Advice to government on oil, gas bid rounds

THE GEOLOGICAL SOCIETY

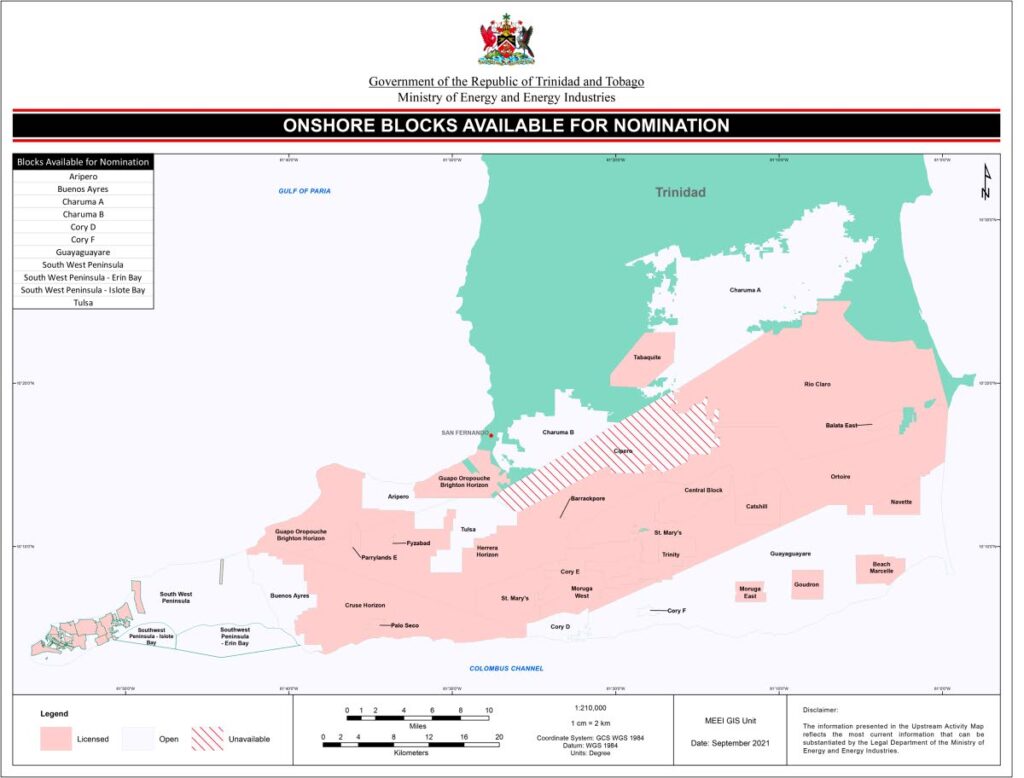

In September, Energy Minister Stuart Young announced that 2022 will feature bid rounds targeting land, shallow and deep-water. The onshore round was launched in September and 11 blocks are up for nomination (see map below). The minister also said 11 deep-water blocks are under consideration, of which eight have partial to full 3D seismic coverage from BHP’s 2014/2015 survey. The shallow water bid-round will open in 2022 – there are 25 possible blocks across the Columbus Basin, Gulf of Paria, North Coast and South Coast.

So, what is a bid round and why are these so critical to our oil and gas industry?

