Mark: ‘Rich man’s bill’ favours wind/solar company

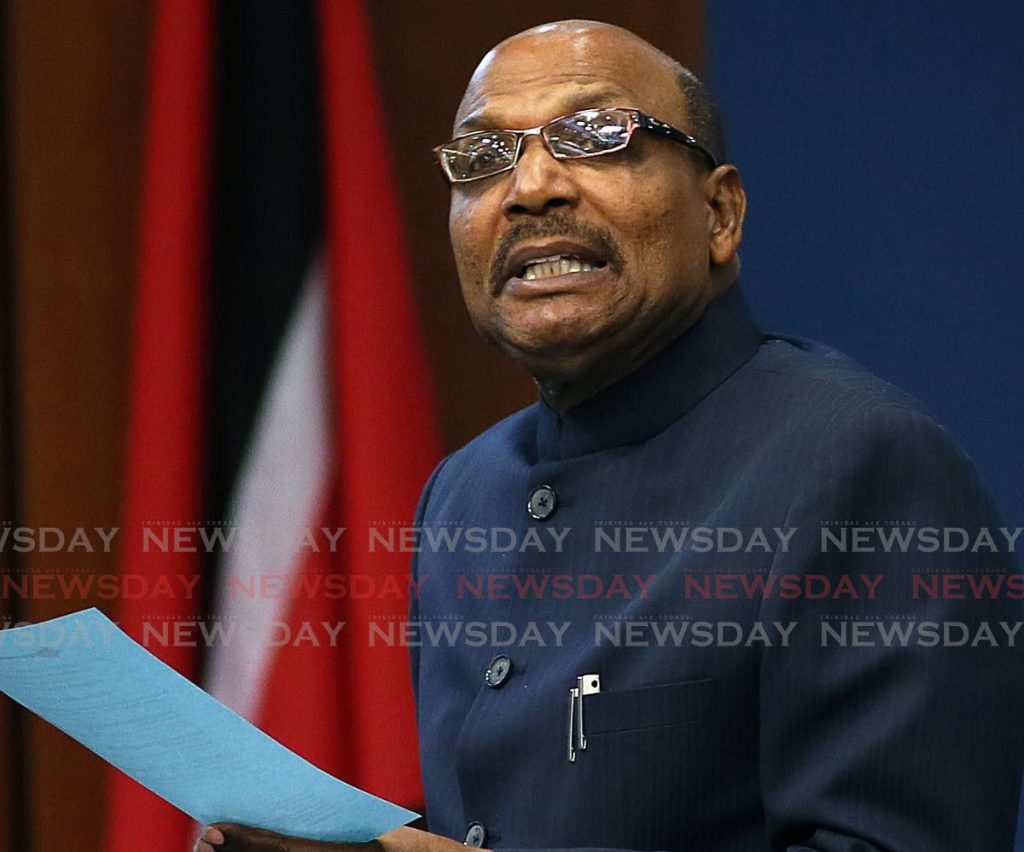

WHILE Finance Minister Colm Imbert had touted measures in the Finance Bill 2020 aimed at helping hundreds of thousands of ordinary people gain $3,000 in an annual tax allowance, Opposition Senator Wade Mark called it “a rich man’s paradise.”

He lamented tax breaks aimed at a German clean energy firm in which local conglomerate Ansa McAl has invested.

Mark dubbed the bill ad-hominem legislation, that is, a law aimed at a specific person/entity, referring to the wind and solar energy company.

The bill, he said, was “extremely disturbing, worrying, troubling and concerning.”

He complained that when Trinidad and Tobago is now cash-strapped, the bill amends the Corporation Tax Act so that small and medium businesses to be listed on the Stock Exchange will enjoy an initial five years of paying no taxes and a further five years of tax at just 15 per cent.

Mark resented these companies literally paying no taxes to the people of TT at this time when a recent Central Bank report said TT’s economy in a state of near-collapse, with a crisis level of foreign exchange and a debt-to-GDP ratio at some 80.7 per cent.

“We are in the danger zone,” Mark said.

His checks had found a company named MPC Caribbean Clean Energy Ltd.

“I’d like to check what is the relationship between this company and the Government," he remarked. "It was listed on January 4. It is a ghost company.”

He said the company employs no one in TT and does no business in TT, yet miraculously got five years of paying no taxes and another five years at 15 per cent. Mark said it is a German company, which had invested in a wind farm in Costa Rica, whose co-investor is the Ansa McAl Group.

Urging the tax breaks be withdrawn, he charged, “The Government is an agent of big business in TT. They are using Parliament to promote self-interests.”

Mark contrasted tax breaks to business with the fact that thousands of people are unemployed and schoolchildren can’t get laptops.

He said the Government will literally close down the foreign-used-car industry by reducing the age of allowable imports from four to three years, even as he alleged a racket of new commercial vehicles for state companies being bought from selected car dealerships.

“But for ordinary people who want to buy a Tiida, they are in trouble. This Government has got to go. They want us to support this measure? We cannot.

“The measures are about promoting their friends, family and financiers.”

Mark was unimpressed by the bill’s saying energy firms need only pay the Supplemental Petroleum Tax when the world oil price reaches US$75 per barrel (as opposed to US$50 now). He said credit rating agency Fitch has predicted the oil price over the next successive five years as US$44 (2020), US$45 (20121), US$53 (2022), US$55 (2023) and US$58(2024.)

“The UNC will not be supporting this measure," he declared. "We call on the minister to withdraw.”

Comments

"Mark: ‘Rich man’s bill’ favours wind/solar company"