A fractured future for regional 5G

BitDepth#1322

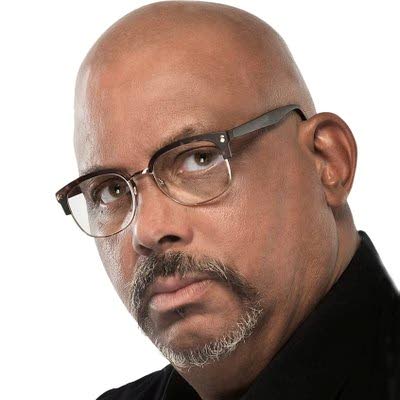

MARK LYNDERSAY

ON THURSDAY, Jamaica's Office of Utilities Regulation (OUR) and CANTO (Caribbean Association of National Telecommunications Organizations) hosted a webinar to discuss the issues governing the future adoption of 5G technology in Latin America and the Caribbean.

The webinar was supposed to be to help journalists in the region understand the problems involved, but beyond repeated reminders that electromagnetic radiation from 5G cell towers poses no significant threat to human health, the conversation seemed to be a running rumination on the challenges that the region faces in implementing the new technology.

According to Michael Charvis, OUR's deputy director-general, Jamaica is a prime prospect for the advantages that 5G would bring to connectivity.

Wireless technologies, he noted, are the best option for filling in the coverage gaps in Jamaica's rugged rural mountains and forests regions.

"Each generation of broadband brings benefits to society and the economy," Charvis said.

He lamented that Jamaica has been ten years behind in every generation upgrade, from 2G onward.

Jamaica isn't alone in its slow and measured roll-out of 5G technology in the region.

Trinidad and Tobago made the adoption list only because TSTT's chosen technology for its zero-copper campaign was 5G-based WTTX, but the company, along with its competitor Digicel, remains guarded on the question of 5G for mobile.

Sometimes, the problems are beyond operational or even financial matters.

Mike Antonius, CEO at Suriname's Telesur, noted, "The digital divide that exists between developed and developing countries is not limited to ICT services.

"You can imagine any kind of service and put an 'e' in front of it, Telesur is an e-enabler," Antonius said, having pushed for a switch to 5G to improve e-services.

He's since discovered that there are challenges with devices, many of which don't have 5G-capable radios and can't access the country's peak 1GB connection (he demonstrated 951Mbps upload and 85Mbps download).

The company is currently negotiating with Apple to "turn on something" so that iPhones with 5G capability can connect to the network.

Digicel's Chandrika Samaroo said that many telecommunications companies are still "sweating the asset."

"There is a danger of the network becoming obsolete before the investment can be recouped," he explained.

According to the ITU's Dr Bilel Jamoussi, 95 per cent of international traffic is carried over fibre and 80 per cent of traffic is video.

According to the ITU's projections, 50 per cent of mobile networks are on 4G and within ten years as many as 20 per cent will be on 5G.

The global economy is projected to expand by US$2.2 trillion over the next 15 years because of 5G connectivity improvements, particularly in industry and enterprise.

C&W's Rodrigo Cardenas pointed to four factors that govern 5G implementation. Networks benefit from lower frequency spectrum allocations, which give the best coverage. But much of that spectrum is in use by 2G, 3G and 4G technologies and can't be allocated until those broadcast ranges are shut down and their decline has been painfully slow.

The new broadcast technology also needs at least 100Mhz of contiguous spectrum or speeds drop to 4GLTE.

If latency is to be a selling point for the service, telecommunications companies will have to invest in a new core.

As an evolution of 4G, 5G has some technical similarities, but the new tech has its own requirements if it is to be executed properly.

The GSMA believes it is the mobile technology of the 2020s and promises ubiquitous connectedness for mobile broadband with high connection speeds and pervasive presence, but like all the boldest promises, it demands serious investment in its execution or there will, inevitably, be compromises.

Mark Lyndersay is the editor of technewstt.com. An expanded version of this column can be found there

Comments

"A fractured future for regional 5G"