Imbert calls for better cyber security measures: TRINIDAD AND TOBAGO MUST GO CASHLESS

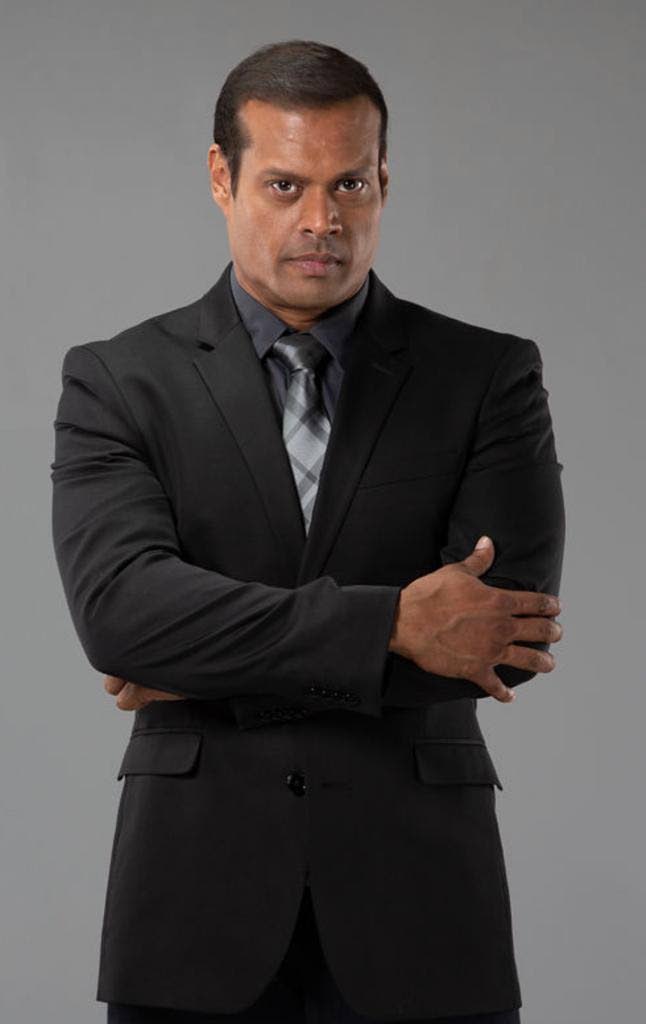

Despite problems caused by cyber attacks, Finance Minister Colm Imbert has said TT must continue its drive toward a cashless society.

He made the statement during his feature speech on the second day of the Institute of Chartered Accountants of TT’s (ICATT) 14th annual conference at the Hyatt Regency on Friday.

“We must simply instal better cyber protection, maintain greater safeguards and far better systems for dealing with issues and informing the public when problems occur,” he said.

He said the digital divide remains a concern, as not every citizen has equal access to the benefits of digital transformation. However, the e-commerce sector has grown significantly, making it easier for local businesses to reach markets abroad.

He added that the Single Electronic Window, TT Biz Link, continues its progress to reduce the cost of doing business and allow organisations to make online payments.

“Our overall ambition is to make as many citizens and businesses (as possible) knowledgeable and comfortable with digital banking and digital payment solutions to keep pace with the rest of the world.”

He said next year 14 new e-services will be launched on the platform.

He also reiterated government’s plans, laid out in the budget, to introduce a cyber security investment tax allowance of up to $500,000, available for the next two years, for companies which have spent money on cyber security software and network security monitoring equipment.

He noted, however, the expenditure has to be certified by iGovTT.

This year, several organisations, including TSTT, PriceSmart, the Office of the Attorney General and the South West Regional Health Authority, have all been targeted by hackers.

In the case of TSTT, more than 1.9 million lines of code were dumped on the dark web with information on customers, including banking information, ID cards and cell phone numbers.

In a recent press briefing, Ansa McAl public information officer Ian Galt said the company is subject to up to 1,000 attacks a month.

Two sides to going cashless

Business chambers had mixed reactions to the minister’s statement, with one saying that as a society, TT is right where it is supposed to be for the time being and now is not the right time to go completely cashless.

Another said the country must progress but with the right security measures in place.

“More than half the transactions done right now are done through Linx and credit card. That is cashless in a sense,” said Vivek Charran, president of the Confederation of Regional Business Chambers.

“Going completely cashless would mean that no one is paid in physical cash any more. We feel, given the different levels of employment and business in TT, that going completely cashless at this time is realistic.”

President of the Chaguanas Chamber of Commerce Baldath Maharaj said going fully cashless at this point is impossible but it is the way of the future as more countries begin to phase out physical cash.

He pointed out several payment methods, such as WiPay and others, that do not even require the use of a bank card or credit card, but he also pointed out that many small businesses do not utilise Linx machines.

“I don't think there's any part of the world that I can recall that is actually cashless,” he said. “The goal is to get there, but over the years, we'll get closer and closer to that.”

He predicted that within the next 20-30 years, several places will go fully cashless.

Maharaj said, however, that for TT to go cashless, it has to invest more in cyber security and take it seriously.

“Cyber attacks probably would not stop, but I'm not sure that the local entities here have invested enough to ensure that we don't have that kind of attack. Companies that store credit card information, they ought to have systems in place to ensure that that information is safe and secure.”

Charran said credit card fraud and identity theft victims were not always fully compensated. He explained that in cases where hackers or fraudsters get their hands on credit card information and make transactions internationally, it is usually not up to the bank but to the vendor to recompense.

“That happened to my wife where she was defrauded of maybe £3,000. Someone got her information and purchased Playstation cards, and Xbox cards to the tune of £3,000.”

Maharaj said in many cases, fraud investigations are done by the bank and people are reimbursed. In some cases, customers are reimbursed before the investigation is complete.

Why are we going cashless?

Charran questioned why government was so eager to move to a cashless society.

“Is it because the Government really can’t handle crime, and they feel the only way is to go completely cashless? Then we have to ask ourselves whether the amount of crime in the country is a result of theft of cash, and the answer to that is no.

“So going cashless may not reduce the level of crime as we know.”

He said Government needs to tell the country the real reason behind its drive to go cashless.

He also said that a cashless society would mean that the Government and the banks may have full oversight of each citizen’s finances, which could mean more taxes, more bank fees and higher inflation.

“So we have to ask another question: How much is it going to cost consumers to go cashless? How much is it going to cost businesses to be cashless? Is it that the government is looking to derive a tax stream from going cashless or is it that the banks are looking to charge for 100 per cent of the transactions that go through this cashless system on a daily basis?”

Maharaj, also a cluster manager at First Citizens’ Bank, said as it stands now, bank payments for transactions of Linx and other cashless transactions are minimal.

“Linx is less than one dollar per transaction. The average transaction would be around $500 or $600. Some will be more, some will be less.”

Comments

"Imbert calls for better cyber security measures: TRINIDAD AND TOBAGO MUST GO CASHLESS"