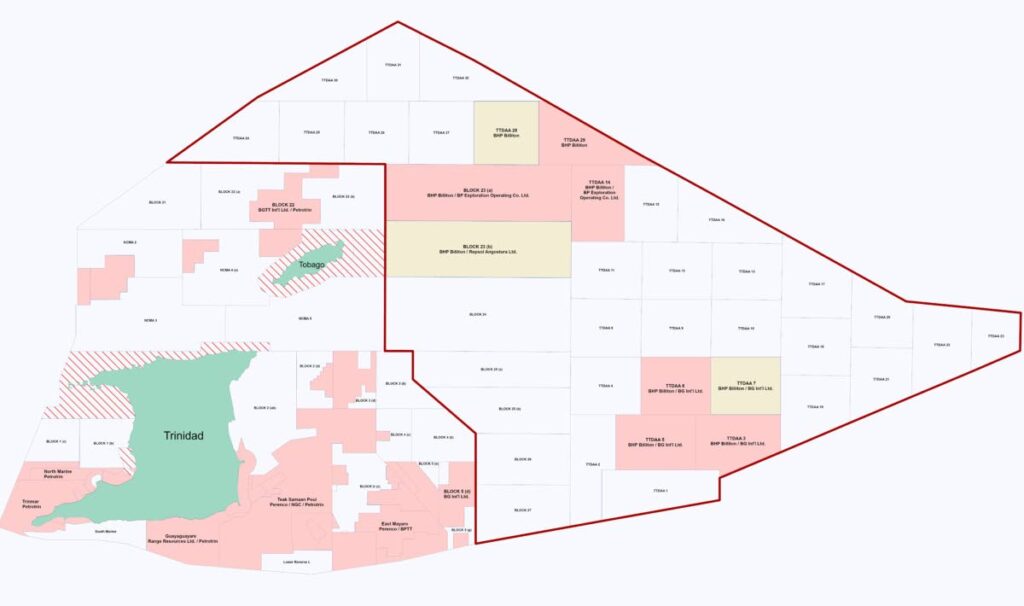

A petroleum licensing or bidding round is one of the most widely used methods of determining which oil and gas companies get to “own” acreage in different countries. Essentially, the government, via the petroleum regulator, divides the acreage within its maritime borders into blocks, and puts them out to the global community to bid on (see below for TT's concession map). The top bidder that satisfied the government’s expectations is awarded the acreage and a contract is drawn up.

In TT, the two types of contracts are exploration and production licences (E&P) and production sharing contracts (PSC). The differences in these boil down to how taxes are managed, which we won’t get into here. The contract holder is called an operator as they operate the block.

In TT, the competitive bid round process is relatively straightforward. In the first phase, the Ministry of Energy identifies blocks where they believe there is high potential and puts them out for nomination. They have data rooms (nowadays virtual) set up for interested companies to view well, seismic and other subsurface data. The ministry reviews the blocks nominated by interested companies and decides which ones to put out for competitive bidding. They will set out a minimum expectation in terms of the amount of exploration wells to be drilled and seismic data to be acquired as well as timeframes for these to be achieved.

In the next phase of the bid round, companies that are interested can put together bids for one or more of these blocks. Companies can form partnerships and bid, but one must be designated the operator. Bids will include the technical part (wells, seismic, etc) and a commercial part (usually the percentage profit share).

The Ministry of Energy evaluates the bids in collaboration with other government agencies (like the Ministry of Finance and the Attorney General). They decide which blocks should be awarded (based on the criteria set out) and who should be the winners. This phase may take several months. If no bids are deemed satisfactory, no blocks are awarded.

Afterwards, a very detailed contract is drawn up and signed off by the operator and the minister of energy.

Bid rounds are critical to explore and find more hydrocarbons to replace what has been depleted. This is most crucial for gas supply, as downstream plants like Atlantic LNG and those at Pt Lisas, need a regular and continuous supply to operate efficiently. The deactivation of plants over the last several years is directly related to unsuccessful drilling campaigns which led to less gas supply than anticipated.

The last bid round in TT that saw blocks awarded was in 2013/2014, where Touchstone, Range Resources and Lease Operators Ltd acquired onshore acreage. We are now seeing the fruits of this as Touchstone has had back-to-back prominent discoveries in the last two years. Gas supply from these fields is imminent.

The BHP operated deep-water blocks have reportedly found substantial gas which came out of contracts awarded in 2012 to 2014. Shell’s current Colibri development off the North Coast resulted from discoveries made in two blocks signed in 2005 and 2011.

In 2018, the Ministry of Energy had a shallow water bid round that failed to see any awarded acreage. We hope the ministry has applied the learnings from this unsuccessful round to the upcoming ones.

