Regional chambers head: Internal inflation, VAT need review in budget

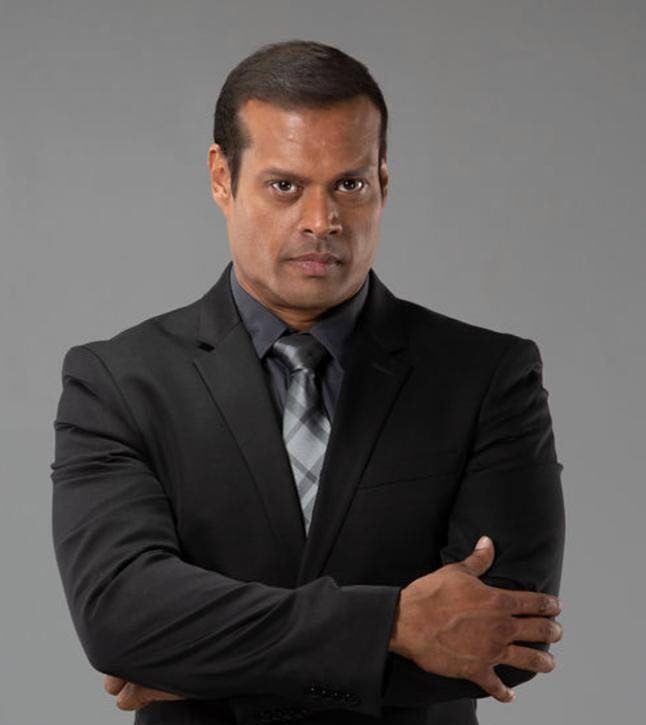

President of the Confederation of Regional Business Chambers Vivek Charran is unsure how many long-term goals can be accomplished in the fiscal year 2023-2024.

In an interview with Business Day on Monday, Charran was asked about his expectations for the upcoming budget – a date is yet to be announced.

He said, “I believe a lot of small things can, incrementally and cumulatively, over time, make a difference, and I believe one of the most important things we have to deal with is inflation internally.”

He explained that despite the Central Statistical Office (CSO) report indicating a three per cent growth in TT's GDP between the last quarter of 2022 and the first quarter of 2023, and the Central Bank report that the inflation rate has decreased from 6.8 per cent to 6.4 per cent, the average man is not reaping the benefits of these decreases.

“So what can we do? Everything, in a sense, stems from inflationary pressures in the economy.”

Charran said only when inflation goes down in a “meaningful way” will commercial activity pick up, employment rates and incomes increase and retail prices decrease.

Referring to the monthly Central Bank report, he said, “I have not really seen an indication of what the employment rate is. Is it constant, increasing or falling? Or what sectors is the rate really increasing in?”

As for the CSO report, Charran noted that there was a 1.5 per cent growth between 2021 and 2022, with the non-energy sector taking the lead in both areas. Though he was not sure how large or prominent these businesses are, he said it is apparent that the performance of the energy sector is falling.

Charran said as the energy sector is diminishing, this will lead to cutbacks, leaving many unemployed unskilled labourers, who account for a lot of the population. He presumes the widespread of small to medium enterprises, however, will increase employment rates.

“The idea is that if we see things like a rise in commercial activity and a fall in inflation and so on, then we would hope we can see some growth with small, micro and medium businesses, which would also help.”

Can you tax an economy into recovery?

Charran said taxes need to be reviewed, especially with the economic state of TT: he said taxes cannot lead to recovery nor an increase in commercial activity.

“In a sense, taxation acts as a barrier to new entrance into industries. So the idea is, let us look at VAT (value added tax).

"It is not an efficient tax. The government is finding it very difficult to deal with the VAT repayments – and we can understand that. Even though they have given a commitment to pay the VAT returns, the reality is that this may actually not occur before the new budget is read.”

He said the majority of the refunds stem from the energy sector, and after those are paid, then manufacturers and other large businesses would be looked at.

“The reality is that the government is going to keep accruing a debt when it comes to VAT repayments.”

Charran added that another debt the government is accruing is wage-related payments to the public sector.

“So we are looking at back pay and overtime pay. We are also seeing that many of those procurement-related bills, contractuall,y that the government is looking at have to be repaid by it.”

He believes the government’s debt profile is going to continue increasing, especially with its growing foreign debt it has been incurring since the start of the pandemic.

“If the government reviews its usage of VAT in the economy and reduces the incidence of VAT in certain areas, for example, retail, and pays off those returns that are accruing in that sector from before, the reality is that the government will no longer have to deal with additional debt coming from that sector.”

Charran explained that if VAT is not repaid, it becomes a cost, and has become one for businesses for many year.

“The incidence of VAT without its repayment puts inflationary pressure within the economy as well.

"So one of the things the government can consider doing is removal of VAT, and this is the key thing: putting a lesser sales tax. This way, the government can still get revenue and not have to worry about an increasing burden of debt that will follow it any more from this whole VAT scenario.”

Another hope Charran has is that the government will review its duties and payments earnings, which, he said, add a lot of inflationary pressures on the economy.

“The government earns a lot of revenue from duty, and we understand that, so what we are saying is, let us level the amount of duty. So some duties are upwards of 30-50 per cent – watches, jewellery and clocks carry 30 per cent, and car parts 30 per cent.

"If it is that the government decides to drop the duty on tyres and car parts and so on to 15 or 20 per cent, one would hope that it gives an ease in vehicle maintenance, including commercial vehicles.”

Charran said transport is of major importance in TT, from the manufacture and export sector to the ports, then to the retail and distribution sector. He added that it will ultimately help the average person as well who uses their car for work.

He added that there could be a general price reduction if the government takes the high number of duties on certain items under consideration. Aside from that, Charran said if TT were to review the duty imposed on jewellery, for example – then a niche market of tourists in a higher income bracket will be introduced to TT’s economy.

“These are small fixes that can affect operations in a positive way, but at the same time, not deter the government too much from earning the revenue it needs.”

Business people, not businesses targets of crime

Asked his hopes for the reduction of crime in the business community, Charran said, “I don’t know, realistically, what my hopes can be. At the end of the day, how can we protect ourselves?”

He lamented that issues such as firearms users’ licences are fraught with difficulty and police overburdened. So the people with authority – the government – need to bear some accountability for what the crime situation has become.

Comments

"Regional chambers head: Internal inflation, VAT need review in budget"