The future is energy

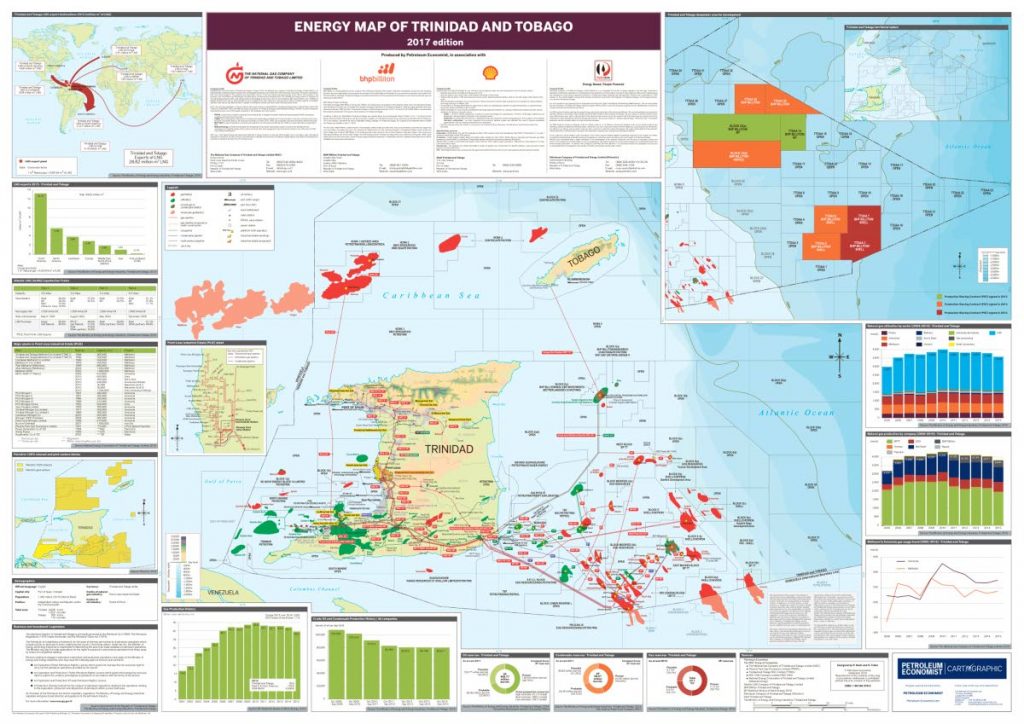

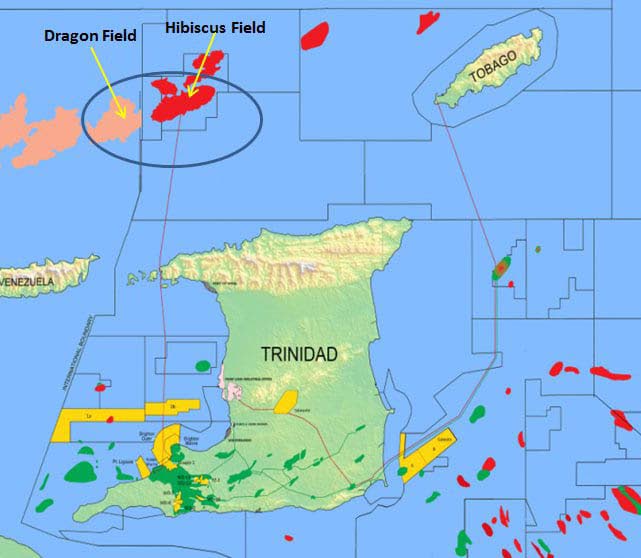

On Monday, the Prime Minister delivered the keynote address at the TT Energy Chamber's Energy Conference 2020. On his agenda were updates on upstream activity in TT, including the announcement of a new deepwater bid round later this year; potential for the local industry and new sources of production set to come on stream within the next five years; and decisions on development for cross-border fields like Loran-Manatee in light of Dragon being put on hold – affected by US economic sanctions against Venezuela. The following is an extract of Dr Rowley's speech, edited for length and clarity.

The theme of this Conference – Shaping the Caribbean’s Energy Future – is very topical and timely as we are currently witnessing a change in the energy dynamics of the Caribbean. However, the Caribbean, until the current successes, has been characterised as an energy deficient region due to its perceived lack of hydrocarbon resources and its inability to exploit its huge renewable energy potential.

