Inflation, foreign rates factor on TT rates

The Central Bank says domestic inflation and foreign interest rates are two of the main factors affecting local interest rates.

Nicole Crooks, senior manager human resources, industrial and external relations at the Central Bank, said a basic prime lending rate generally represents a reference rate that a bank establishes to guide the interest rates it sets on loans to its customers.

"As its name implies, the ‘average basic prime lending rate’ calculated by the Central Bank takes an average of the prime rates set by commercial banks in TT. Movements in prime lending rates give a fairly good representation of the general path of interest rates in an economy. Two of the main factors affecting local interest rates are domestic inflation and foreign interest rates. Consequently the trend in prime lending rates since 1999 is closely connected to inflation and external rates."

Crooks also spoke with Business Day about trends the bank may have observed in economic activity, with the rise and fall of the prime rate at commercial banks.

"Since the international financial crisis in 2008, both domestic inflation and foreign interest rates have been dipping, affecting the path of prime lending rates. More recently, interest hikes by the US Federal Reserve have led to a rise in interest rates across the world, including in TT."

Meanwhile, a retired senior banker said if there are any similarities between the current economic climate and the circumstances which led to the median prime rate peaking at 17.5 per cent in 1996 before fluctuating in the following years.

"Not really," the banker said. "When the prime rate was double digit, it was the Central Bank trying to manage inflation and to try and 'cool' the economy. Then we went through a cycle to stimulate the economy by having low interest rates but this has never really worked in the commercial sector – in the area of productive investment. Retail sector, yes, as individual borrowings increased with low rates of interest."

Regarding the belief by some that this is the start of a steady rise in lending rates again, the banker said, "Never say never but I believe the increases are more to discourage capital flight as the interest rate differential between the USD and TTD is minimal."

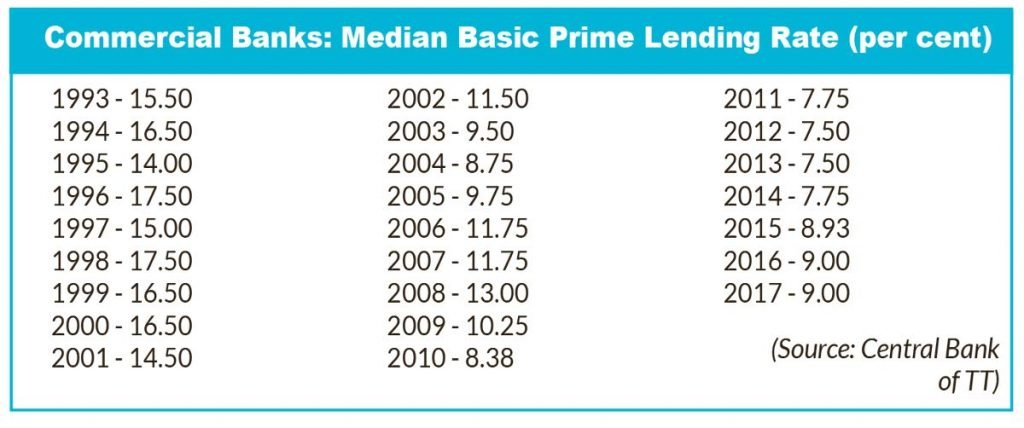

Central Bank data (see table) shows fluctuations in median basic prime lending rates for 1993-2017. The rate moved from 15.5 per cent in 1993 to 16.5 per cent in 1994 before dropping to 14 per cent in 1995 then spiking to 17.5 per cent in 1996.

The median went down but remained in double digits between 1999 and 2002 before dropping to 9.5 per cent in 2003. It hit double digits again in 2006 at 11.75 per cent then, after a few increases and one decrease between 2007 and 2009, it dropped to single digits again in 2010, at 8.38 per cent. The median rate then hovered below eight per cent for four years before rising to just under nine per cent in 2015. It hit nine per cent in 2016 and remained unchanged in 2017.

Comments

"Inflation, foreign rates factor on TT rates"