Drilling is required for hydrocarbons to be discovered. There is great uncertainty in exploration (10 per cent to 35 per cent chance of success is average), so many wells need to be drilled to make commercial finds. For drilling to occur, acreage needs to be made attractive for operators to drill. For already licensed blocks, tax incentives can be quite effective. For open blocks, awarding acreage via bid rounds is the preferred way. However, it is not the only way.

The minister of energy via the Petroleum Act can directly enter into negotiations with interested parties for open blocks. This has rarely been exercised in TT and is something that should be considered as the government can tailor-make a contract for the interested parties. The goal ultimately is to get wells drilled and find commercial oil or gas.

Unfortunately, a new deepwater bid round in TT has a high chance of being unsuccessful for the following reasons:

1. Uncertainty about the commercial viability of discoveries in the deep-water to encourage other companies to bid. Gas has been found by BHP but no public declaration has been made to state if this gas is commercially lucrative. Appraisal work is ongoing.

2. All the big players from TT were involved in the nine deep-water blocks signed between 2012 and 2014 – BHP, BP, Shell and Repsol. BHP, Repsol and Shell have relinquished their stake in several of these blocks. We can say that these companies are unlikely to bid on new deep-water acreage having been there, done that.

3. Regional competition:

• The other big multinationals with deep pockets needed for deep-water are busy right next door in Guyana and Suriname (Exxon, Hess, Chevron, Petronas, Repsol, Tullow, Qatar Petroleum, CNOOC, Total, Apache, and others).

• Suriname just completed a bid round in 2021 that saw 3 blocks awarded, with shareholding belonging to Chevron, Total and Qatar Petroleum.

• Guyana just signalled a bid round for 2022 – and the world’s largest companies are eagerly awaiting. The ministry needs to ask itself if and how our technical, commercial, and contractual offerings will be superior to Guyana and Suriname’s.

A shallow water round focusing on the east coast performed far below expectations just three years ago. Very little has changed technically, so serious changes to the commercial incentives should be considered. The north coast blocks have gas potential, and these are most likely to attract bids from Shell and others. The Gulf of Paria blocks have a couple small gas fields that De Novo is developing. The other blocks here may be of interest to them and EOG. The southern coast blocks are unlikely to attract much attention. No new data has been acquired and that area has not had any major successes.

A land bid round, however, has very good prospects for licensed blocks. Touchstone singlehandedly has proven that onshore has serious exploration potential left. The challenge here is making it worth the while of the operators. These blocks need to be marketed mainly to existing onshore producers who already know the acreage and know how to make things happen on land, where operating has many more challenges than in the sea.

Tax incentives and commercial terms are the key to making this bid round a success. Limiting the seismic commitment to just 2D lines or reprocessing data may also be wise. Onshore 3D seismic takes long, is burdensome, expensive, typically generates poor resolution data in Trinidad. Another consideration could be to allow operators to write off some or all of their exploration costs against profits from their producing fields.

We should accept that TT’s acreage is mature. It’s not as attractive as it once was, and certainly not in comparison to our Caricom neighbours. We cannot afford to just put out blocks, attend a few conferences and expect that investors will come. There are, however, certain sizes and types of companies that are a good fit, with the right contractual and commercial terms. Aggressive and targeted marketing is needed. There must also be a very serious effort to ease doing business in TT for these operators, especially when it comes to interacting with other state entities.

The GSTT has a fantastic cohort of petroleum experts who are willing to advise and assist the ministry in any way possible to give these bid rounds the best chance for success. Our energy future, economy and standard of living depends heavily on it.

The Geological Society of TT is a professional and technical organisation for geologists, other scientists, managers and individuals engaged in the fields of hydrocarbon exploration, academia, vulcanology, seismology, earthquake engineering, environmental geology, geological engineering and the exploration and development of non-petroleum mineral resources.

Comments

"Advice to government on oil, gas bid rounds"