Key moments for Trinidad and Tobago’s energy sector in 2023

JAVED RAZACK

This piece seeks to summarise the major happenings in the local energy sector for 2023.

Trinidad and Tobago’s 2023 budget, presented in September 2022, was based on oil at $92.50 per barrel and gas at $6 per mmbtu. WTI oil price averaged $78 during 2023 ($95 in 2022), with Henry Hub natural gas averaging $2.56 (this was $6.45 in 2022).

The 2024 budget is based on $85 for oil and $5 for gas.

The budgeted numbers appear high based on the last few months of 2023, and we will see the impact in 2024 on the actual vs expected revenue numbers.

Crude oil plus condensate production averaged just under 55,000 barrels per day for 2023, while gas production was 2.6 bcf/d for the same period. This is slightly down from 2022 (58,500 and 2.7).

The larger local players – BP, Shell, EOG, Perenco, Woodside and Heritage – have had a lot of activity over the year, the highlights of which we have tried to document below. Meaningful new gas has come online from Touchstone onshore, and we look forward to more from them. On the downstream end, we are happy to see Atlantic restructuring completed and new gas sales contracts with the Pt Lisas plants and NGC.

Regional geopolitics have dominated the headlines over the last few months. Over the year, Venezuela and TT have been progressing the negotiations on the Dragon gas field, getting support from the US to make this happen. However, the last two months have cast doubt on the project after Venezuela claimed the Essequibo region as their own, an issue that has arisen time and again for over the past 100 years. Fears of annexation, military action, US intervention, Russian instigation and many other factors have been expressed and discussed throughout the region. A meeting organised by Caricom in December appears to have put a temporary truce on the matter. Just before Christmas, we understand a licence has been granted by Venezuela for the Dragon project.

Meanwhile, ExxonMobil in Guyana began oil production from its third offshore asset, the Prosperity FPSO, which over the next few months will bring the country’s production up to over a whopping 600,000 barrels of oil per day (it’s currently at 500,000). The next three FPSOs are expected to be online by 2027, pushing Guyana to over 1.2 million barrels per day. At this point, they will be the highest oil producer per capita in the world.

Just a little further south, Suriname is following Guyana’s trajectory. Their first offshore project is expected to be sanctioned in 2024, after which Total Energies will be fast-tracking this to first oil in 2028. 200,000 barrels per day is expected, with an investment tag of US$9 billion. Several other discoveries are in the appraisal and evaluation phase.

So, our neighbours are moving full speed ahead with their offshore developments, which appear to be endless at this stage.

TT is focused on getting new gas from Dragon, Manatee (Loran too if we are lucky), Calypso (deepwater) and smaller bits onshore and in our shallow waters.

TT signed a few deepwater blocks in 2023, the first after almost a decade. Onshore blocks are in the process of being finalised and a shallow water round is open.

Guyana and Suriname also have bid rounds where awards were announced in 2023. In addition to Guyana and Suriname’s ongoing project, the entire region should be a hotbed of exploration and development activity over the coming years. TT services companies should be well poised to benefit from all these projects.

On the new energy front, TT’s first utility-scale solar project has begun construction, with production expected in 2024.

Hydrogen has made some progress, although it still seems we are moving too slowly on making a pilot project a reality.

Overall, we are seeing major progress on the cross-border gas front, but geopolitics can put a stop to that at any time.

It is critical we get our deepwater gas to market as well as Manatee, as these are the projects within our realm of control. While these are being developed, gas production will fall from existing fields and will make the next few years quite difficult from multiple perspectives. We need to be cognisant about this and plan accordingly as a country.

