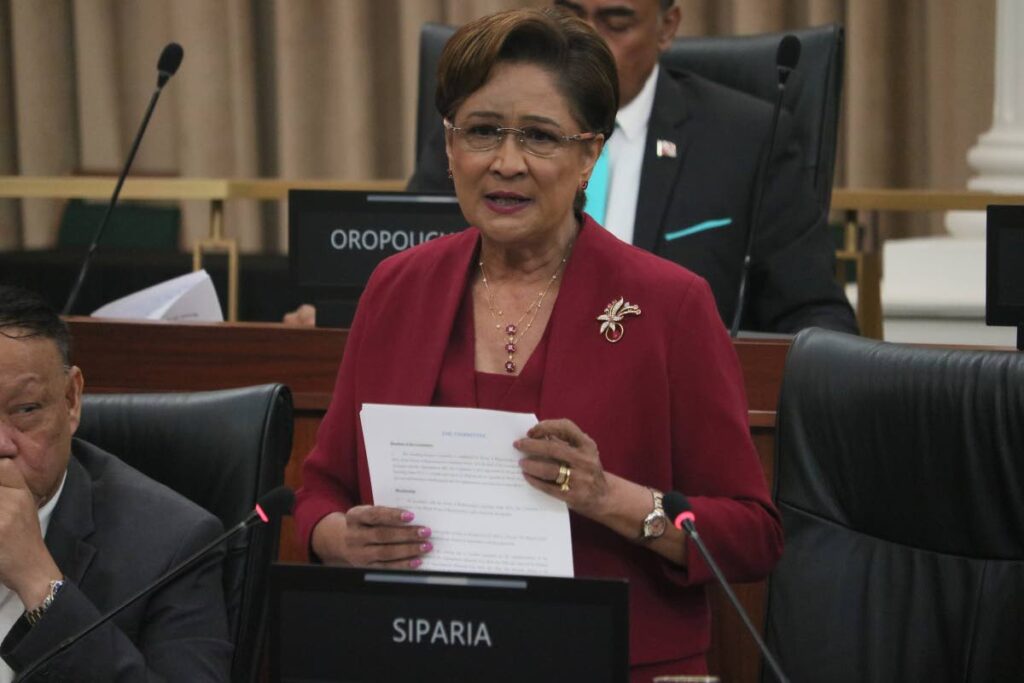

Kamla: 'Callous pension policy was no error'

Opposition Leader Kamla Persad-Bissessar has slammed the government’s handling of a recently rescinded policy that would have disqualified elderly citizens with savings of over $25,000 from receiving pension assistance.

Describing the policy as a “callous and deliberate attack on the vulnerable,” Persad-Bissessar accused the Cabinet of failing to admit responsibility.

“No public servant will get up on their own and decide on clauses that will disqualify elderly citizens with over $25,000 in savings from receiving pensions,” she charged during a press conference on December 19.

After public backlash, the government reversed the $25,000 savings cap, calling the disqualification an “error.” Persad-Bissessar dismissed this explanation, pointing to the extensive legislative process involved, including policy development within the Ministry of Social Development, legal vetting and Cabinet approval.

“This is not a simple oversight. The policy would have gone through several layers, including the Senior Legislative Review Committee chaired by the Attorney General, before reaching Parliament. How could such an important clause go unnoticed for over 18 months? Were they asleep at the Cabinet table?”

She also criticised the government for its attempt to shift blame onto public servants, saying this was part of a broader pattern of deflection. She cited previous instances where she said the Attorney General’s office sought to deflect responsibility during perceived legal missteps.

“This is not just about the AG or the minister responsible; it concerns the entire Cabinet. Their attempt to shift blame will not work,” she said.

Chaguanas East MP Vandana Mohit, who joined the press conference, supported Persad-Bissessar’s scepticism. She referenced what she described as a history of policies that harm the poor, citing the Ministry of Social Development’s removal of 18,000 people from the food support system in 2018 as another example of the government targeting the vulnerable.

“The government’s track record shows a consistent pattern of making serious errors that harm those most in need,” Mohit said, adding that frequent policy rollbacks create instability for affected citizens and lead to distrust.

Persad-Bissessar said the government was incompetent lacked transparency, taking particular aim at AG Reginald Armour.

She accused him of dishonesty, recalling previous “embarrassing” moments involving the AG. One, she highlighted, involved Armour reportedly misrepresenting his role in an affidavit during the Piarco Airport court proceedings in Miami.

Another controversy involved the “missing file case” at the AG’s office, where public servants were blamed for the disappearance of crucial legal documents. She added that the AG’s attempt to downplay the pension clause as a mere “mistake” was absurd.

She also addressed the statement made by Minister Donna Cox, who staunchly defended the controversial clause before it was rescinded. “She was clear – the government’s policy is that anyone with $25,000 or more did not deserve a pension,” Persad-Bissessar said.

“Now they’re trying to cover it up by claiming it was an error, but the damage has been done. Pensioners will remember this come election time.

“Had it not been for public pressure, they would not have rescinded it,” she said.

“This government is broke, and their attempts to implement cuts, hikes, and taxes are signs of a looming IMF bailout. They’re trying to paper over their mistakes, but the public sees through it.”

Difference between NIS pension and senior citizen's grant

While the terms senior citizen's grant and NIS pension are often used interchangeably, they are not the same thing.

The senior citizen's grant is administered by the Ministry of Social Development and Family Services and provides financial assistance to eligible older persons in TT.

It is given to people 65 years and over. Applicants must be resident in TT for 20 years preceding the date of application. Any periods of absence must not total more than five years during the 20 years before the application is made or the applicant must be residing in TT and have lived 50 years (not consecutively) in total in TT.

The applicant’s monthly income must not be more than $5,500, and the amount of the grant is tied to the person’s income, with the maximum amount being $3,500.

People earning $0–$2500 get $3,500; people earning $2,500-$3,5000 receive $2,500; people earning $3,500-$4,500 get $1,500; and people with income over $4,500 but not more than $5,500 get $500.

For more details, go to https://social.gov.tt/senior-citizens-pension/.

The NIS pension or National Insurance Retirement Benefit is designed to supplement the income of individuals after retirement. Every employee who has paid National Insurance contributions is entitled to a retirement benefit.

People qualify for the retirement benefit at any time between the ages of 60 and 65 if they are retired or at age 65 whether or not they retire. The benefit can either be a retirement pension or a retirement grant.

The retirement pension is payable for life to people with 750 contributions or more, which is the minimum requirement for a basic pension.

The retirement grant, which is a one-time lump sum payment, is subject to a minimum sum of $3,000 for people who have made less than 750 weekly contributions.

For people to qualify, they must have reached retirement age and have a minimum of 750 contributions. The contributions may comprise of paid contributions inclusive of voluntary contributions, age credits and or benefit credits.

The insured person who is 65 years old will receive the benefit whether or not they stop working.

The insured person who is between 60 to under 65 years will receive the benefit if they cease to be in insurable employment and will continue to receive the pension even if they return to insurable employment before they attain age 65.

WITH REPORTING BY PAULA LINDO

Comments

"Kamla: ‘Callous pension policy was no error’"