5 keys to decision-making for impact

Companies frequently proclaim their commitment to providing cost-effective products and services that not only benefit customers but also positively impact employees, communities and supply chain members. They declare adherence to ethical values and responsible behaviour.

Is this problematic? Not at first sight. We desire companies that are conscious and responsible, and many are reporting their engagement in environmental, social and governance (ESG) initiatives and alignment with the UN's sustainable development goals (SDGs).

Despite these commitments and increasing investments in sustainability, actual progress remains painfully slow.

The challenge to manage impacts effectively, align resources and activities in order to increase the value of positive outcomes and minimise negatives seems elusive and random.

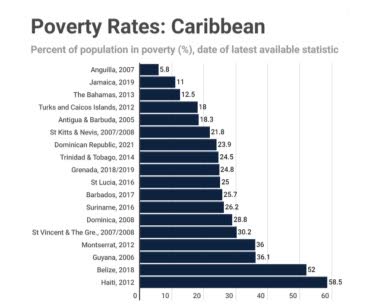

Take OXFAM’s 2024 Inequality Inc report as an example – the five wealthiest men have more than doubled their wealth since 2020, while nearly five billion people have experienced a decrease in wealth. Or consider the poverty rates in the Caribbean. According to the World Bank's 2023 data, TT has a staggering poverty rate of 24.5 per cent, Saint Lucia 25 per cent, Barbados 25.7 per cent and Jamaica 11 per cent.

Navigating this complex landscape, companies seek guidance, often embracing ESG and associating with SDGs.

However, a noticeable trend is that many companies, despite significant progress and sophisticated strategies, fall short in providing tangible evidence of the impact they claim to create.

Descriptions of initiatives related to ESG or sustainability goals are often general narrative description, accompanied by selective quantitative output indicators that merely track activities, not outcomes.

ESG disclosure standards like IFRS S1 and S2, or the European ESRS, although useful, don't fully address this gap. They guide measurement and management of what needs to be disclosed.

Diagram courtesy World Bank. -

They are not designed to optimise governance and management decision making within the company. Rarely do we see companies employing principles similar to financial accounting to account for their impact. This would include considering thresholds for example, not making a loss and achieving a profitability targets that the company has committed to.

Is accurate impact measurement possible? Absolutely.

Various frameworks exist to guide companies. Two key factors can help raise ambition and accountability:

– Identify practical methods to measure and manage non-financial stakeholder impacts.

– Ensure the process is manageable and not overwhelming, especially for companies already stretched thin.

The five dimensions of impact, developed by the Impact Management Platform Community (co-chaired by the OECD and UNEP), illustrate the core of a comprehensive approach:

– Who experiences the impacts? How underserved are they regarding the outcome?

– What outcomes or changes does the company contribute to? How vital are these to stakeholders?

– How much change is expected and experienced? What is the scale and duration of impact on stakeholders?

– Contribution: Assesses the extent of the company’s role in the changes experienced by stakeholders.

– Risk: Evaluates the probability and consequences if the expected changes don't materialise.

Companies can obtain this data in a number of different ways – assessing the expectations and experience of relevant stakeholder will always be part of it.

Engaging stakeholders is a core governance and management function for decision making and accountability.

Undertaking such measures is crucial for managing impacts effectively, allowing firms to align resources and activities with the aim of increasing the value of positive outcomes and minimising negatives.

A common concern for companies embarking on this journey is the reliability of such data and the necessary level of precision.

Practically, investment in reducing uncertainty should match the decision's potential impact. Decisions with significant stakeholder implications warrant more investment in accuracy. Modern software platforms aid in measuring and managing diverse impacts across stakeholder groups, simplifying data tracking and management.

Dr Axel Kravatzky is managing partner of TT-based Syntegra-360 Ltd, vice-chair of ISO/TC309 Governance of Organizations and president of EUROCHAMTT.

He enables companies to flourish through integrated governance, certified management systems and transformational leadership.

Comments

"5 keys to decision-making for impact"