Government’s failure on property tax payments: An inexcusable neglect

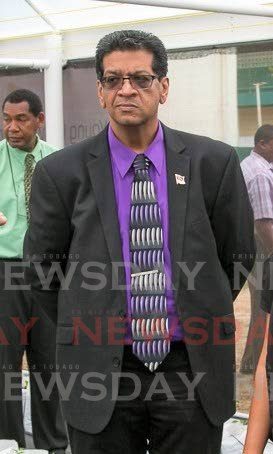

RUSHTON PARAY

THE RECENT extension of the property tax payment deadline by Finance Minister Colm Imbert exposes the Government’s complete failure to provide a convenient system for citizens to meet their obligations.

With more than two years to develop an efficient payment process, the fact that we’re facing chaos at the 11th hour is both negligent and disrespectful to citizens. This situation highlights the administration’s laidback approach to governance, which leaves citizens frustrated and scrambling.

A needless crisis

In an era where digital solutions are the norm, it’s appalling that property tax payments in Trinidad and Tobago still involve standing in long lines, dealing with limited payment options, and encountering bureaucratic delays.

Citizens should never have to stand in line to pay money to the Government. Making payments should be as effortless as possible. The idea that individuals must queue up to meet their tax obligations in 2024 reflects an outdated, inefficient approach to governance that disrespects the time and effort of law-abiding citizens.

The Government has known for years that property tax payments would become due, yet it failed to implement a system that could handle the demand. Now, instead of a smooth, well thought-out process, we see panic and disorder.

The last-minute introduction of automated clearing house (ACH) payments and credit card options is not a solution; it’s a bare-minimum requirement that should have been implemented long ago.

Ignoring simple solutions

This crisis could have easily been avoided with a bit of foresight. The Government could have set up property tax payment bins in high-traffic commercial areas.

Citizens could have deposited their property tax assessments and cheques into these secure drop-off bins, which could be emptied daily, and a receipt mailed to the property owner.

This would have eliminated the need for in-person payments, long lines, or dealing with limited working hours at government offices.

It’s a simple, efficient solution, yet it’s one the Government has completely ignored. Instead of thinking proactively, it waits until chaos ensues before rushing to implement temporary fixes. This approach reflects a lack of creative problem-solving and a deeper issue of governmental incompetence.

A failure of digital modernisation

The Government has repeatedly promised digital transformation, but when it comes to property tax payments, those promises ring hollow. In many other countries, property tax payments are completed in minutes online, with multiple payment options and immediate confirmations. Here we are still dealing with outdated systems and only now being promised ACH and credit card payments, which should have been available from the start.

The fact that this government has failed to roll out a fully functional online payment system after years of knowing property taxes were due is a clear failure of leadership. Citizens should be able to pay their taxes quickly and securely, yet we are forced to deal with a government that acts as if modern technology is beyond its grasp.

The inconvenience and security risks for citizens

Even more concerning is the security risk this failure imposes on citizens. Some individuals, faced with limited payment options, have had to withdraw large sums of cash to pay their property taxes.

This not only inconveniences them but also puts them at significant risk of robbery and theft. The National Security Ministry has already raised concerns about the criminal risks of such large cash withdrawals, further exacerbating an already chaotic situation.

The fact that citizens are put at risk because of the Government’s inability to provide basic payment options is inexcusable. In a modern society, no one should have to withdraw cash to make a government payment. This entire situation could have been avoided if the administration had implemented secure, convenient payment systems as promised.

Reactive leadership, not proactive solutions

At the heart of this crisis is the Government’s lack of proactive leadership. Instead of anticipating and solving problems before they escalate, the administration waits until the situation becomes untenable, then tries to control the damage. This is not leadership; it is crisis management at its worst.

The Government’s last-minute fixes, including extending deadlines and promising payment options that should have been available from day one, do little to address the underlying issue: the failure to modernise and streamline the property tax payment process. Citizens deserve better. They deserve a government that respects their time and provides simple, efficient solutions to meet their obligations.

The path forward

To prevent this situation from recurring, the Government must prioritise citizen convenience and safety. This means implementing fully functional online payment systems, providing multiple payment options, and creating secure, easy ways for citizens to comply with their tax obligations. The idea of installing secure drop-off bins in commercial areas for cheque payments is just one simple solution that could make a world of difference.

The administration also needs to stop treating citizens as an afterthought. Taxpayers are the backbone of the economy, and they deserve to be treated with respect. The Government should not make paying taxes a burden. Instead, it should be a seamless process that acknowledges the value of citizens’ time and effort.

This is not just a failure of technology or planning; it’s a failure of governance. The Government must move beyond last-minute fixes and implement real solutions that work for the people. Anything less is unacceptable.

Rushton Paray is the MP for Mayaro

Comments

"Government’s failure on property tax payments: An inexcusable neglect"