Not all digitalisation is bad

The Government this week clarified its position on various forms of digital money transactions, including the use of digital cheques and cryptocurrencies such as bitcoin.

Finance Minister Colm Imbert on Monday rejected the idea of allowing the public to use digital cheques, citing the risk of fraud.

On Tuesday, Minister in the Ministry of Finance Brian Manning said the Government will not support cryptocurrency at this time because of its speculative nature, vulnerability to price manipulation and cyberattacks, drain on energy resources and use in a range of illicit activities.

Both officials reflected the position taken by the Central Bank of Trinidad and Tobago on these kinds of issues.

Last July, Deputy Governor Dr Dorian Noel noted the lack of technological and legislative frameworks to support cryptocurrency. Dr Noel noted the current systems cannot support cryptocurrency while also guaranteeing the stability and integrity of the financial system.

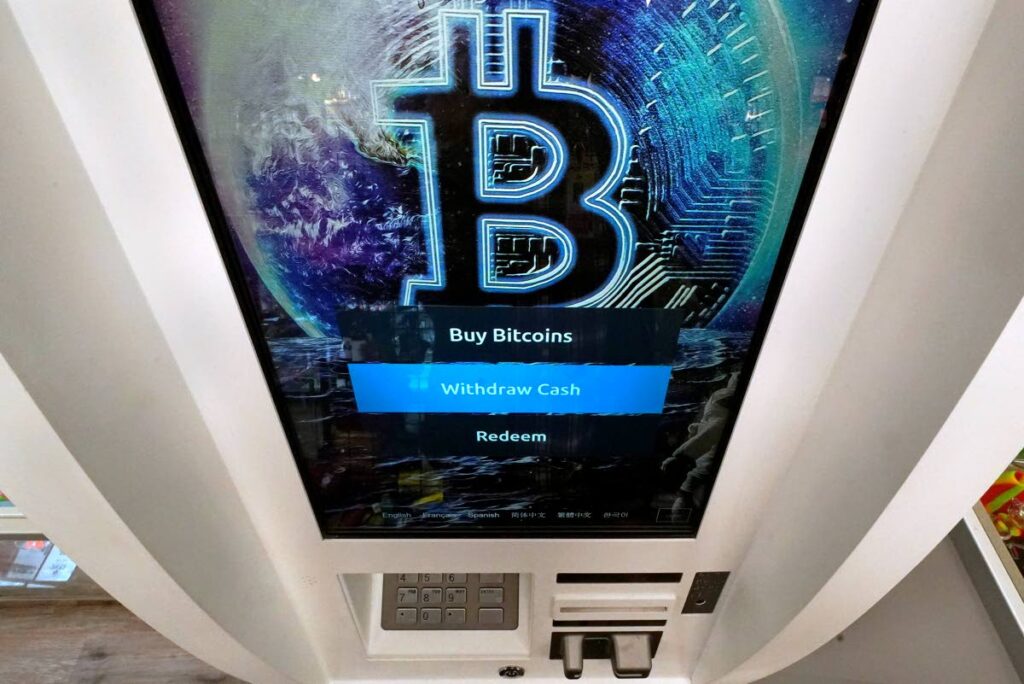

Cryptocurrency is an electronic, decentralised currency system that puts trust in consumers, as opposed to a central authority. The most widely known form of cryptocurrency is bitcoin, but there are several others, including litecoin, cardano and ethereum.

While the use of digital images of physical cheques is an entirely different matter, the issues surrounding their possible use are, from the perspective of the Government, the same.

“One would have to create an entire platform for that,” Mr Imbert said in Parliament on Monday as he ruled out the possibility during debate of the Bills of Exchange (Amendment) Bill 2022.

“One would have to put in place a number of cybercrime features, and the potential for fraud would be tremendous.”

It is clear the State is concerned about the risk of undermining the various controls and measures that have been introduced in recent years to tackle the problem of money laundering and other illicit financial activities.

In fact, so many controls have been promulgated that some see them as unjustly punitive. Even the Prime Minister has been involved in regional lobbying of some US officials on this issue on behalf of Caricom.

Mr Imbert’s and Mr Manning’s timely remarks came after weeks of plummeting cryptocurrency prices. The New York Times declared on Tuesday that the sector is crashing, having already dropped by about 65 per cent in value.

But while there is a need to protect citizens and maintain the controls that might safeguard the integrity of systems, the Government must still confront the need for digitalisation in the public service more generally. Indeed, isn’t that what the Cabinet’s own stated policy of digital transformation is meant to entail?

How much progress has been made, for example, in moving away from cheques to things like direct deposits, as called for by the Ministry of Social Development a few months ago?

What headway is being made to widen the services for which online payment – tied to regular currency – can be made, inclusive of government services?

Bitcoin and digital cheques are just more extreme iterations of an issue that requires the Government’s robust attention.

Comments

"Not all digitalisation is bad"