George: Foreign Investment Act 'crippling' Tobago

The Tobago Business Chamber is calling for the repeal of the Foreign Investment Act and the removal of Value Added Tax (VAT) from goods on the island.

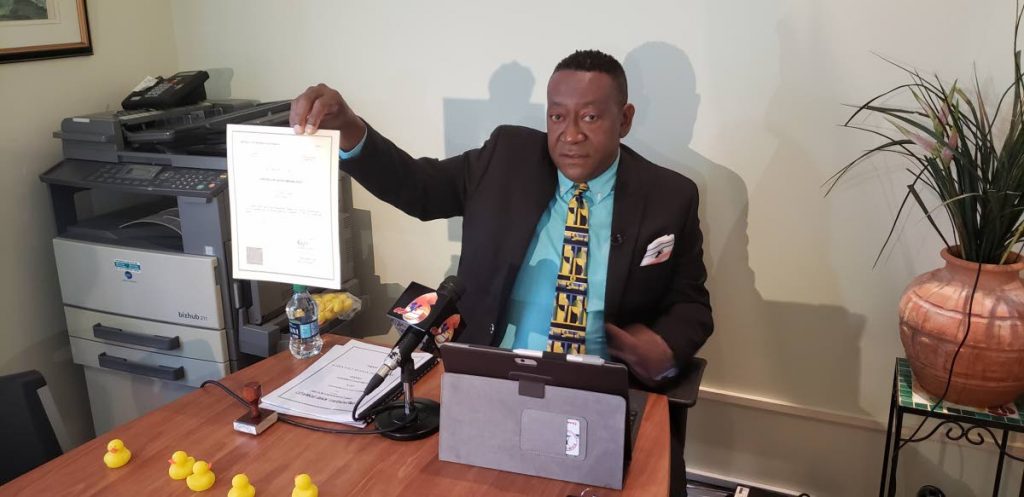

Speaking with Newsday on Friday, chamber chairman Martin George said he's willing to work with the new Ancil Dennis-led THA executive council to help the island progress economically.

George said one of the first priorities the chamber would like to see is the removal of the Foreign Investment Act. Although less restrictive than the Aliens Act which it replaced, the Foreign Investment Act still provides regulations guiding foreign investors' interests in TT.

George said, "Allow once more to have direct foreign investment flow into Tobago.

“That piece of legislation has crippled and hamstrung all foreign investments into Tobago and we want to see that legislation repealed and removed immediately so that you can have immediate foreign investment come back to Tobago.”

Concerning the removal of the 12.5 per cent VAT, George said this would also encourage greater investment in Tobago.

“Lobby Central Government to make Tobago VAT-free zone.

“We are asking for this for two reasons. It would provide immediate relief from the covid19 disaster which has befallen businesses in Tobago but it would also provide two major incentives; for the general population in Tobago, if it is their goods are VAT-free it means immediately there is a 12.5 per cent on their goods and services that they don’t have to pay, so that makes it a lot more affordable in terms of their goods and services. So therefore, you may actually now find your items on par with the prices in Trinidad even when you factor in the transportation costs and the delays with the boats and the cargo etc. So therefore, you would now make life in Tobago a lot more affordable for everyone; from the man in the street to the business executive.”

George said being VAT-free would also persuade people to view the island as an affordable and enjoyable place to retire.

“Persons from Trinidad who may wish to say, 'Hey look, I want to spend the rest of my days in Tobago,’ it would be an attractive destination to them because if they think that they can now live out their days VAT-free so they don’t have to pay VAT on anything once they are residing in Tobago, that is an investment opportunity that they would look at and they would see as a benefit.

"Even nationals abroad who may think of returning home to retire, they would then choose Tobago as their preferred destination because when you add up the benefits and the savings of Tobago being a VAT-free destination, you’d recognise that this is something that from a business perspective would provide a tremendous boost for investment and further development for Tobago.”

Comments

"George: Foreign Investment Act 'crippling' Tobago"