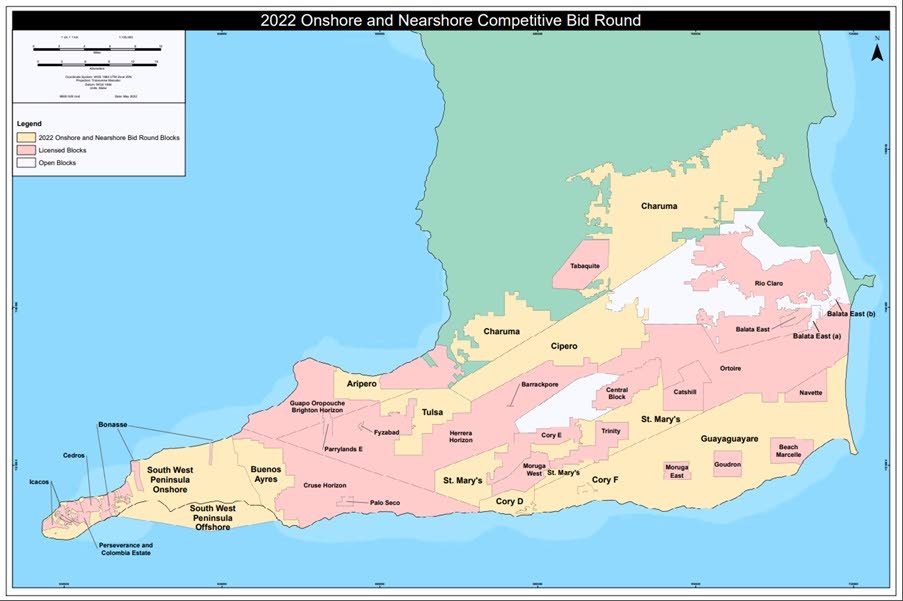

BID ROUNDS

June: Onshore blocks have been awarded. The Ministry of Energy and Energy Industries (MEEI) received 16 bids for eight blocks and six have been recommended for award. The final announcement of awardees has not officially occurred, nor has the final signing of the contracts. The recommended awardees are Touchstone (Cipero block), Challenger Energy (Guayaguayare block), A&V Oil and Gas Ltd (St Mary’s block), Nabi Construction (Aripero block), Trinity E&P (Buenos Ayres block), Eco Oil and Gas Solutions (Tulsa block).

