101 years laid to rest

On the eve of the country’s 56th anniversary of Independence, the board of Petrotrin announced it was shutting down the state oil company’s refinery and marketing operations, choosing instead to focus on exploration and production.

Over 2,500 jobs will be affected, and all refining jobs — about 1,700 — will be terminated as the company begins its transition period on October 1.

The tragedy of Petrotrin goes beyond the immediate impact of job losses, though. One of the major casualties of this decision is the 101-year-old Pointe-a-Pierre refinery – once the crown jewel in a collection of state enterprises that has now lost its lustre, a beacon of nationalism whose light is now dulled.

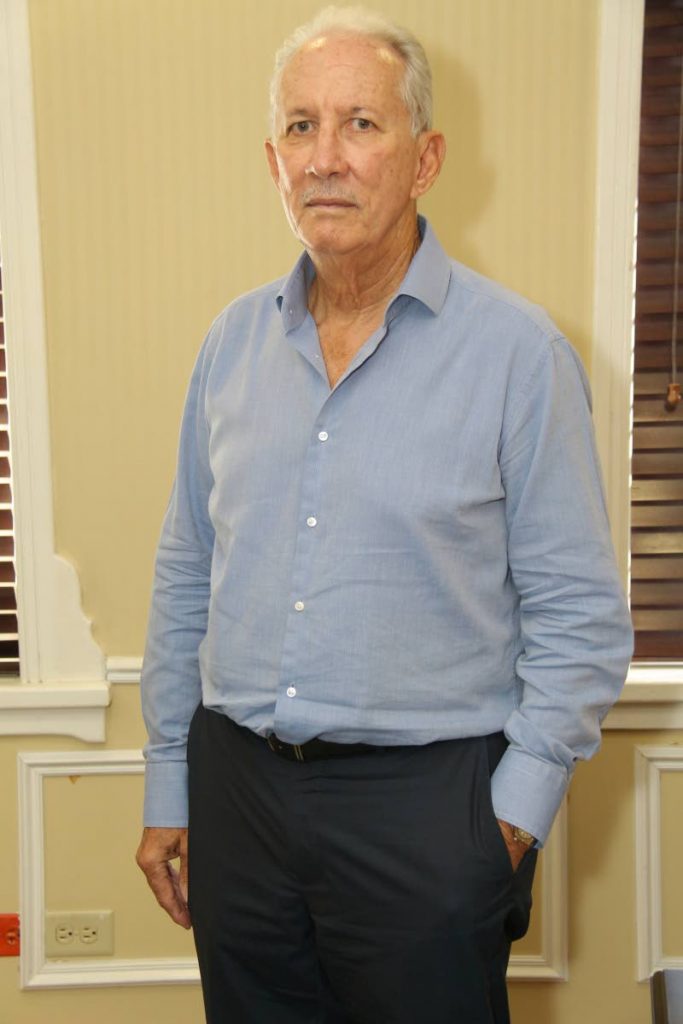

“We are now 101 years old in the refinery business and the purpose of getting into it is no longer relevant, but we are holding on to it because there are emotional ties. And because it is there, what we’ve done now as a board is look at it hard and said, 'Hey, let’s start from a clean sheet'," chairman Wilfred Espinet told a media conference on Tuesday.

In the beginning

The Pointe-a-Pierre refinery has had a storied history. First set up in 1917, it was once the biggest in the British Empire. During World War II the refinery was identified as an asset to be “protected at all cost” as a major supplier of aircraft fuel for the Allied forces. In 1940, refining capacity in Trinidad and Tobago was recorded at 28.5 million barrels per year.

In 1956, US company Texaco acquired the refinery, and in 1985, the government, through Trintoc (1974) bought over Texaco’s assets except Trinmar. In 1993, Trintoc and Trintopec were incorporated into Petrotrin. The board had most recently claimed that as part of the restructuring, initiated on March 1, it would split the company’s operations into two arms — exploration and production and refining and marketing. The announcement to shut down the refinery, then, came as a surprise to most.

It’s a bold move, because the nostalgia surrounding Petrotrin and Pointe-a-Pierre is palpable — especially for south Trinidad. The livelihoods of thousands more than 5,000 direct employees of the company are intertwined with the refinery — from restaurants to the technical service providers who have had their base in and around the San Fernando/Marabella area, including Vistabella and Gasparillo.

“It’s a whole domino effect,” said president of the San Fernando Business Association, Daphne Bartlett.

