Deep water horizon: TT's energy future in offshore blocks

With the 2020 Ryder Scott report completed, showing overall declines in reserves but highlighting a few areas where there was increases in production, the Ministry of Energy is now looking forward to new opportunities in the new year.

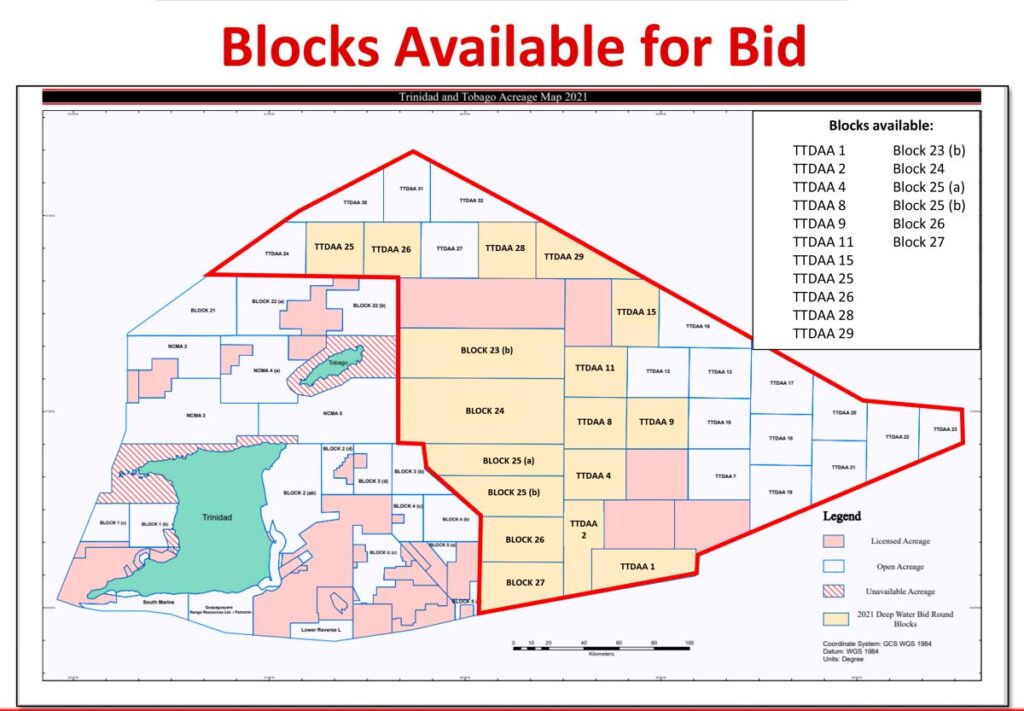

That would come, in the first instance, in the form of the deep water bid round announced on December 5 in Houston Texas, and again on Tuesday along with the reading of the Ryder Scott report. The bid round is for 17 blocks of the northern and eastern coasts of Trinidad and Tobago.

While several factors still affect how much interest is gained from the bid round and how it will translate into exploration and by extension revenue for TT, the next six months will determine how the country manages its oil and gas industry.

Ryder Scott dips in proven reserves

On Tuesday, Energy Minister Stuart Young explained that the Ryder Scott report was an indication of the level of TT's natural gas reserves.

“The Ryder Scott report is critical to everyone in the industry that is operating in the gas hydrocarbon sector, to know what is currently there and to know what is on the horizon,” he said.

The report reflected a need for more investment in exploration and drilling so that resources could be moved from categories of higher risk to lower risk, and finally to be taken out of the ground for commercial use.

As far as risk is concerned, it is divided into three categories based on the certainty that the resources could be extracted. P1 and C1 are proven resources with a 90 per cent certainty of commercial extraction. After that the certainty goes down to 50 per cent, or probable resources – P2 and C2; and then possible resources – P3 and C3 reserves with a 10 per cent chance of commercial extraction.

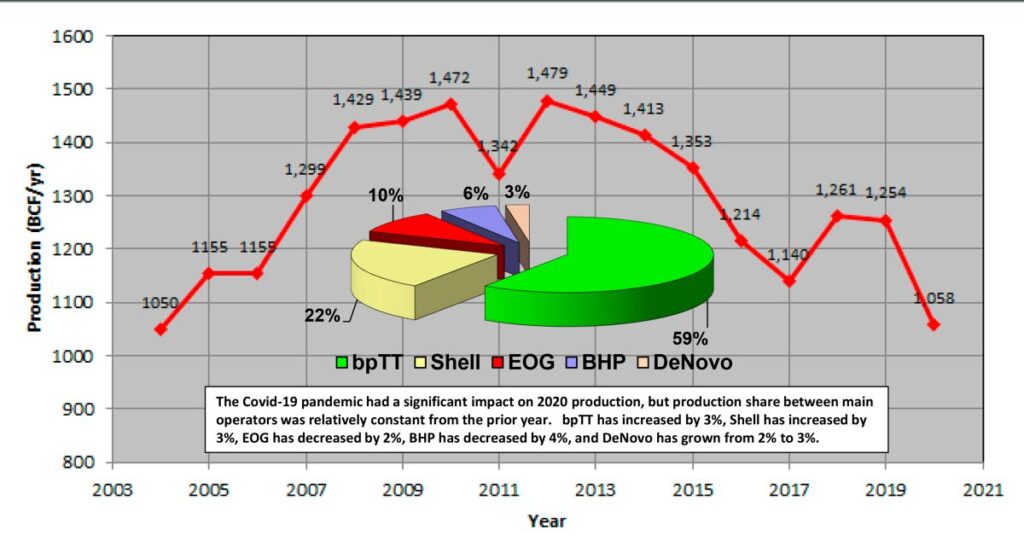

The report indicated declines, of which the covid19 pandemic was a factor in decreased exploration. P1 reserves amounted to 10.2 tcf, down from 10.7 tcf from last year. Young explained that production of about 1.06 tcf was replaced by about 0.6 tcf.