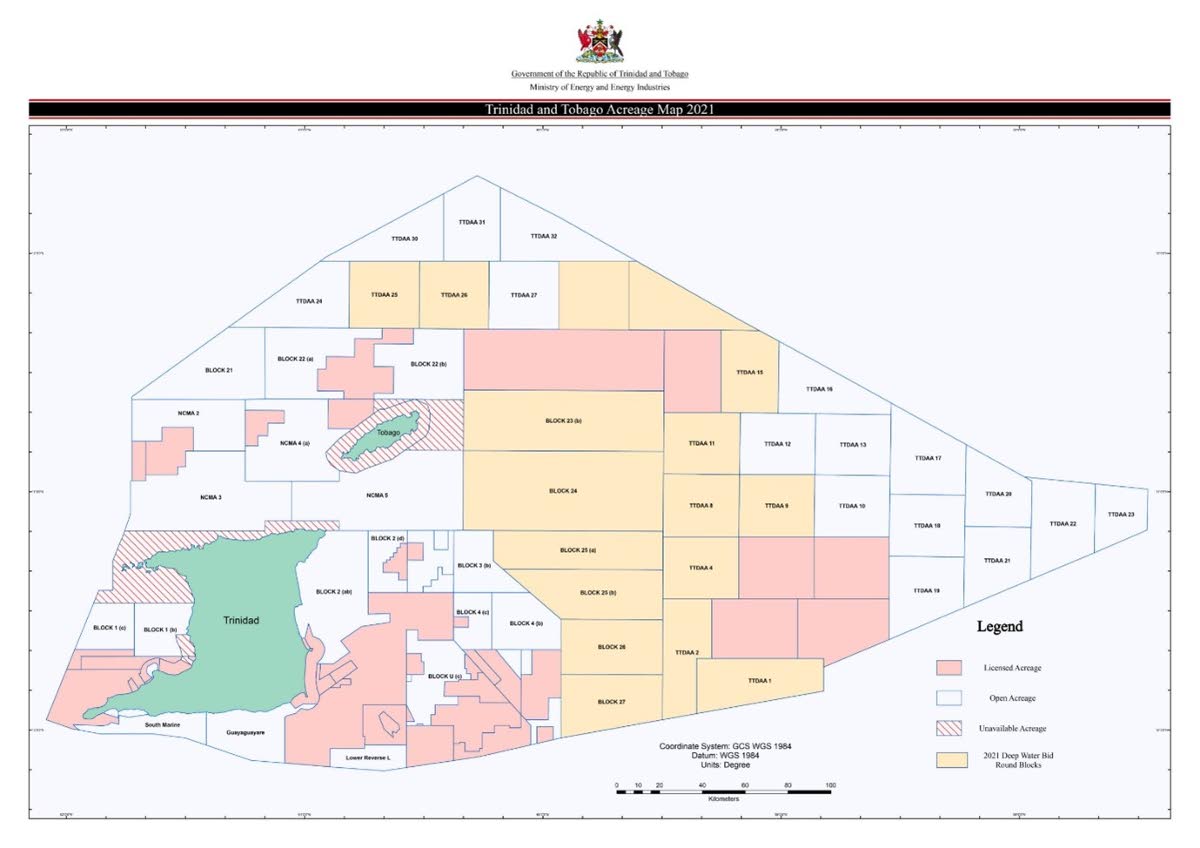

September: Three deepwater blocks were awarded to a 50/50 consortium of BP and Shell. BP will operate blocks 25(a) and 25(b) while Shell will operate Block 27 (see Map 2). These are the first deepwater blocks to be awarded since 2014 to BHP (now Woodside).

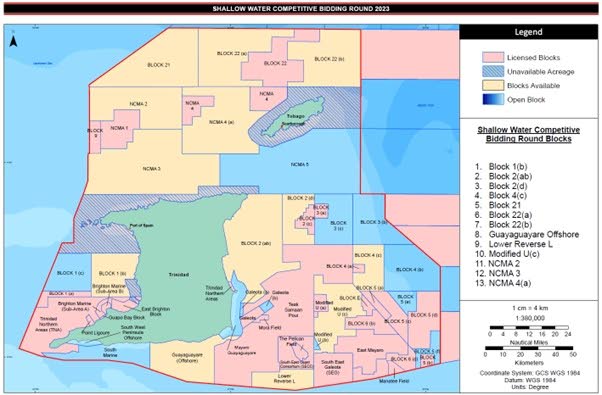

October: A Shallow Water Bid Round has been launched by the MEEI. 13 blocks are available on four coasts of Trinidad (see Map 3). The deadline for submission of bids is April 2 2024.

OFFSHORE UPDATES

February: EOG disclosed in their financial statement, the price they sold gas at to NGC in 2022; US $4.43 per mmscf. They added that this was higher than the prices in 2021 (US $3.40) and 2020 (US $2.57). These prices are usually carefully guarded by the operators and NGC for fear that this will compromise the competitiveness of gas price negotiations.

March: EOG announced they will construct a new platform to bring gas production online from the field discovered by the Mento well in 2020. It is estimated to hold one trillion cubic feet (TCF) of gas. The Mento project is a 50/50 joint venture with BP, and the first gas is expected sometime in 2024.

June: Trinity has hired Petrofac to conduct a development study of its Galeota block, which includes the producing Trintes field (three platforms – Alpha, Bravo and Delta) and the TGAL area. TGAL-1 was drilled in 2013 and is an oil discovery that has yet to be developed. Leased mobile offshore production units, converted jackups and FPSOs will be considered to develop the project.

July: Woodside and Shell (65 per cent and 35 per cent) relinquished deepwater block TTDAA 5 back to the MEEI. Despite having two gas discoveries in the block (LeClerc and Victoria), it was deemed uneconomic to proceed.

Woodside shut down all their production operations after a safety incident occurred on one of its platforms. This resulted in a shortage of gas to Pt Lisas plants, causing four of them to shut down – Proman’s M2 and M3, as well as Tringen 1 and Nutrien 03. Woodside’s gas production at the time was 350 mmscf/d (13 per cent of the country’s total). Woodside resumed production a few days later.

September: EOG is currently drilling development wells with the Valaris 249 jack-up at the Osprey field.

October: Shell has started a nine-month workover and well abandonment campaign at its Dolphin field.

November: BP has extended its contract with the Valaris 118 jackup (formerly Rowan Joe Douglas) for six wells. The one-year extension will start in March 2024.

In 2023, BP has been using the 118 for development drilling at the Mango, Savonette and Angelin fields.