Prior to 2015, only three countries, Trinidad and Tobago (TT), Barbados and Cuba were known to have reserves of oil and gas, with TT being an exporter of oil and gas. This led to a dependence by Caribbean countries on oil imports to meet their energy needs and a vulnerability to the frequent oil price fluctuations. This uncertainty and dependence on the oil imports impacted national budgets and investments and contributed to economic instability within the region.

In the face of the then energy challenges faced by Caribbean countries, mitigating initiatives, such as Petrocaribe sponsored by (Venezuela) and the Caricom Oil Facility Fund established by the TT, as a grant fund to provide relief to member Caricom states experiencing economic hardship, were introduced.

Notwithstanding the support provided by TT and Venezuela, Caribbean countries continue to struggle with the energy burden. Except in TT energy cost in the Caribbean is the highest in the Western Hemisphere and amongst the highest in the world. The cost of energy in various Caribbean countries range from as low as US$0.20/kwh to as high as US$0.37/kwh. In TT, however, the average subsidised cost is US$0.05/kwh.

In face of high energy costs and the debilitating effect of climate change, Caribbean countries have begun to embrace renewable energy and energy efficiency solutions. Renewable energy first took root in the Caribbean with distributed systems such as Barbados’ solar hot water heating industry in the 1970s. Today there is in excess of 3.1 gigawatt of installed and operational renewable energy in the Caribbean, including hydroelectric power.

Untapped potential for renewable energy

Despite the strides made by the Caribbean (regarding) sustainable energy sources, renewable energy systems account for a small fraction of the region’s untapped potential. It is estimated that the Caribbean holds 2,525 mw of potential solar energy, 800 mw of potential wind energy, and 3,770 mw of potential geothermal energy. These resources, if harnessed, would displace approximately 2.7 million barrels of oil per year and save Caribbean countries US$5 billion in fuel imports per annum. Given the potential savings, Caribbean countries have established ambitious targets in the implementation of renewable energy systems. Financial aid from donor countries and institutions, the falling costs of renewable energy technology and improvement in the efficiency have made these targets somewhat achievable.

TT, temporarily insulated from high energy costs by virtue of its hydrocarbon resources, has been measured in its approach to renewable energy. This in part is to ensure that citizens are not burdened by the transformation costs on the conversion to renewable energy systems. Having canceled our attempts at economic diversification in the form of manufacturing of aluminium products, we are left, at this time, with substantial quantity of surplus installed power which has to be paid for but for which there is no immediate market. This condition makes investment in renewables a little tricky but we have not given up on the need to join in with this future prospect.

Notwithstanding these challenges, the Government of TT is fully committed to the protection of the environment and in February 22, 2018, deposited its instrument of ratification to the Paris Climate Change Agreement.

Energy security has long been a challenge for Caribbean countries. However, technological advances in renewable technologies and recent hydrocarbon discoveries have brightened the prospects for the once considered elusive energy security within the region. Exploration successes for oil and gas particularly in Guyana have radically changed the perception of the region. The region, with justification, is now being heralded as the next major oil and gas province. This has generated unprecedented interest by upstream companies in the region. Guyana has been the main recipient of investment in exploration and development by these companies. It is estimated that the discoveries in Guyana hold cumulative recoverable resources of approximately six billion barrels of oil equivalent. Spurred on by the Guyana success there is exploration activity along the length and breadth of the Caribbean and with some success. With an estimated resource potential of 13.6 Billion barrels, the US Geological Survey ranks the Guyana-Suriname Basin second in the world for prospectivity among the world’s unexplored basins and 12th for oil among all the world’s basins – explored and unexplored.

TT is poised to participate in the exploitation of hydrocarbon in the marine areas off the Guianas. Our claim to the United Nations Commission on the Limits of the Continental Shelf is expected to be presented this year and if successful would extend our maritime jurisdiction seawards to areas in close proximity to the Guyana-Suriname Basin.

Other Caribbean countries are seeking to capitalise on the interest shown by the investing energy companies. Barbados has granted licences to the Australian multinational conglomerate, BHP, to explore off its south-east coast and to the Spanish company, Repsol, to explore to the northwest of the island. Tullow and its partners continue to prospect on a huge block to the south of Jamaica on the Pedro Banks, while the Bahamas Petroleum Co is conducting exploration to the south-west of Andros Island. It is reported that Global Petroleum Group has found some gas close to Grenada’s maritime border with Venezuela.

TT, with its long history in the industry, is well poised to assist the new entrants – Guyana, Grenada, Barbados, Jamaica and the Bahamas – in the development of their petroleum sectors. To date we have entered into Memoranda of Co-operation with Guyana, Grenada and Barbados for provision of technical assistance. Preliminary discussions are in their early stages on the development of unitisation agreements with Grenada and Barbados for the exploitation of hydrocarbons reservoirs that extend beyond our respective maritime borders.

