CCJ throws out Apsara (Barbados) $22m insurance claim

THE OWNERS OF Apsara Restaurants will not collect on a $22 million insurance policy after their Barbados restaurant was destroyed by fire in August 2007.

In a ruling on January 22, six Caribbean Court of Justice (CCJ) judges dismissed Apsara Restaurants (Barbados) Ltd’s appeal.

The court sat in its appellate jurisdiction as Barbados’ apex court.

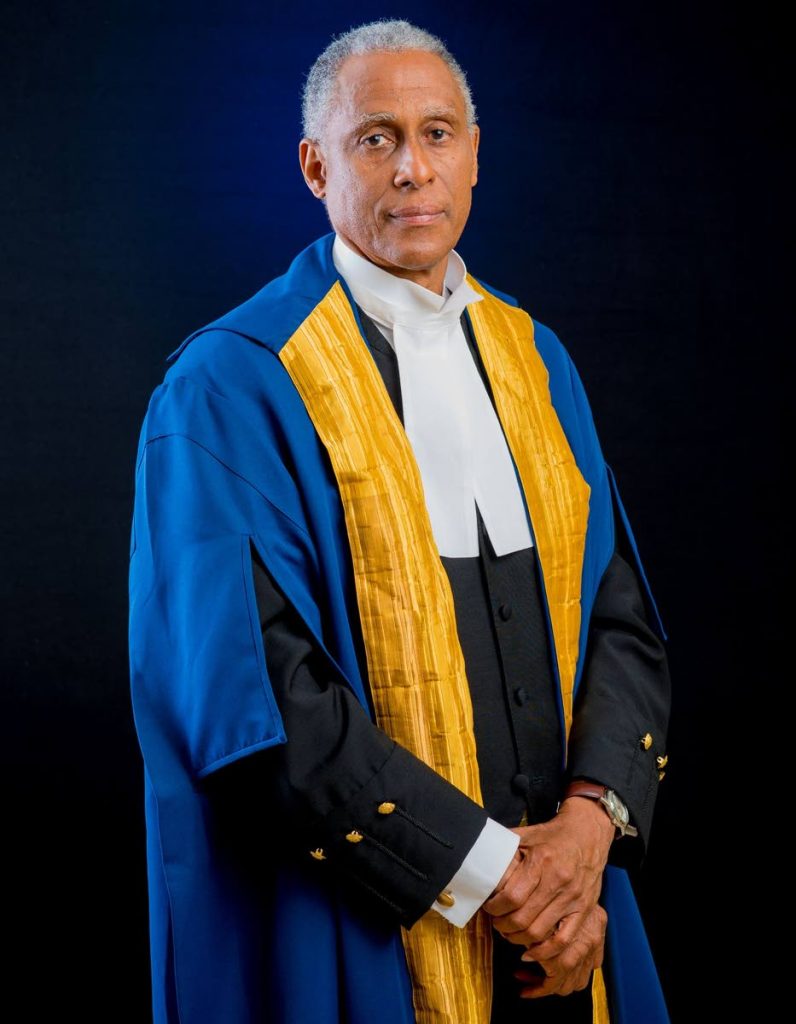

Presiding over the appeal were president of the court Justice Adrian Saunders and Justices Jacob Wit, Winston Anderson, Maureen Rajnauth-Lee, Denys Barrow, Andrew Burgess and Peter Jamadar.

Before the judgment could be delivered, Wit retired on the grounds of ill health, and died shortly after. The decision said his inability to participate in the deliberations did not affect the outcome of the appeal, as all remaining six judges agreed it must be dismissed.

Apsara filed the appeal after the Barbados Appeal Court endorsed the findings of the High Court which upheld Guardian General Insurance’s defence.

In resisting Apsara’s claim for payout of the fire insurance policy, Guardian General alleged the restaurant’s owner and director, Sharif Mohammed, was responsible for the fire; and the restaurant did not disclose several material facts when insurance coverage was proposed and was in breach of one of the conditions of the policy.

A year after the two restaurants, Apsara and Tamnak Thai, opened at Morecambe House, Christ Church, a fire destroyed the premises. The restaurant’s two sole directors and shareholders were Marie Kavanaugh and Mohammed.

According to the case, in April 2007, Apsara acquired an insurance policy with Guardian General for loss or damage by fire at the Morecambe House premises.

The fire happened on August 27, 2007. The insurance company hired an adjuster to investigate and on September 5, 2007, Apsara’s two directors formally submitted a claim for loss of leasehold improvement, equipment, furniture and content, and restaurant stock damaged or destroyed in the blaze.

However, Guardian General contended Apsara failed to disclose a failed attempt to collect insurance in another case. The non-disclosure related to the cancellation of a policy effected in Trinidad and Tobago by O’Meara Foods Products Ltd, a company of which Mohammed and Kavanagh were both sole shareholders and directors; had denied a claim made by O’Meara; and that there was an unpaid judgment debt in TT against O’Meara.

In its ruling, the CCJ, by a majority of four judges, held that it was entitled to review the concurrent findings of the trial judge and the appellate court.

Also by a majority of four, the CCJ further held that there was insufficient evidence to justify the trial judge’s conclusion that Mohammed was responsible for setting the fire.

“The majority’s view was that neither the trial judge nor the Court of Appeal appeared to have taken into account circumstances that pointed away from the notion that Mr Mohammed was the likely arsonist.”

On the material non-disclosure argument, five judges held that Apsara’s failure to disclose to Guardian General that O’Meara had previously made an unsuccessful claim on an insurance policy was a material non-disclosure which entitled it to void its policy of insurance.

All six held that Apsara’s failure to disclose that there was an outstanding judgment in TT against O’Meara by the Agricultural Development Bank for $1 million was “a material non-disclosure which entitled Guardian to avoid the policy of insurance.”

However, on the alleged breach of one of the clauses in the policy – to provide particulars of loss within 15 days of the fire – all six judges held that “given the extenuating circumstances revealed by the evidence, Apsara’s failure to provide the particulars within the stipulated time did not entitle Guardian to avoid the policy on this ground because Guardian’s conduct amounted to a waiver of the requirement for strict compliance with Clause 11.”

At the CCJ, Apsara was represented by Douglas Mendes, SC and Clay Hackett. Christopher Audain, KC and Roger Forde, KC, represented Guardian General.

Comments

"CCJ throws out Apsara (Barbados) $22m insurance claim"