Local historian Prof Brinsley Samaroo has likened the refinery’s end to the closure of Caroni (1975) Ltd, which also had rippling effects throughout local communities of south and central Trinidad.

“The refinery was crucial to the development of Trinidad, from Claxton Bay to San Fernando and beyond. The whole area was developed when the refinery was opened and the opportunities it provided,” he told Business Day.

It’s likely we’ll see a repetition of the economic displacement that happened after Caroni was shut down, and similar areas, like south and central, he said. This time may even be worse though — when Caroni closed, the refinery was still running, providing an economic buffer for the area.

“People in south depend directly on the oil industry. The whole economy hinged on the oil industry since the closure of the sugar factory and we haven’t been able to diversify the economy since then, so we continue to depend on oil. The closure of the refinery is not a good sign and I think we are in for a rough period for the whole country,” Samaroo said.

Many questions to answer

For the wider economy, though, there are still questions that need to be answered. The Petrotrin refinery provided cheap fuel for the local market. Now the country will have to import the equivalent of 25,000 barrels of oil per day to supply the economy, although the amount will hopefully be offset by the how much the company produces — about 40,000 barrels per day. Nonetheless, this will likely require some adjustment, most notably to the fuel subsidy. According to the TT Energy Chamber, over 90 percent of Petrotrin’s sales to the local market have been fuel — 46 per cent is from gasoline, 37 per cent from diesel, and 11 per cent from jet fuel. Five per cent is from liquefied petroleum gas (LPG or cooking gas), but the company has said it will continue to supply this.

“About 20 per cent of the refinery's output is consumed locally. The refinery is our sole source of gasoline, diesel, and jet fuel. If we don’t have an operational refinery we will of course have to import fuel. Another 17 per cent is exported to Caricom with the main markets being Jamaica, Barbados and Guyana. These countries will have to source fuel extra-regionally,” former energy minster and now consultant and lecturer Kevin Ramnarine said.

He was also concerned about the uncertainty of the subsidy. “The fuel subsidy is based on the ex-refinery price. Since there will be no refinery there will be no ex-refinery price. So, what happens to the subsidy? The country will likely spend about $900 million this year subsidising liquid fuels to the population,” he said.

Rooting out debt 'cancer'

Petrotrin’s lack of competitiveness has consistently been cited by the board as the fundamental reason for restructuring. In February, during a presentation to a joint select committee of Parliament, the board noted that the company’s key performance indicators, when placed against international benchmarks put the company at the “lowest of the low” in terms of competitiveness.

The refinery has a nameplate capacity of 140,000 barrels of oil per day — it therefore has to import 100,000 barrels a day to remain viable, making it a net consumer of foreign exchange.

“We had a continued programme of looking at all sorts of ways to make this work. We came to the conclusion that if we wanted to be able to pay back the debt, and if we wanted to be able to have a profitable company that could be sustained over time, we would have to take out what was the cancer of the operation and that would have been the refining and marketing.”

And the company has a lot of debt: over $10 billion — including $3 billion to the government. It requires a $25 billion cash injection to stay alive, and next year, a US$850 million bullet payment on a bond issue comes due. In dire tones on Sunday, Energy Minister Franklin Khan said the company had the potential to bankrupt the country.

Even some of the government’s biggest critics have agreed that something needed to be done to get the company back to profitability.

“Things definitely needed to be restructured,” said Bartlett. Ramnarine agreed, especially in the context of the debt burden of the company

Save the refinery

Despite the board’s claims then, that it needed to cut out the “cancer” of the refinery, though, Ramnarine and Bartlett believe the refinery could have been salvaged.

“I don’t think Petrotrin would have bankrupted the country. Petrotrin and its refinery are completely redeemable but there is a need to push for efficiency and cost reduction. US refineries are currently experiencing a 'golden age' and are running at record levels in response to robust domestic and international demand for gasoline and fuel oil. The paradigm in the refining business is competitiveness. Having said that we need to appreciate that the country spent US$1.6 billion on the refinery in the last decade and we have some relatively new plants there such as the continuous catalytic reforming plant (Cat Cracker), the iso plant and the acid/alkyl plant,” he said.

Bartlett said instead of shutting the refinery, the country should have instead looked towards improving it to take advantage of opportunities in places like Guyana, which is currently experiencing the first waves of an oil boom.

“We know it can be viable because of what’s happening in Guyana. State-owned companies do not belong to politicians. A decision like this should have been made with open discussion. It makes me wonder, did they think this decision through or did they just want to get rid of it?”

Comments

"101 years laid to rest"