TT by virtue of its location has an opportunity to provide logistical and offshore support to operators in the emerging Caribbean oil and gas economies. This will require the expansion of our marine infrastructure on our south-east coast. In this regard, active consideration is being given to the expansion of the Galeota Port to meet the demand for services that will be generated by exploration in new marine blocks on the south east and east coasts of TT and in offshore oil and gas developments in the Guyanas and other Caribbean countries. A request for proposals (RFP) was issued for the expansion of the Galeota Port and the responses are currently being evaluated. There is also continued interest in the establishment of a dry dock facility at La Brea.

Diversity and technology transfer

The interest by upstream companies in the region augurs well, not only for the region but for TT. New entrants such as Apache, Hess and Tullow bring diversity, capital and technology transfer to upstream activity in the region. Technology in particular has been instrumental in the rejuvenation of our shallow water areas and for the successes in deepwater.

In the medium term the deepwater represents our best opportunity for the sustenance of the domestic oil and gas industry. To date only 31 per cent of the deepwater has been explored. To capitalise on the interest by upstream companies for deepwater opportunities in TT, the Ministry of Energy and Energy Industries has proposed a deepwater bid-round for 2020/2021. To this end, the ministry has been acquiring extensive seismic data over the deepwater area to facilitate meaningful evaluation of the deepwater blocks.

At present all production of gas and oil is from land and shallow marine areas and will remain so for the immediate future. There have been challenges with respect to oil and gas production. A lack of investment by upstream companies has been a major factor in the decline in production particularly of natural gas from levels achieved in 2009/2010. We have been able to stem the decline and stabilise the production of natural gas, albeit at levels below peak historical production, as confirmed by the Ryder Scott natural gas reserve audits for 2017 and 2018.

The upstream companies have committed to capital investment which will result in an improvement of gas production. Shell TT plans to execute two development projects (Barracuda on the east coast and Colibri on the north coast) for a total investment of approximately US$1.2 billion. This will offset natural gas production decline and grow current levels from approximately 600 million standard cubic feet per day to approximately 800 million standard cubic feet per day by 2023. In addition, Shell plans to drill up to three exploration wells on the east coast, with one well in 2020 and two wells in 2021, to identify more gas resources. Shell also proposes to partner with Heritage for oil exploration in the Gulf of Paria. The intention is to acquire state-of-the-art Ocean Bottom Node (OBN) 3D seismic in the Gulf of Paria in 2021, subject to concluding definitive farm-out agreements with Heritage in 2020.

The country’s major gas producer, BPTT, continues to undertake significant activity to support production as well as manage decline on its existing fields while continuing to progress future exploration activity and complete execution of projects underway. The total spend of BPTT is projected to be in the range of US$1.2 billion in 2020 and US$1.4 billion in 2021. In 2022 the Cassia C compression projects, Matapal and Cypre are due to come on stream, with Ginger in 2023 and Jasmine in 2024.

BHP’s major activity will be completing and commissioning the Ruby field with first production targeted for 2021. This is a US$500 million investment which is at platform construction commencement stage. When the Ruby field comes on stream BHP expects to see an increase in oil production of about 16,000 barrels of oil per day. This is to be the single largest oil development project in Trinidad since Teak, Samaan and Poui in the 1970s and Angostura in the 1990s.

In 2020, EOG is continuing with the drilling programme, which resulted in the successful Osprey East well in 2019, and will drill three exploration wells. EOG is currently drilling the second exploration well, Mento, in partnership with BPTT. This well is expected to be completed in the first quarter 2020. In 2021, EOG is planning to drill seven wells, consisting of five development wells and two exploration wells.

Consequent on the number of new fields/projects coming on stream, gas production is expected to increase from the current 3.6 billion cubic feet per day to four bcf per day by 2024. In 2024/2025, there will be a major game change that will provide greater certainty and predictability in gas supply.

Exploring the Manatee field

Gas production is projected to come on stream from Manatee field, which forms a part of the Loran-Manatee cross-border field and is located in the marine area of TT.

The Loran-Manatee has an estimated resource of 10.04 tcf, with 2.712 tcf within the Manatee field. Shell TT holds 100 per cent interest in the Manatee field and has projected that gas production could start in the 2024/2025 period at rates ranging from 270 to 400 million standard cubic feet per day. Shell is in conversation with the TT government and is working on various development scenarios to determine the best option. This major policy shift which frees up investment and development of Manatee gas also provides easy access to market for all gas from these fields if the circumstances permit and the owners so desire.

