Halt on property tax

Property owners may be getting a reprieve as an amendment to the Property Tax act is expected to be laid in Parliament on March 15 and debated next week.

Issued to MPs around 5.30 pm on March 14, it proposed that the residential property tax be reduced from three to two per cent and includes a section that would extend the Board of Inland Revenue (BIR’s) deadline to issue notices of assessment to June 30 for this year only.

An attorney familiar with property tax law explained it would also allow the Finance Minister to amend schedules for certain acts and made it so that Parliament would have to actively prevent the minister from making such changes rather than him needing the Parliament’s permission to do so.

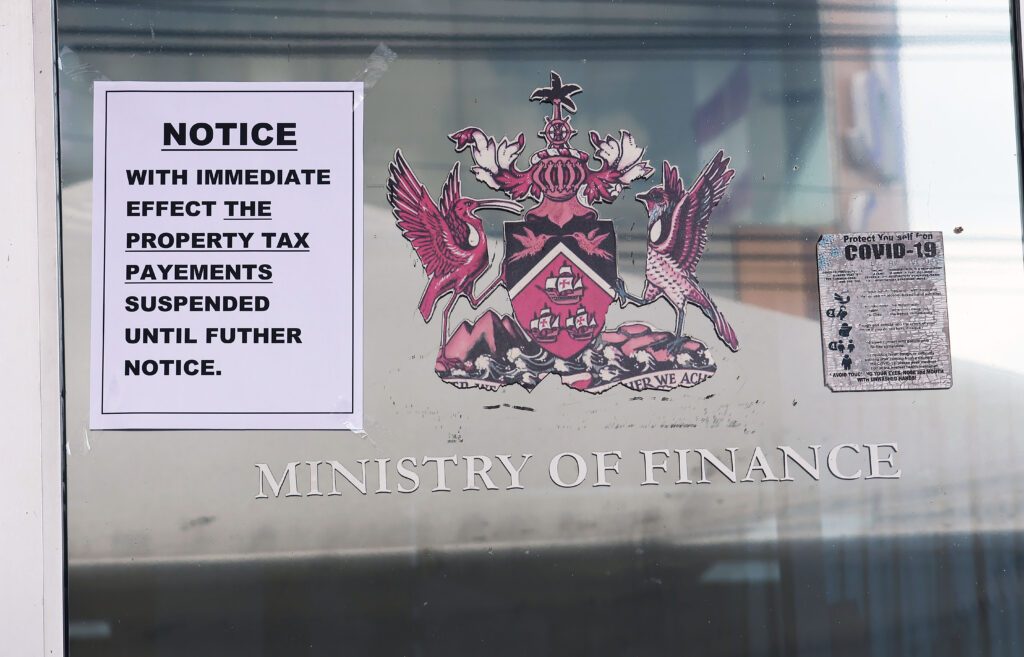

The public was alerted to an issue when printed signs were posted at several BIR offices stating property tax payments were suspended. While differently worded, the signs all indicated tax payments had ceased on March 14 “with immediate effect until further notice.”

Efforts to get a response from the Finance Ministry proved futile up to press time. When News- day contacted former minister in the Ministry of Finance Allyson West, she said she was not prepared to speak on the property tax and referred this reporter to Finance Minister Colm Imbert.

This is yet another delay as the PNM government has been trying to get property tax implemented since 2010.

Formerly known as the Land and Building Tax, the old Property Taxes ended in 2009.

The Property Tax Bill 2009 was introduced to the House of Representatives on December 11, 2009, and the act was assented to on December 31, 2009. The act made provisions for the assessment, rating and taxation of land and was supposed to come into operation on January 1, 2010.

The TT Revenue Authority (TTRA) Bill was introduced to Parliament in January 2010 under the PNM. It was supposed to create a semi-autonomous authority to manage and collect taxes and customs duties.

But when the People’s Partnership came into power in May of that year, the bills lapsed.

The Revenue Authority was again proposed by PNM in its 2015 election manifesto. According to Imbert, during Conversations With The Prime Minister at Skiffle Bunch Pan Theatre on March 5, the PNM brought the bill back to Parliament and sent it to a Joint Select Committee.

There were also two years of consultation before the bill was brought back to Parliament and eventually lapsed.

In 2020, the government mod- ified the legislation to make it a simple majority bill, which was passed in December 2021.

Regarding the property tax, the PNM government started gather- ing information on properties to develop valuation rules in 2017.

The Property Tax (Amendment) Bill, 2018, was introduced to Parliament on February 2, 2018, passed in the House of Representatives on March 2, 2018, passed in the Senate on May 11, 2018, and assented to June 8, 2018. Then there was the Valuation of Land (Amendment) Bill, which was introduced and passed in the House of Representatives on May 24, 2023. The bill sought to amend the Valuation of Land Act, Chap 58:03, providing for the valuation of land for taxation, rating and other purposes.

The bill was introduced in the Senate on May 31, 2023, passed in the Senate on June 2, 2023, and assented to on June 7, 2023.

Imbert noted there were several court matters and injunctions that delayed both the TTRA and Property Tax Acts.

“In 2022, within a couple of months (of the TTRA bill being passed), they (the UNC) gone to court again. They said the bill is unconstitutional, the act is unconstitutional, and we’ve been in the court with them for almost two years.”

“They lost in the High Court, they lost in the Court of Appeal, they gone to the Privy Council. And while we are there seeking to implement this new agency, they keep applying for an injunction.”

The Public Services Association (PSA) was also part of the court and injunction action, saying parts of the TTRA legislation were unconstitutional and that the Government did not have the power to delegate its tax-reve- nue-collection duties.

High Court Justice Westmin James dismissed the case on November 17, 2023, but the PSA appealed the judgment and asked for an injunction to block the authority’s implementation. The government, therefore, pushed back the implementation of the TTRA Revenue Authority to March 1.

But Imbert said the government was pressing on.

The property tax took effect from January 1.

Comments

"Halt on property tax"