Crouching Tiger

Kiran Mathur Mohammed

kmmpub@gmail.com

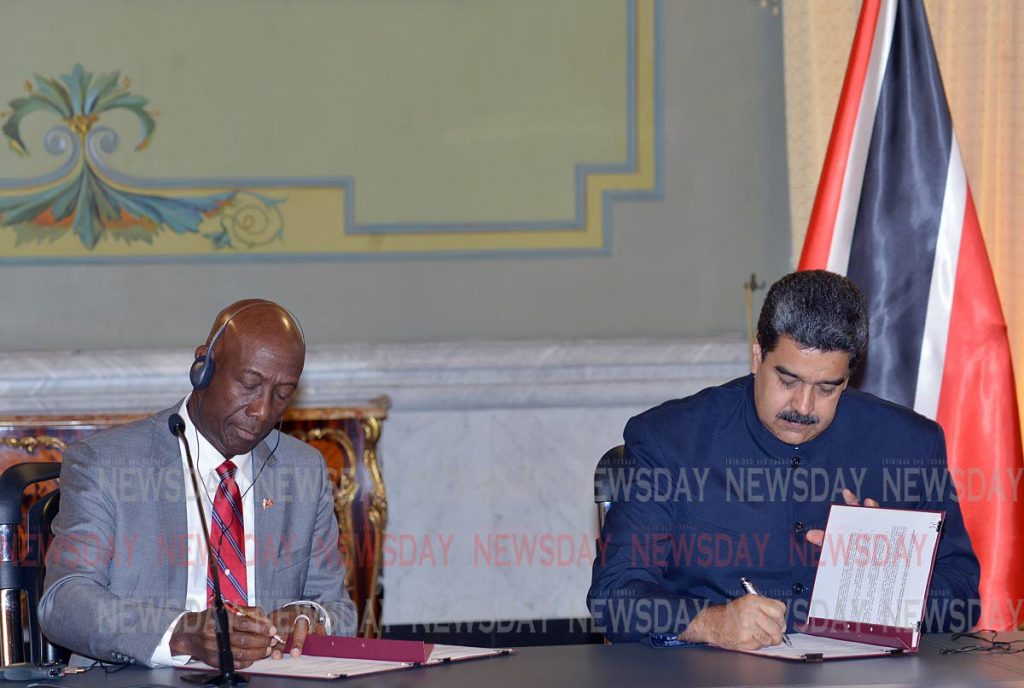

The Dragon gas deal signed last Saturday is worth celebrating. The clink of glasses will be heard in boardrooms in both countries. The government deserves it for getting this far, amid the chaos in Venezuela, and the spectre of international sanctions.

At least one senior banker I’ve spoken to noted that the agreement rings hollow for Venezuelans on Maduro’s Twitter feed who mocked the grand signing ceremony, as thousands of hungry and desperate refugees flee to Trinidad. Instability there may still upset the deal’s execution, and could result in costly penalties if supply is ever interrupted. That said, there is much to be hopeful about.

Another energy executive reckons that this could eventually lead to Venezuela exporting its onshore gas (currently being flared off and wasted) to Trinidad: improving efficiency and the environment. It could even lead to discussions on how we can help the refugees coming to TT, and seriously engage with Venezuela on human rights.

We are massively short of gas. It may sound strange, given that we export it and the world is awash with the good stuff. Gas is firstly used in Trinidad to generate power. Then, almost all the rest is liquefied and exported. What remains is used as "feedstock" for the plants in Point Lisas that produce chemicals that are exported, mainly for fertiliser. The energy producers have locked-in contracts that mean that almost all of our gas is exported.

When we were producing enough and earning tax dollars, this was a good deal. But our gas production has been in continual decline. There isn’t enough gas to satisfy local and external demand. Since the multinational energy companies make more money exporting gas than by selling it locally, this means that the plants in Point Lisas end up starved of gas. Some have shut down and sent home hundreds of workers. To help plug this shortage, and boost revenues, the government aims to pipe in gas from the Dragon field in Venezuela’s waters.

The celebration has been earned. But back to work. We won’t see first gas from the Dragon field until 2020. Moreover, as an energy executive pointed out, the gas is coming from Venezuela and will not be directly subject to our petroleum taxes – unlike gas produced from Trinidad waters. No doubt this is one of the reasons the energy companies are so keen to sign up. The Dragon field will also produce just 150 million cubic feet of gas per day, compared to our average current consumption of 3.46 billion cubic feet per day. And this is consumption with a number of mothballed plants. So, what can we do quickly?

It turns out that energy efficiency – once laughed at in a country with gas to burn – could be one additional way forward. Our lumbering power plants, partially owned and operated by multinational corporations, are ripe for investments in efficiency – and the operators have said so themselves. Powergen alone could save up to US$45 million a year in gas if it invested US$80 million to make their plant more efficient. This is according to both the National Gas Company (NGC), and youth-led non-profit IAmMovement’s co-founder Jonathan Barcant. This gas could be freed up for our chemical industry – allowing it to bring back workers. The numbers get even more impressive if renewable energy or LED bulbs are considered as gas saving alternatives.

With numbers like that, why haven’t they done it already?

The answer lies in the incentives embedded in the power-purchase agreements signed between the TT Electricity Commission (TTEC), the government and the international power operators. TTEC pays the generators by capacity (the amount of electricity they are able to produce) instead of by the amount of electricity they actually produce.

At the same time, TTEC guarantees and pays for the gas supply to the power plants. And in practice, TTEC hasn’t actually paid for any of the gas it receives from NGC.

So Powergen doesn’t benefit by investing in more efficient plants, even though the country as a whole would save money.

If an agreement was signed that allowed Powergen to benefit from investments in energy efficiency: this would be a win-win. Powergen would boost its bottom line, have a better operating plant, and (yes) reduce polluting carbon emissions.

Gas would be freed up for the downstream chemical plants, and NGC would benefit by finally getting paid. Most of all, the workers and engineers worried in their houses in Couva and Freeport could breathe just a little easier.

Kiran Mathur Mohammed is a social entrepreneur, economist and businessman. He is a former banker, and a graduate of the University of Edinburgh.

Comments

"Crouching Tiger"