Progress in the development of the unitised Loran-Manatee field has been impeded by the sanctions imposed by the US Government, which inhibits US companies from doing business with PDVSA. As a consequence, TT and Venezuela have (rescinded the 2010 Unitisation Agreement) and agreed to the independent development by each government of the field within the Loran-Manatee cross-border that falls within its respective marine area.

Loran-Manatee field is a landmark decision in the countries’ cross-border relationship. This has implications for development for other cross-border fields such as the Manakin-Cocuina and the Kapok-Dorado, which collectively have an estimated 850 billion cubic feet of natural gas within the TT maritime area.

It is regrettable that we cannot move ahead with the Dragon project, which is on hold, at this time, due to US sanctions on Venezuela. At a moment notice, we are ready to move ahead with the project on the lifting of such restrictions since virtually all the preparatory work has been done. Notwithstanding, we are proceeding with the Manatee initiative which is the single most significant development in the energy sector in recent times.

The domestic energy sector is due for a further lift as oil production is set to rise. It is estimated that production will increase to in excess of 90,000 barrels a day by 2022. The production is driven by developmental drilling activity, workovers and enhanced oil recovery projects undertaken by Heritage, its resumption of offshore exploration, new oil from Rio Claro and Ortoire blocks and significantly, BHP Ruby Delaware field in block 3a.

I am (also) pleased to inform that the newly created entities, Heritage Petroleum Co Ltd and Paria Trading Co Ltd, have been profitable.

The unaudited results show that for the first year of operations, ended September 30, 2019 Heritage Petroleum realised a profit, after tax, of $884 million. For the same period Paria achieved a profit, after tax, of $172 million. That is a turnaround in the state oil business from a projected loss of $2 billion per year to a profit of just over a billion dollars in the first year of transition.

As regards, the Guaracara Refining Co Ltd, negotiations are ongoing with the preferred bidder Patriotic Energies and Technologies Co Ltd and, subject to a satisfactory outcome, the refinery should be operational within 12 to 18 months.

A principal entity in the energy landscape is the National Gas Co Group of Companies comprising the parent, the National Gas Co (NGC); its main operating companies, National Energy, and the Phoenix Park Gas Processors Ltd. The NGC Group of companies contributes significantly to the Government’s income by means of taxes and dividends and is TT’s major avenue to lay claim to some of the wealth derived from the exploitation of our main natural, depleting resource.

For its part, NGC has been primarily a mid-stream operator with responsibility for transportation, distribution and aggregation. Given its role in the securing of the requisite gas supplies to meet the needs of the gas-based industry, NGC as an instrument of national policy has been mandated to align its core activities as aggregator with current upstream developments, including Venezuelan across border initiatives to enable the on-time delivery of gas from these sources.

With the support of Government NGC has finalised gas supply agreements with all of the upstream gas suppliers. As a consequence, the company is in a position to offer term gas supply contracts to its downstream customers. To date gas supply contracts have been executed with Nutrien, N2000, CNC and interim agreements with MHTL, Methanex and Tringen. The international gas supply and markets have undergone and are undergoing revolutionary shifts requiring fair trading co-operation and frequent adjustments to keep pace and preserve our space in this billion dollar maelstrom. To this end the Government of TT has for the last two years opened and encouraged discussions among all the stakeholders in the LNG business with the aim of protecting the future of the industry for all investors in it, not the least of whom are the people of TT.

As regards revenue, we adopted the principle that the state must have a fair share of revenue earned from the exploitation of our non-renewable hydrocarbon resources. As a first step we introduced across the board a royalty rate of 12.5 per cent. This was followed by a loss relief restriction to 75 per cent of taxable income and a limit of capital allowances to 20 per cent per annum on a straight line basis.

The energy sector of TT is on a solid foundation, as are the emerging oil driven economies of Guyana and Suriname. The story is still unfolding as other Caribbean countries are in the early stages of exploration for oil and gas. This coupled with the improvement in renewable energy technologies present the region with an opportunity to attain the previously elusive energy security. However, this will require a shift in the policy, which previously centered on exploitation of our abundant renewable energy resources, which is an effective tool in combating climate change and its deleterious effects on the Caribbean. Given the complexities in the matter there needs to be a collective approach in addressing this matter. It therefore needs to be placed on the agenda on Heads of Government of Caricom States. I am prepared to advocate the same.

Comments

"The future is energy"