Inoculate our economy against covid19

kmmpub@gmail.com

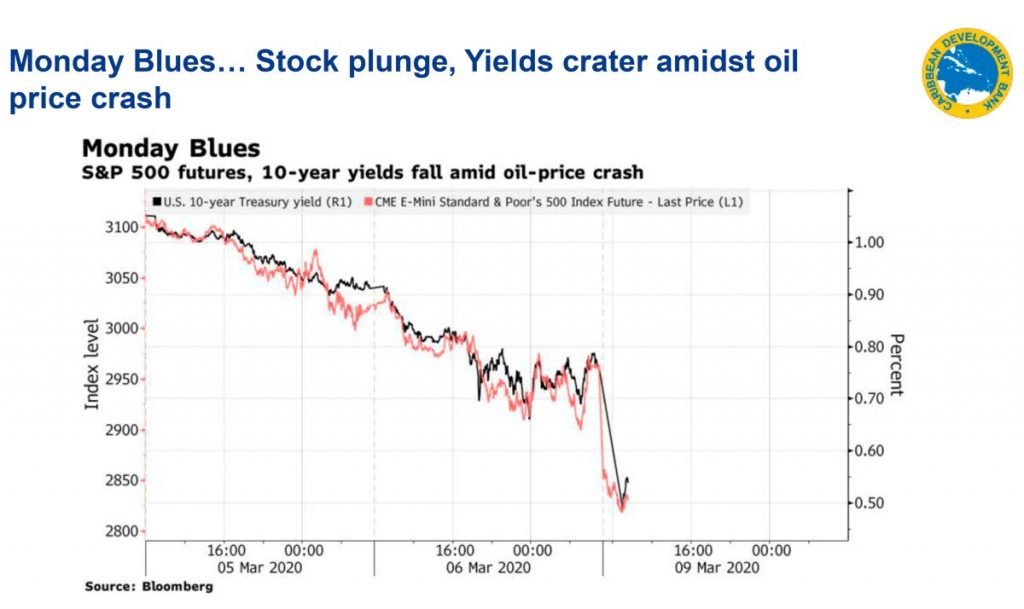

On Sunday, I had a pleasant dinner and went to bed early. By Monday morning, my phone was blowing up. Oil and stock markets had plunged. Europe was shutting down.

In the last three weeks alone, the S&P500 index of US equities fell by more than 16 per cent. Panic reigns. The world teeters on the edge of recession. My Instagram feed has changed: food pictures and cat pictures have been replaced by empty-shelf pictures and cat pictures.

The coronavirus (covid19)'s effects will be twofold. The first is direct. Sick people won’t be able to work. Some will die.

The second is indirect: the cost of beating the virus. Efforts to delay and contain the virus mean that people must stay at home. Many will not be allowed to go out and work to earn income and they won’t be able to go out and spend it. Supply chains will be interrupted. Businesses will face a liquidity crunch. Uncertainty will add fuel to the fire.

Justin Ram, director of economics at the Caribbean Development Bank, has pointed out that the virus is causing a supply shock and a demand shock at the same time.

At the time of writing, Brent crude was US$35, and gas was US$1.9, after the largest single fall since 1991. Saudi Arabia and Russia have decided this is a perfect time to pump more and sink their rival US shale producers, who need higher prices to survive.

We are collateral damage. Our national budget and most investors had assumed a price of US$60 for oil and US$3 for gas. Government now expects to collect $3.5 billion less in revenue than expected. It will largely borrow to fill the gap, causing our debt to GDP to rise. Interest will also be more expensive as investors flee emerging-market debt to safe havens. Though by October, Government can draw on the Heritage and Stabilisation Fund, and flog a couple state assets, experience has shown that this will take a while. Neither is an immediate solution.

The good news is that the State intends to maintain spending. The relatively small fall in revenues is also a testament to the new tax regime that Government negotiated with energy companies. Prices fell more swiftly on Monday than in 2015, but revenues fell by a proportionally smaller amount than last time, when we were out by some $20 billion. The hit from oil prices may not be so bad in the immediate term. It all depends how long prices stay low.

More immediately we could be hit with supply-chain shocks. I’m not saying to rush to the stores, but since we import almost everything, we should start planning. The silver lining? Local producers and manufacturers can seize the opportunity to fill the gap.

We don’t yet know whether this will be temporary or if the combination of hits will trigger a longer-term recession.

What we do know is that the lasting effects will be affected by how we support the economy in the short term. Globally, governments are preparing large stimulus packages. The UK has just unveiled a £30 billion emergency health budget and announced £600 billion more for infrastructure – not numbers to sniff at. They’ve also slashed business taxes for small businesses. Central banks in the UK and the US are cutting rates to support demand.

Unfortunately for us, these tools don’t work as well: most government spending leaves the country through imports. But we can support small businesses through their liquidity crunch by quickly cutting business taxes and introducing a Japanese style time-to-pay measure that allows businesses to spread out their tax payments.

I spoke with our chief medical officer for epidemiology, Dr Harry Smith. He is confident that our system can deal with cases, as they will be spread over several months. There is strong backing from the top to tackle the virus.

These efforts must be supported by an emergency health budget. As Ram has said: “Governments should sufficiently resource hospitals and primary health care facilities with labour and financial resources.”

Apart from hiring doctors and shoring up hospitals, the CDB has recommended quick investments in health tech. Remote patient monitoring, telemedicine and e-prescriptions have been critical to China’s efforts to contain the virus.

Now is the time for swift and decisive government support. For everyone else the approach is clear: plan, secure short-term cash, protect your supply chain, don’t rush to sell anything, keep calm and carry on.

Kiran Mathur Mohammed is a social entrepreneur, economist and businessman. He is a former banker, and a graduate of the University of Edinburgh

Comments

"Inoculate our economy against covid19"