Businessmen on 3% first-quarter GDP growth: It looks good on paper, but...

BUSINESS CHAMBERS AND ASSOCIATIONS are saying the recently announced three per cent growth in TT’s gross domestic product (GDP) may look good on paper, but businesses are still not feeling any effects from this growth.

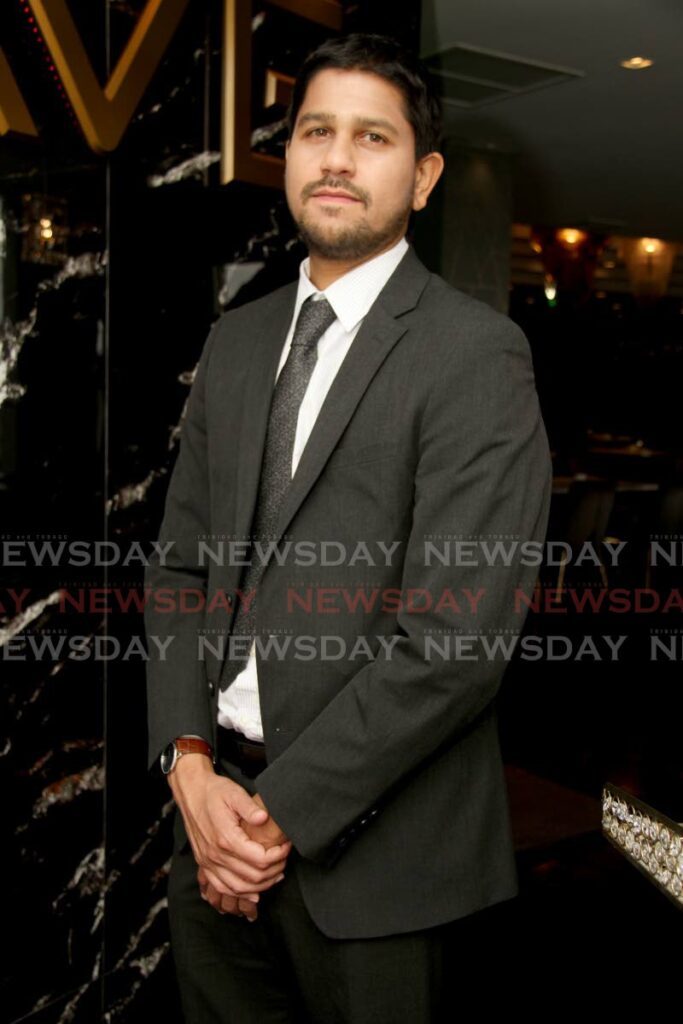

“The three per cent growth, on paper is a good thing,” said president of the Confederation of Regional Business Chambers Vivek Charran. “It is a good indicator and it should build confidence."

On Sunday, a Central Statistical Office (CSO) report indicated three per cent growth in TT's GDP between the last quarter of 2022 and the first quarter of 2023.

Year on year, the CSO report indicated 1.5 per cent growth between 2021 and 2022, with the non-energy sector leading the charge in both areas.

On Monday, Charran said, “However, the issue is, given the length of time in which this growth has occurred we should have seen some real effects of that growth in the economy.”

He questioned where the added revenue is being spent, saying government has a balancing act to perform, between managing the debt-to-GDP ratio and ensuring the added revenue trickles down to those who need it.

He said, despite the growth, businesses were still being plagued by challenges to the ease of doing business, such as high import prices and long waiting periods for receiving VAT returns.

“Regardless of whether we have growth in the economy, we are also struggling with inflation,” he said. “One of the major contributors to inflation is shipping and that has since dropped.

"However, what has happened is that many foreign suppliers have been giving higher prices.

“Even in a time of inflation, when goods land on the port, whatever the cost of the goods is abroad, we have to pay sometimes a minimum of 20 per cent duties on goods and 12.5 per cent VAT.”

He said because VAT returns were not timely and many businesses which import goods did not even apply for VAT returns amid stringent requirements for approval for returns, some smaller businesses were now considering VAT an added cost of doing business.

“They are being asked for ten years of audited statements and so on, so some businesses have stopped applying,” he said. “The reality is that even though the VAT is said to be repaid, it is not.”

“When you look at these factors the increase in prices is not insignificant. When you look at it across the board, you could be looking at something close to a 30 per cent increase in prices of goods once it hits TT ports. That also affects prices and inflation in TT.”

Rajiv Diptee, president of the Supermarkets Association, said the growth indicated buoyancy in the economy. He said it was an indication that the economy was exiting the challenges posed by the pandemic and the war in Europe, and gradually re-entering the circular economy.

He said that would allow for businesses to operate more freely.

But businesses are still facing shocks such as a lack of foreign exchange and supply-chain issues coming out of the pandemic and the Russian/Ukrainian war and climate change.

Diptee said, “There have been some supply-chain reconfigurations because of the war in Europe and climate change providing deep challenges to traditional lines of imports.

"What that means is there have been a number of challenges, particularly with respect to distributors and importers of food.

“Suppliers still cite foreign exchange as one of the biggest problems.”

Both Diptee and Charran added that consumers were not as free-handed as they were before the pandemic. Charran said consumers were more discerning about what they bought because, while the cost of living had increased, most consumers were saying their salaries and buying power had not.

“If there was growth, there would be more resources, which would mean more people would get hired and more overtime. So even if wages remain the same, people will get opportunities to earn more by working longer hours. But that has not been happening.

“Several sectors have seen various levels of inflation, and that tends to affect the prices of goods as well.

"Consumers have different costs and expenses to look at. You are seeing a more wary consumer. When they come into the stores they are more deal-oriented.”

Crime has also had a serious effect on businesses' ability to operate and consumers’ confidence, both said.

“Crime has affected not only retailer confidence but consumer confidence to come to the stores after hours,” Diptee said. “That has also impacted sales a little.”

In the CSO's report, the professional, scientific and technical services sector saw the most growth year-on-year, with 47.6 per cent growth.

In the first quarter of 2023, the trade and repairs (10.9 per cent); transport and storage (16.7 per cent); and accommodation and food services (17.5 per cent) showed the most growth.

Comments

"Businessmen on 3% first-quarter GDP growth: It looks good on paper, but…"