CBTT reaffirms commitment to green financing

Despite the newly-installed Trump administration freezing over US$300 billion in funding for green infrastructure designed to improve environmental conditions, the Central Bank of TT (CBTT) remains committed to its net zero pledge of ensuring climate-related risks do not adversely impact TT's financial stability.

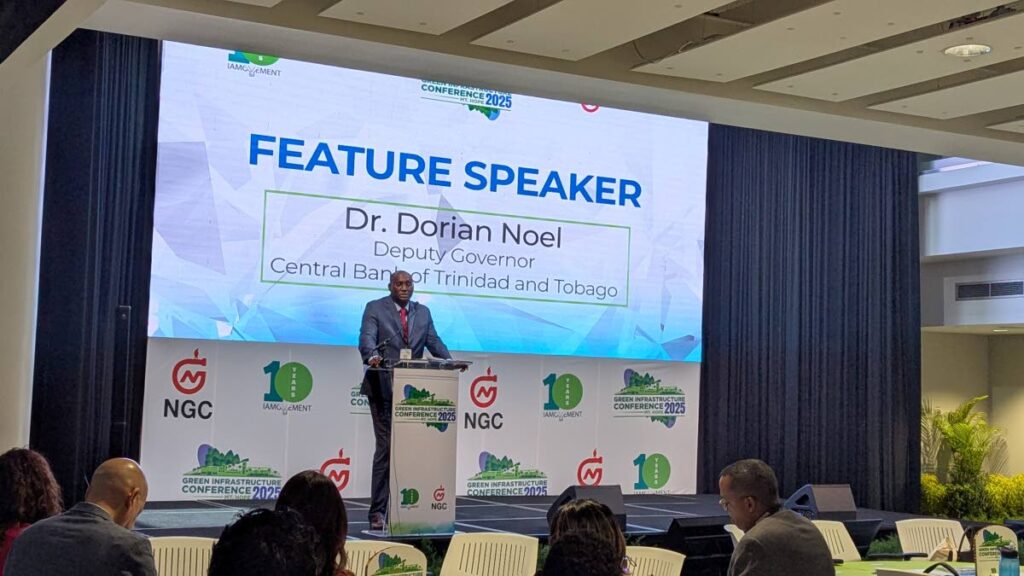

Dr Dorian Noel, deputy governor of monetary operations and policy of the CBTT, reiterated the bank’s commitment to address climate change and its risks at the Caribbean Green Infrastructure Conference (CGIC) 2025 held at the Arthur Lok Jack Global School of Business on January 23.

Noel said during the 63rd bi-annual meeting of the Caricom Committee of Central Bank Governors in Bridgetown from November 7-8, 2024, regional banking officials reiterated their dedication to greening the financial system.

"CBTT as well as our regional colleagues recognise the importance of climate change and we are moving very aggressively, incorporating climate change considerations into our operations."

He said the banks are working to improve regional climate data; develop a consistent regional climate taxonomy to facilitate the development of green instruments and markets; and undertake climate assessment of the regional financial system.

Locally, CBTT is working on improving climate awareness and education through climate data reporting and disclosure.

Noel, however, called for improvements in the culture within the business sector as it pertains to climate action.

"Until recently, climate and climate-related concerts were not factored into mainstream finance and definitely not the production cost of businesses. Emissions were viewed as negative externalities and need to be addressed because they generate social costs."

He said since 2022 CBTT has been measuring its carbon footprint and has been working with the EMA to incorporate climate exchange consideration into procurement activities and work environment. He said the bank has been working to fine-tune its climate action plan which involves climate change consideration in the areas of monetary policy, conscious stability and internal operations.

CBTT has already invested around three per cent of the country’s reserves into green bonds which will be used to finance projects that contribute positively to the environment and climate.

Noel praised the work of local financial and non-financial institutions as they continue to work towards sustainability and green finance.

He said in light of the US Federal Reserve withdrawing from the Network for Greening the Financial System – a network of around 114 central banks and financial supervisors that aims to accelerate green financing – he expects a reduction in the presence of US banks in green spaces.

Still, this does not deter the commitment of CBTT and regional partners in their work towards boosting climate action.

Noel said he is of the full view that green spaces, instruments, markets and infrastructure are still necessary and viable options.

The two-day CGIC conference is hosted by the IAMovement and National Gas Company (NGC).

The conference focuses on green bonds and carbon credits.

Comments

"CBTT reaffirms commitment to green financing"