Perenco has contracted the Valaris 249 jackup (which is currently drilling for EOG in Trinidad) to drill one appraisal well in the TSP block in the second half of 2024.

ONSHORE UPDATES

February: Heritage said that in 2022 they had an aggressive drilling and workover program, with ten land wells and one offshore. Their plan for 2023 is another ten shallow wells onshore and five in the Soldado field offshore. Heritage’s profit after tax for the year ending September 2022 was $1.1 billion, a 63 per cent increase over the preceding period.

June: Touchstone disclosed the minimum work program and other details for the aforementioned Cipero block. Heritage has a 20 per cent non-operating interest, 426km of 2D seismic are to be reprocessed, and four exploration wells are to be drilled.

August: Trinity’s Jacobin-1 exploration well in Palo Seco was confirmed as an oil discovery with 290ft of net oil pay. The well was drilled to approximately 10,000ft and testing is to be done on the Lower Forest, Upper Cruse and Lower Cruse formations, where a significant reservoir was encountered.

September: Year to date, Heritage’s crude oil production (offshore, land, lease out partners, farm out partners, IPSC contractors) has averaged approximately 35,000 barrels per day.

December: Trinity is having operational challenges getting the Jacobin discovery online. Initially, the well was flowing clean black oil, but then varying amounts of water and gas began to flow as well. This has caused several issues which the company is currently managing. Trinity said that Jacobin has helped de-risk the deeper oil play and will be taken into account when they begin exploring their new Buenos Ayres block in 2024.

NEW GAS PROJECTS

September: Touchstone began production from its long-awaited Cascadura field in Rio Claro. Two wells are producing approximately 60 mmscf/d of gas and 1,000 barrels of condensate per day. The facility has a designed gross production capacity of 200 mmscf/d and 5,000 bbls/d of associated liquids.

Shell has approved the go-ahead to develop the Manatee gas field, with the first gas projected for 2028. The Manatee field is part of the cross-border Loran-Manatee discovery, shared by TT and Venezuela. The field holds about ten TCF of natural gas, with 7.3 TCF on Venezuela’s side and the remaining 2.7 TCF on Trinidad’s side. Manatee is projected to produce 700 mmscf/d at peak. 550 mmscf/d is expected to go to Atlantic LNG. NGC also signed in September, an amended gas sales agreement with Shell to take at least 150 mmscf/d from Manatee for the petrochemical sector. Pending the final sanction of the project, McDermott has been awarded the EPCI (Engineering, Procurement, Construction and Installation) contract for Manatee.

October: Energy Minister Stuart Young announced that discussions are ongoing with the Venezuelan government to allow Shell to also produce from the Loran field. Until such time, Shell is moving ahead with just the Manatee field.

November: At an investor briefing, Woodside gave encouraging news about Calypso, the deepwater gas project that comprises five discoveries in blocks 23(a) and TTDAA 14. Woodside indicated the project is very much alive and has the support of the MEEI and BP. Woodside and BP are the stakeholders in the blocks (70 per cent and 30 per cent respectively). Calypso has approximately 3.2 TCF of gas. If it goes to development, it would be the country’s first deepwater hydrocarbon project. The Atlantic restructuring is also expected to help facilitate the development of this project.

December: Dragon has seen a series of ups and downs over the year. The project entails the following: a pipeline will be built between the field and Shell’s Hibiscus platform. 300 mmscf/d is the expected production. The project’s life will be 30 years. Shell will operate the project with 70 per cent interest, with NGC holding 30 per cent. The US has granted an initial two-year licence for TT to get the project going. A few weeks ago, it was reported that Venezuela was close to approving a licence for Shell and NGC to operate the field and then within the last week, it seems this has stalled due to disagreements between Shell and PDVSA on LNG future pricing. Then just before Christmas, the Prime Minister announced the licence had been granted. This was likely just one of many roadblocks ahead. We give TT’s government and Shell full support in making this transformative project a reality.

DOWNSTREAM ACTIVITY

August: NiQuan’s Gas to Liquids Plant at Pointe-a-Pierre was shut down in June after a Massy employee died after sustaining severe burns in an accident. Then in August, government-owned Trinidad and Tobago Upstream Downstream Energy Operations Company Ltd (TTUDEOCL), which supplies gas to NiQuan, cut off their supply due to non-payments for the gas (US$21 million). The plant was put into preservation mode and the situation remains unresolved.

