Khan: Oil price plunge not a disaster for TT

Monday’s historic collapse of US crude oil prices into negative territory is not the end of the world for TT, Energy Minister Franklin Khan has said.

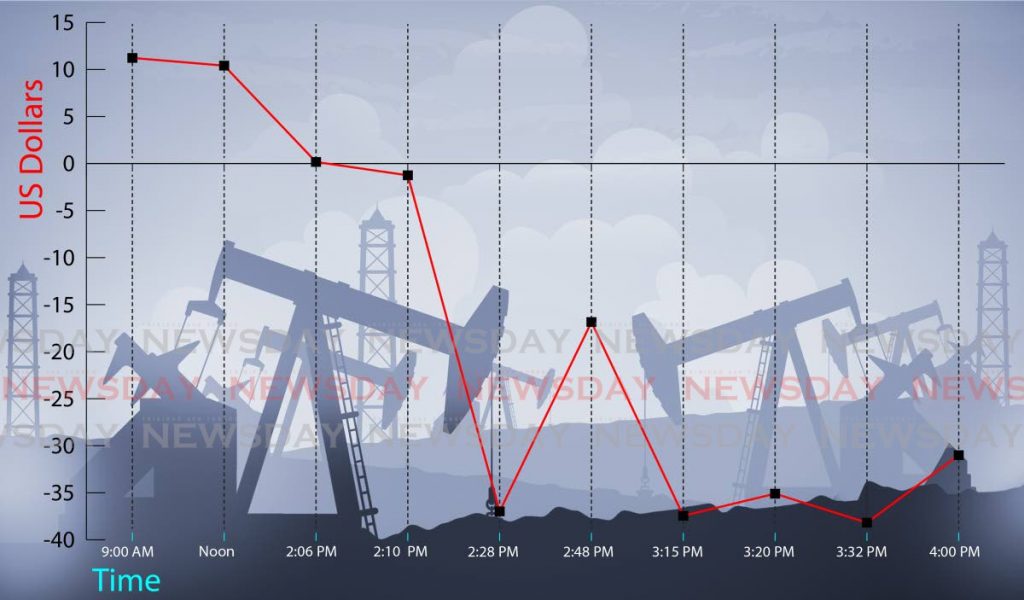

The prices on the May futures contract for West Texas Intermediate (WTI) crude – the North American oil price benchmark – due to expire on Tuesday, went as low as -US$38.52 per barrel before closing the day’s trading at -US$14.72. The short term sell-off of is linked to a slump in global demand for oil as countries impose some form of lockdown on their people in a bid to slow the spread of the covid19 pandemic and a glut in supply, despite an agreement by major oil producers to cut production. While May futures are dire, with producers and traders willing to effectively pay people to take excess oil off their hands, there is some hope that June will see a pick up in activity as lockdowns are relaxed and the world economy returns to normalcy. June futures are projected at about US$20 per barrel.

Khan: TT oil not pegged to WTI

In a telephone interview, Khan said today was a free fall but added, “It is not as totally disastrous as if we were pegged to WTI.”

He explained, “In TT’s case, we export two types of crude – Paria, and Galeota mix, which is BP and Perenco.” Both of these crudes are referenced (priced) to Brent crude oil – the international benchmark for about two-thirds of the world’s oil. “Brent has remained fairly okay at around US$25, US$26 per barrel. We are pegged to Brent either with a premium or a discount. In (international) markets it will be Brent plus a discount.”

That discount, Khan said, is left to the negotiation of the individual companies. TT’s Heritage Petroleum, Khan said, trades on the spot market. “So, we expect that Heritage will have a fairly sizeable discount from Brent when it makes its next shipment.” WTI is referenced to US crude oil, largely based on US domestic production.

As a result of demand dropping significantly because of the covid19 pandemic, Khan said, a tremendous glut has been created in the the US market because US production is high and its storage capacity is limited. The US is the world’s largest producer of oil.

For most of producers (including TT), however, the breakeven price of oil is around US$50 per barrel. Asked if declines in WTI’s price will cause Brent’s price to fall, Khan replied, “Not strictly speaking.”

Brent is a North Sea crude which is traded out of Europe, he said. “So it is how the oil pricing is referenced, and then there are futures markets.”

A futures market is a kind of auction where commodities are bought and sold based on agreed-upon future delivery dates (futures contracts). “The zero price is really for the future and the trading futures.”

Heritage hopes to ‘wait out’ poor market

While the WTI price collapse will not have an immediate impact on TT, Khan said market conditions were not favourable because of high inventories and the slowdown of the world economy.

“At the end of the day, the signals are not positive, but we just hope that the level of negativity is not as intense.” While Government will closely monitor the situation, Khan said TT still has sufficient oil reserves. Heritage has storage capacity for about three months, he said.

“Fuel is very much available because the refineries are loaded with aviation (fuel) and liquid petroleum products for vehicles.”

Khan said Heritage, BPTT and other producers “are still producing their level of liquids, and will continue to so do until such time that we need to re-evaluate that position.” Heritage chairman Michael Quamina in message to Newsday said, “We are very fortunate to be in the unique position of having strong cash reserves which will enable us to store what we produce.” Heritage, he added, will “wait out, as best as possible what we can only hope to be a short-term to medium-term crisis in the market.” In a subsequent statement, Heritage said it had taken a multi-faceted approach to respond to the collapse in US crude oil prices. The elements of this approach include identifying and implementing additional cash-generating options such as the sale of obsolete assets; a freeze on recruitment, except for critical jobs; and discussions and negotiations with financial institutions on financing arrangements and loan repayments arising out of legacy Petrotrin debt obligations.

Heritage also said production grew to approximately 41,000 barrels of oil per day as it completed workovers and installed gas lift on offshore wells. The company now produces approximately 1.2 million barrels of oil per month.

With the oil price expected to be in the low teens in this quarter, Heritage said, “We are pursing a strategy of storage of oil production, which will be sold as the oil market improves.”

Brent price below TT breakeven

Former energy minister Kevin Ramnarine said what is happing in the US is the destruction of demand for fuel, which has led to a massive oversupply of crude oil which has to be stored somewhere.

Brent’s price is holding, he said, because Brent North Sea crude is sold on the sea and easily traded.

“Most, if not all of the oil sold in TT is sold based on Brent.”

While what is happening is mainly a US oil market phenomenon, Ramnarine said, “That does not mean that things are okay elsewhere. The Brent price is well below the breakeven of many companies in TT.” Energy Chamber president Dr Thackwray Driver said the world is in uncharted territory and it is extremely difficult to predict what will happen with oil prices. Apart from the total collapse of WTI oil prices on Monday, Driver said there were some declines in Brent but US natural gas prices rose slightly.

“Low oil and gas prices obviously have major implications for TT as we depend on these commodities for the majority of our export earnings, along with petrochemicals.”

Driver said it was uncertain how long low prices would continue, as it largely depended on the ending of public-health-related lockdowns in the major markets. While these extremely low WTI prices are unlikely to last for a long time, Driver said, TT needs to plan for a low price environment and have policy measures in place that reflect that scenario.

Comments

"Khan: Oil price plunge not a disaster for TT"