Nutmeg energy

TT is set to benefit from Grenada's oil and gas discoveries but not for another few years.

Exactly when depends on the outcome of Global Petroleum Group's (GPG) exploration off Grenada's south coast, Leonid Mironov, finance and corporate affairs officer, shared with Business Day.

"The timing is to be determined by the outcomes and the results of the appraisal and delineation drilling campaign, which will help better inform the detailed development and production plans and the timings of those," Mironov answered via e-mails on how soon GPG expects to send gas to the National Gas Company Ltd (NGC) for processing and sale.

GPG, incorporated in Grenada, is conducting petroleum and natural gas exploration, development and production under the country's Petroleum Act and Petroleum Regulations.

On April 6, NGC announced a commercial agreement with the Russian oil and gas company which includes a first right of refusal. This means TT will have the option to buy Grenada’s natural gas before anyone else.

GPG is currently exploring in Grenada waters near the fields of Patao/Dragon in Venezuela and North Coast Marine Area (NCMA) in Trinidad. The company was granted a development licence for four blocks in the D band of Grenada’s maritime territory.

"The geological prospects identified by GPG within those blocks are named after tropical spices. The most prominent and promising prospect was named Nutmeg. A number of drilling locations were proposed over the Nutmeg prospect and the first well drilled was in Nutmeg-2 location," said Mironov.

The gas discovery was made in the Nutmeg prospect – drilled in 2017.

In a statement, NGC said it would use its "capabilities and expertise", honed over four decades, to help GPG develop Grenada's natural gas-based energy sector.

(Left to right) NGC chairman Gerry Brooks, GPG executive director Eduard Vasilyev and NGC president Mark Loquan sign a commercial agreement at NGC's head office, Couva on March 19. GPG is undertaking exploration and appraisal activities off south coast of Grenada, and the agreement gives NGC first option to buy. PHOTO COURTESY NGC.

Commenting on this, Mironov said, "NGC is the natural offtaker of gas supplied by GPG from Grenada. GPG will incorporate NGC technical requirements into its development and production plans. GPG’s upstream gas production in Grenada will be channelled through NGC’s midstream pipeline network to its aggregation facilities, further ensuring the supply to downstream users in Trinidad’s petrochemical industry."

Grenada's drilling programme has been supported by Trinidad-based companies, something which Energy Chamber CEO Dr Thackwray "Dax" Driver, recently told Business Day "will likely continue in the future, given the lack of capacity to support the industry in Grenada."

Driver also said in addition to helping increase the gas supply there will be opportunities in Grenada for local energy service companies and contractors. Mironov confirmed this and noted GPG had established relationships with several local and international companies.

"GPG extensively utilised services of Trinidad-based logistical suppliers of industrial materials, consumables and equipment as well as specialised drilling industry service providers with a well-established presence and track record in Trinidad. There is no reason to doubt that such relationships will continue and will expand and strengthen further."

Trade and Industry Minister Paula Gopee-Scoon also saw the potential for new business for local companies.

Gopee-Scoon recalled that in May 2010, as foreign affairs minister in the Patrick Manning administration, she was involved in the delineation of TT and Grenada's maritime boundary which set out the NCMA.

The NGC/GPG commercial agreement was "an exciting move," she told Business Day.

"It's about sharing resources, about brotherhood, about seeing the economy of Grenada improved and diversified. It's also about TT benefiting from increased gas, once that is brought in to TT," Gopee-Scoon said. "So it's a win-win and we are more than pleased to share it with Grenada. Great success."

Grenada's government made its first public comment on the commercial deal, 11 days after NGC's announcement.

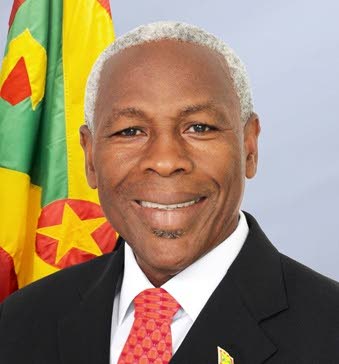

Energy minister Gregory Bowen – who served as acting prime minister while Dr Keith Mitchell attended the 2018 Commonwealth Heads of Government Meeting in London last week – confirmed Grenada would "push all the gas if Trinidad will buy it."

The Mitchell administration helped GPG secure the NGC agreement.

"Grenada played a significant role with the government of TT in finding that particular market, because you have Venezuela close by. They have their problems but they have massive gas reserves as well. Everyday they’re finding another place, so we did not sit idly by," Bowen at a post-cabinet meeting on April 17. "We worked with the government of TT to ensure we could get a market."

Bowen said while the Grenada government was "cautiously optimistic... 60 or 70 per cent certain" about the abundance and quality of gas in its territory, three more test wells need to be drilled to verify this.

Doing so requires significant funds and with Grenada seeking to diversify its economy beyond tourism and agricultural exports, the government is working with GPG to achieve this in the shortest possible time.

"We have to drill three more wells and we want to get this done within a year, year and a half. These are very costly, so GPG must find the resources and we're working with them in that regard."

Noting that NGC is ready and "waiting" to offtake Grenada's gas, Bowen told reporters there is a need to act now because "Grenada is a good source but we're not the only source. If we linger and if a next source comes up, we don't expect them to wait on us."

Asked for a cost estimate, Bowen said, "Many years ago, when Cuba and Barbados were doing it, it was half a million (US$500,000) a day. Now, an exercise could cost up to US$100 million. One drilling, test well exercise, could cost up to US$100 million (a day)."

Again addressing the time frame for drilling the three wells, Bowen assured, "We will be doing it expeditiously and we're working with the investors (GPG) – finding financing is not our task but because we know we want it to happen within that time frame, we will not sit idly by. So a year, year and a half, is what we're looking at."

Should TT's well-established sector produce downstream products, it would leave Grenada's tourism product largely unaffected by the gas discovery, said Bowen.

"When we get the resource and it's sent to TT because they're so close by, then refining can be done – whether it's removing the water from the gas and so on – so we can get a lot of things out of that. The industries in Trinidad can prepare things and send it to us, now that pipelines can be built and are being planned to be built in the region, even up to Puerto Rico," he said.

"Besides that, you have a lot of opportunities. You have massive plants in TT producing electricity, massive plants, and they have big capacity. They can produce electricity from the plant, oil and gas, and the region, the OECS (Organisation of Eastern Caribbean States), can benefit. So there are lots of opportunities going there."

Comments

"Nutmeg energy"