September: EOG sold its equity interest in two ammonia plants at Pt Lisas (CNC and N2000) to Proman. EOG said they sold their stake in the plants to focus efforts on upstream exploration and production operations in Trinidad.

October: Methanex plans to restart its Titan methanol plant (875,000 tonnes per year capacity) after signing a two-year natural gas agreement with NGC. They simultaneously announced that their Atlas methanol plant (1,085,000 tonnes per year capacity) will be idled from September 2024 as its 20-year natural gas agreement expires.

November: NGC executed new gas sales contracts (GSCs) with several operators at Pt Lisas within the last few months of 2023. These include ammonia producers Tringen, PLNL (Point Lisas Nitrogen Ltd, Proman (for CNC and N2000) and Nutrien.

December: Atlantic has successfully been restructured after five years of discussions. The individual trains have been unitised into one entity. The shareholders are BP, Shell and NGC with the unconfirmed shareholding at 45 per cent, 45 per cent and ten per cent respectively. Under the previous arrangement, NGC only had stakes in Trains one and four (ten per cent and 11.1 per cent respectively).

LOCAL UPSTREAM ACQUISITIONS

January: Touchstone and Lease Operators Ltd entered into an asset exchange agreement to transfer Touchstone’s Fyzabad, San Francique and Barrackpore blocks (approximately 130 bbl of oil per day) in exchange for LOL’s Rio Claro, Balata East and Balata East Deep Horizons blocks (approximately 35 bbl/d). Touchstone intends to use these blocks and their facilities as they explore the Ortoire block prospects and develop discoveries like Cascadura and Royston.

August: NGC has acquired Heritage’s non-operating interest in offshore north coast blocks -NCMA 4 (20 per cent), Block 22 (ten per cent), and Block 9 (100 per cent).

REGULATORY UPDATES

October: The Regulated Industries Commission has recommended an increase in electricity rates for T&TEC’s residential customers. The increase depends on customers usage but the range has been stated as between 15 per cent and 64 per cent. T&TEC has not yet accepted the recommendations, so the timeline for implementation or even if the changes will occur is not yet known.

Next year’s budget is based on an oil price of US$85 per barrel and $5.00 per mmbtu for gas. Taxation changes: A 20 per cent discount on SPT for small marine and mature oil fields is currently available and is being increased to 25 per cent from 2024. A new SPT tier for small shallow water producers is to be introduced in 2024. This is expected to incentivise the currently open shallow water bid round. Petroleum Profits Tax (PPT) for deepwater will be reduced from 35 per cent to 30 per cent in 2024. Generally, there were no significant petroleum fiscal changes during this budget announcement.

NEW ENERGY DEVELOPMENTS

February: The Prime Minister announced that MEEI along with National Energy and the European Union would be conducting a national Wind Resource Assessment Program (WRAP) for TT. The WRAP will cover onshore and offshore and comprise three phases over approximately two years, where one of the key outputs is the identification of five candidate sites for wind farm development. The government will then be seeking to attract potential investors and project developers. The intention is to have a pilot project with wind powering the production of green hydrogen.

April: BP Lightsource and Shell turned the sod to signal the start of construction at the long-awaited Project Lara solar project. The 112MW project will be split into two sites – at Brechin Castle (92MW) and Orange Grove (20MW). The plant is expected to come online in 2024 and produce almost ten per cent of the country’s electricity demand. In October, NGC announced they would be investing in the project, but did not disclose additional details.

July: In November 2022, the IDB launched a study, The Roadmap for a Green Hydrogen Economy in TT. In March 2023, Cabinet approved a request from the IDB to advance the roadmap in a specific project focusing on initiating the WRAP, green hydrogen demonstration projects and developing business models and financial structures to attract private investors to TT’s new green hydrogen sector.

Javed Razack is the immediate past president of GSTT.

This article was submitted by the Geological Society of Trinidad and Tobago.

Comments

"Key moments for Trinidad and Tobago’s energy sector in 2023"