However in the riskier, probable categories there was an increase by 5.4 per cent, with exploration resources increasing by 10 per cent thanks to leads identified by the ministry.

This means that while there are gas reserves, the larger share is in the riskier areas, thus the need for TT to break into deep water exploration.

The new frontier

While Young described deep water exploration as a new frontier and regime, oil and gas giants such as Shell, Exxon and BHP have not only shown interest but followed up with bids since the mid-1990s.

The first deep water well Haydn 1 was drilled in 1999, three years after four blocks were awarded to Shell, AGIP and Exxon in 1996.

A graph presented as part of the 2020 Ryder Scott report showing yearly gas production between 2003 and 2021. Image taken from the Ryder Scott report -

Exploration continued between 2000 and 2003, during which seven more deep water wells were drilled. Those wells included the Adelpha-1, Dynamine-1, Catfish-1, Callicore-1 Heliconius-1, Peppersauce-1 and the Liszt-1.

Another nine blocks were awarded to BHP, one of TT’s main oil and gas investors, between 2012 and 2014. BHP began drilling in 2016 with the Le Clerc and Burrokeet wells. These wells were drilled mostly in the waters off southern Trinidad.

In the waters off northern TT seven wells were drilled by BHP – the Burrokeet 2, Bongos 2, Tuk 1, Bele 1, Boom 1, and Hi-Hat 1 and Carnival-1. In the waters off southern Trinidad four more wells were drilled – Le Clerc 1, Victoria 1, Concepcion 1 and Broadside 1.

According to a presentation during the launch of the bid round on Tuesday, the exploration on the 17 blocks resulted in the discovery of about 6.6 tcf of commercially viable natural gas bearing sands.

The Energy Ministry said bids must be submitted in duplicate under the cover of confidentiality, in sealed envelopes. Entities are also required to pay a pre-bid fee of US$40,000 and a bid application fee of US$50,000.

Proposals will be evaluated based on the provisions outlined in the order and a point system. The successful bidders would be announced three months after the close of the bids in June.

If successful, the bidder will enter a production sharing contract with the government which will be held for a term of no more than nine years from the effective date.

The contract will include a requirement to present to the minister a work programme for each year for the minister’s approval; a requirement of the contractor to make payments with regard to annual charges, production bonuses, technical assistance and equipment bonuses.

However the bidder is allowed to recover costs and expenses incurred during development of infrastructure and drilling.

Bid rounds not what it used to be

Young said there was an “appetite” for exploration. He said in order to identify the blocks that were made available, the ministry provided data and 17 companies responded.

A presentation by the ministry indicated there is a high possibility that exploration would provide a positive result for all parties involved. Blocks 25 a, 25 b, 26 and 27, for example, with an average size of 14sq km has similar geological settings with fields in the Columbus basin.

In 2017, the Oil and Gas Journal reported that operations in TT had a minimum of 12.578 tcf of probable natural gas reserves in the Columbus basin. BPTT at the time had 6.728 tcf in proven reserves, 2.969 tcf in possible and 2.881 in probable reserves. It also had another 5.597 tcf in identified exploration resources.

In the Columbus basin major fields include the Cassia, Mahogany, Flamboyant and Mango. In addition to production of 15 tcf in natural gas there was more than a billion barrels of oil produced up to that time.

The reservoirs are considered trap types, one of the three elements which provide accumulation for oil and natural gas.

But, even if there is interest there are still some factors to be considered. Young pointed out that while companies, exclusive of those with which TT already has long-standing relationships – BPTT, EOG, BHP and Shell – the global market is changing and companies are more cautious about going into new areas for exploration.

“The shareholders (of the oil companies) have said do not invest in new provinces,” Young said. “In Houston you had CEOs of major companies saying they are also aware of this. A lot of the major oil and gas players are not being permitted by their shareholders or there is that push back not to go into new areas to invest.”

He said some companies with which he discussed possible ventures had an “aggressive” approach that may lead to bids.

Young maintained his cautiously positive outlook even when he was questioned about possible competition from newcomer to the oil and gas industry – Guyana – as well as Venezuela and Barbados where some of the blocks sit close to the latter's borders.

“We are fortunate that we have multi-million dollar plants that can literally turn gas into money. Either via LNG, ammonia or methanol,” he said. “Everything is on the table as far as we are concerned.”

He said that while Guyana found significant oil reserves which had some finds of associated gas, Guyana’s focus at the moment is in oil production. He said he made contact during the World Petroleum Congress with members of the Guyana government, which intends to bring its gas to shore for domestic electricity and small manufacturing.

“That would need hundreds of kilometres of pipeline,” Young said. “And we have the know-how, so that is available.”

“Suriname also found gas and one of the conversations was how we can work with them and if there is a possibility that they could bring some of that gas to TT.”

Young also expressed excitement over the BHP/Woodside merger, for which processes began earlier this year. He said appraisal wells had produced good results and the ministry is now waiting for the merger to be complete so that terms can be reached to bring deepwater gas to TT shores.

Comments

"Deep water horizon: TT’s energy future in offshore blocks"