Financial professionals' career concerns

SHELLY-ANN MOHAMMED

Talent research from global accountancy body ACCA shows accountancy remains a smart and popular choice in the Caribbean.

However, the pandemic has changed the world of work for ever, and both employers and employees are learning to live with the new reality.

Financial professionals from the Caribbean were among those who took part in a ground-breaking study along with over 8,000 fellow professionals in North America, Central and South America and around the globe.

From the survey responses, it is possible to understand attitudes to key workplace issues, such as employee engagement, well-being and technology adoption.

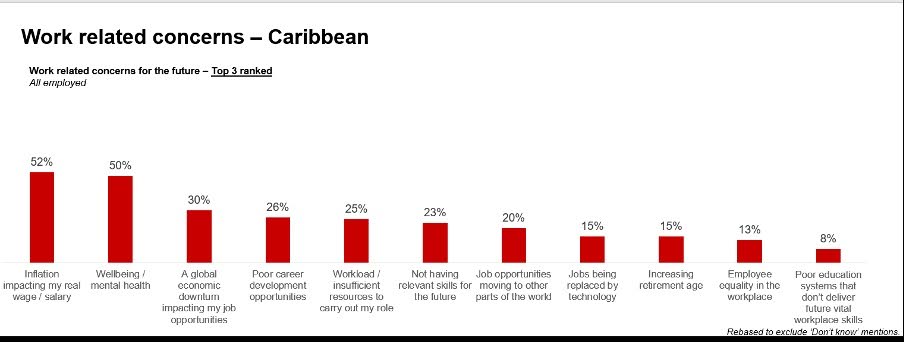

In the Caribbean, the leading concerns were the impact of inflation on real wages (52 per cent) and wellbeing and mental health (50 per cent). These were closely followed by the impact of a global economic downturn on job opportunities (30 per cent).

The impact of inflation also consistently ranks as the leading concern across all generations by both men and women, and as the leading concern across many sectors

(Table 1.1).

Employers in our roundtable discussions reported particular concern linked to retaining talent in the face of growing wage pressures, exacerbated by inflation.

Concern about inflation across the Americas is highest for accountants in the public sector, scoring at 60 per cent. This is likely to be caused in part by public-sector wage constraints and potential funding cuts.

The chart shows the depth of feeling among Caribbean financial professionals over wellbeing concerns.

An astonishing 17 out of 20 of those surveyed said they wanted a better work-life balance – and such depth of feeling may have an impact for employers in terms of retaining highly skilled staff.

And while the numbers weren’t so clear-cut, nearly seven in ten said their organisation could help them more in managing mental health, with a clear majority saying their mental health suffered because of work pressure; only around one in four said their employer saw employee mental health as a priority.

As part of the research, ACCA held roundtable discussions with accountants to discuss talent trends.

Wellbeing came up, with one participant saying, "Stress levels and work-life balance is a big topic right now. Lots of people, especially young people, have concerns about mental wellbeing."

While the impact of inflation and wellbeing were the two key standouts for Caribbean financial professionals, the other key concerns were:

· The impact of a global economic downturn on job opportunities

· Poor career-development opportunities

· Workload and insufficient resources to carry out the role

· Not having relevant skills for the future

· Job opportunities abroad.

Unlike many other parts of the world, Caribbean financial professions seem not to have moved towards hybrid and remote working as a result of the global pandemic. North America showed high levels of remote and hybrid working, with 17 per cent fully officebased; fully remote 20 per cent' and hybrid working 63 per cent.

However, Caribbean data highlights a much stronger preference for fully office-based working, at 63 per cent. Of those in Central and Southern America, 41 per cent reported a fully office-based working pattern, with the remaining 59 per cent hybrid or fully remote working.

At one ACCA roundtable a Caribbean participant pointed out the tensions between home and office working, saying: "I lose probably three hours getting to and from the office, so it’s more productive to me being at home, but the problem with that is that sometimes you need the collaboration."

As part of the analysis, ACCA compared the satisfaction levels between those who were mostly office-based and those mostly remote working.

It is interesting to note that data suggests those working in a fully office-based environment tend to have lower levels of satisfaction than those working in a hybrid way. Of hybrid workers, 60 per cent report satisfaction with employee wellbeing support, while only 38 per cent of those fully office-based reported satisfaction. Fewer than half of fully office-based respondents (44 per cent) reported satisfaction with career-development opportunities, rising sharply to 59 per cent for hybrid workers.

These gaps in employee satisfaction remain consistent across a broad range of other factors including remuneration, employee recognition and job security – one for employers to think through.

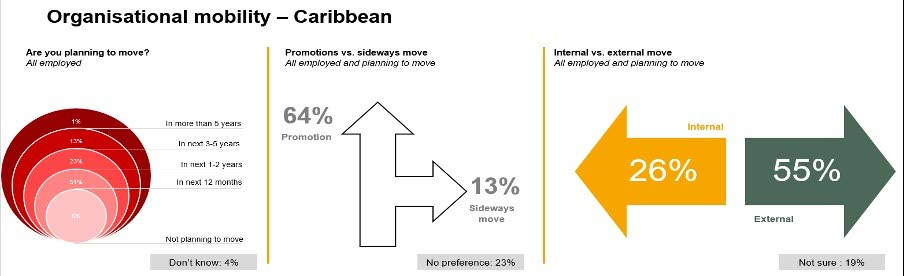

The talent trend throws up a challenge that employers need to work through: mobility is driving a possible talent crunch, and this is as true in the Caribbean as it is elsewhere.

(See organisational mobility chart).

In the Americas, 46 per cent of respondents expect to move to their next role within 12 months, rising to 71 per cent within the next two years.

With over two thirds of employees seeking to change roles within the next two years to pursue new opportunities, employee satisfaction and career-progression opportunities are crucial. Forty-nine per cent of employees seeking to move role are looking for external opportunities, while 32 per cent are looking internally and the remaining 19 per cent are undecided. Almost two thirds (63 per cent) of respondents planning to move are interested in a promotion, while 15 per cent would choose a sideways move and only 22 per cent have no preference.

As one participant in the ACCA Caribbean roundtable put it: "We’re concerned about being able to attract new talent to the profession, and this may create a real problem in the longer term."

Comments

"Financial professionals’ career concerns"