First steps to a regional Central Bank digital currency

BitDepth#1298

ON MARCH 31, the Eastern Caribbean Central Bank (ECCB) launched a Central Bank Digital Currency (CBDC) system for the eight member states of the EC.

It is the second retail-payment system active in the world, and the first implemented project within a monetary union.

It is in use in four countries in the EC: Antigua and Barbuda, Grenada, St Lucia and St Kitts and Nevis. The other four states will be brought into the DCash fold by September, with a special priority on St Vincent and the Grenadines.

Using DCash, payments and domestic remittances can be made across borders in the territories under a year-long pilot project that's meant to define systems and procedures for the final implementation of the CBDC.

The Bahamas SandDollar project is also active, and a Jamaican CBDC is under active development. Haiti has announced plans for a CBDC project.

The motivation for the development of DCash was spelled out by Sybil Welsh, senior project specialist at the ECCB, during a webinar in June 2020, when she explained: "You can't really integrate the region if you have to move cash by plane or boat."

The key goals of DCash are to reduce cash transactions by 50 per cent by 2025, increase financial inclusion and provide a faster, cheaper and safer digital currency alternative to the people of the Eastern Caribbean.

The problem isn't only one for the financially linked but separate states of the Eastern Caribbean. The Caribbean archipelago, linked by geography, ancestry and cultures, has largely resisted the kind of economic and strategic unification that's proven valuable to other related nations, notably the European Union.

According to Shiva Bissessar of Pinaka Consulting, "The identification of the problems associated with cross-border transactions is well defined and understood, but the willingness to establish a cohesive practical response which can be implemented is where we begin to unravel.

"The emergence of CBDCs in the Caribbean region does assist in stimulating the conversation of what is the next possibility here."

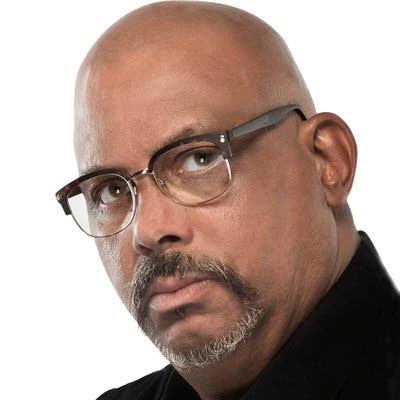

Pinaka Consulting was selected via public tender as the blockchain technical adviser to the ECCB in early 2019. Bissessar has worked on the project since its inception two years ago.

He was particularly inspired by ECCB Governor Timothy Antoine's statement at the launch of DCash: "We cannot outsource our development."

Beyond the immediate value of turning cash transactions into controlled digital currency, Antoine noted that "innovation goes at the amortisation schedule of legacy systems," and that "the pace of our development is at the mercy of decision makers within and outside our environment."

By taking the reins of the technical back end, the ECCB is using digital technologies to more fully control the development and relevance of its financial systems.

Barbados's Bitt is the ECCB's digital currency management systems partner for the DCash project. At the virtual launch of DCash, Bitt's CEO Brian Popelka said, "We have developed DCash to be interoperable with present and future digital currencies in mind."

The next step will be to push greater interoperability of CBDC regimes between islands.

"Some research into the concept of a Caribbean Settlement Network has taken place via the IDB," Bissessar said. "However, more effort may be required at the policy, legal and regulatory level. A concerted effort by regional central banks at the forefront of CBDCs can assist this agenda, as they may be most able to test solutions here.

"Many eyes are on the Bahamas and ECCB to gauge performance of CBDCs in a live retail-payment environment. The world is watching us in the Caribbean and assessing their next move."

Comments

"First steps to a regional Central Bank digital currency"