameer Ronnie Mohammed as chairman and Michael Quamina SC, attorney-at-law, as vice chairman. In October 2017, CAL announced the appointment of Garvin Medera as its new CEO.

One of the first priorities of the new board and CEO was the development of a strategic business plan to put CAL on a robust and strategic platform to achieve commercial viability.

A major pillar of CAL’s recovery plan was replacing its ageing Boeing 737-800 aircraft with the Boeing MAX 8 aircraft, which offered far better operating economics and was congruent with CAL’s business objectives.

The covid19 pandemic and the worldwide grounding of the Boeing MAX 8 aircraft put CAL’s plans into a financial tailspin, over which the airline had no control.

At a virtual news conference in June 2021, Imbert, as corporation sole, said the Government cannot bail out CAL to the tune of $700 million in 2021, "Unless the airline gets itself ready and makes itself as efficient as possible for resumption of flights."

At last week’s function, Imbert said that the transition from loss to profit does not include the hundreds of millions of dollars of support that CAL receives every year from the Government for debt servicing. According to Imbert, CAL’s debt servicing is a continuing obligation of the Government.

On a similar note, the Government was well in order to instruct the Airports Authority (AATT) to write off $205 million in debt owed by CAL for 2007-2019, representing charges for the use of covered space for CAL’s hangars and head office. This debt write-off provides much breathing space for CAL.

CAL, like its predecessor BWIA, has its main base at Piarco International Airport. CAL’s present head office and the western hangars were constructed in the early 50s and BWIA built the eastern jet hangars in the mid-60s and early 70s. At that time, both the Piarco and Crown Point airports were run by the Civil Aviation Division of the Ministry of Works and Transport. BWIA did not pay any rent, as the lands were state lands.

The AATT came into existence in 1979 by Act 49 of 1979. The AATT, over time, got Cabinet approval for the vesting of airport lands and other lands in close proximity to the airport in the AATT.

CAL should seriously investigate whether it has grandfathered rights to the land rental concessions that BWIA enjoyed for its head office and hangar space.

CAL at present contributes approximately 40 per cent of the AATT’s revenue. Therefore, as two state entities, there must be a strategic collaboration between the AATT and CAL to transform Piarco International Airport into a world-class centre of aviation excellence on a sustainable basis.

CAL is operating an ultra-modern fleet of Boeing MAX 8 and ATR 72-600 aircraft and soon operate the Embraer EMB 175 aircraft.

CAL employs a cadre of very high-calibre aviation professionals.

Therefore, CAL’s aircraft fleet and employees should be complemented by an ultra-modern administrative complex, including state-of-the-art maintenance hangars, instead of facilities built over 50 years ago. This will greatly enhance operating efficiencies.

With modern hangars, CAL can earn revenues from third-party maintenance during periods of low maintenance activity. This facility can be constructed at the AATT business park northeast of the Piarco terminal building.

CAL, as the national airline, should be given a moratorium on land rental fees for a minimum ten-year period, which will not be repugnant to the ICAO policies on charges for airports.

More importantly, runway efficiency would be vastly improved by the relocation of CAL’s hangars, which would facilitate the westward extension of Taxiway Alpha to the takeoff holding point at Taxiway Delta for Runway Ten. At present, aircraft have to cross the runway at holding point Alpha One onto taxiway Bravo on the southern side to get to takeoff holding point Bravo Three.

In addition, the present location of the CAL hangars constitutes an obstacle for the approval of Category Two approaches into Runway Ten.

Finally, credit must be given to Mohammed, Quamina and Medera, who, without any prior airline experience, were able to provide the astute leadership and business acumen to steer CAL back on course.

According to Mohammed, technology and automation remain at the forefront of CAL’s growth strategy, focusing on its five pillars – people, process, growth, customers and finance.

Comments

"CAL’s flight path to fiscal recovery"