How does TT earn revenue from oil and gas?

Courtesy the Geological Society

Governments typically license acreage (can be land, marine or both) to operators (BP, ExxonMobil, Shell, etc). The operators explore for oil and gas, and if successful, these fields may be developed, and hydrocarbons produced.

Governments set up a petroleum fiscal regime to regulate how these companies are taxed, how their contracts are managed and so on.

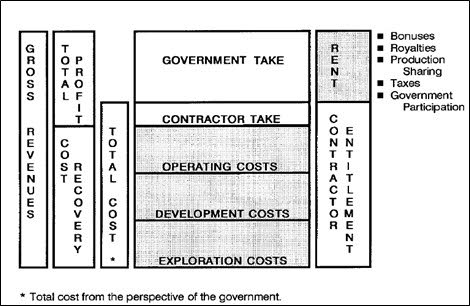

These fiscal regimes are designed to capture a “fair” share of economic rent, which is essentially the difference between the revenues from oil and gas and the costs to extract it, inclusive of an acceptable return on the investment. What “fair” means is most hotly negotiated by governments and companies.

Figure 1 illustrates how the government attains economic rent from petroleum operations. From the government’s perspective, the contractor-take is considered as a cost. Therefore, the government-take or economic rent is the gross revenues minus the total cost, which includes exploration costs, development costs, operating costs and the contractor-take.

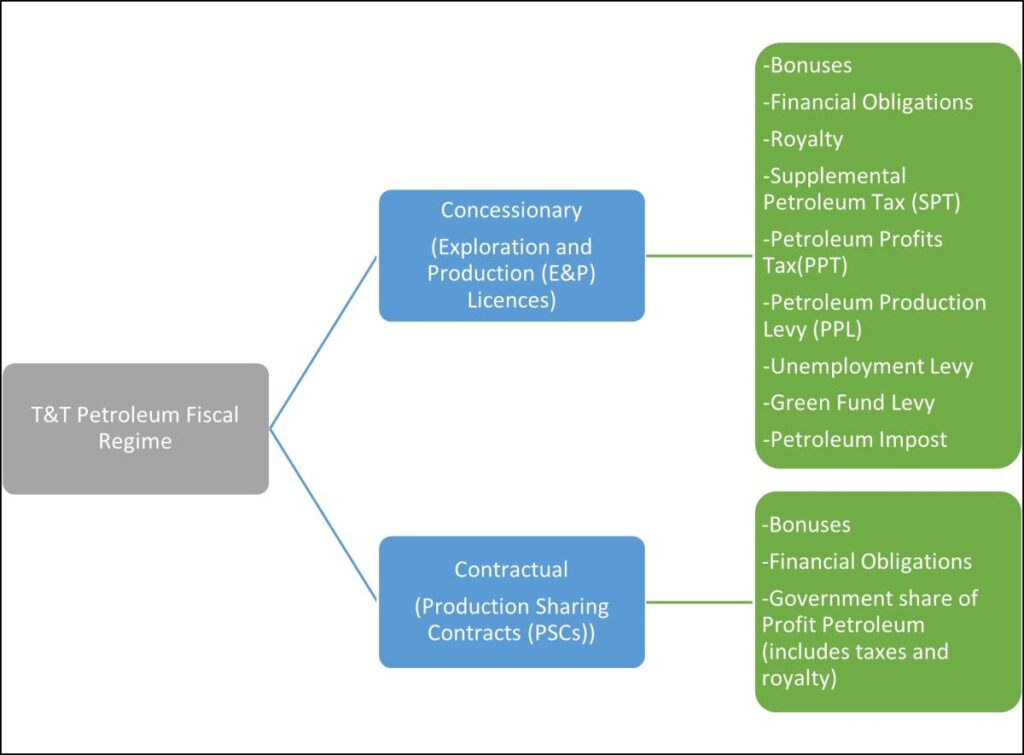

TT’s petroleum industry has been in existence for well over a century, so it is understandable that TT’s petroleum fiscal regime has undergone numerous changes to adapt to the volatile nature of the industry. Our fiscal regime consists of two types of arrangements: concessionary – exploration and production (E&P) licences and contractual – production sharing contracts (PSCs).

The Petroleum Act and Petroleum Regulations, Chap 62:01, govern the industry in TT and provide the regulatory framework for the granting of these contracts. It explicitly states that the government is responsible for granting E&P licences and PSCs to petroleum companies interested in exploring for and producing the country’s resources over a specified time in a contracted area via a procedure of competitive bidding.

Presently, the Ministry of Energy and Energy Industries (MEEI) is undergoing two separate competitive bid rounds for onshore acreage and offshore deep-water blocks. The deep-water competitive bid round 2021 contains 17 deep-water blocks and companies are invited to submit their bids before the deadline on June 2, 2022. Meanwhile, the 2021 onshore competitive bid round is yet to be launched following the invitation by the MEEI for companies to nominate eligible acreage from 11 blocks. This ended on November 5, 2021. Further information on these bid rounds can be found in the MEEI’s website. (https://www.energy.gov.tt/)

The following section explains how the government earns revenues from E&P licences and PSCs.

TT E&P licences

In TT, E&P licences were the first type of contract to be granted to operators to exclusively explore for and produce hydrocarbons in a specified area. Initially, the term of the E&P licence is six years and can be extended to 25 years if there is a commercial discovery. In TT, E&P licences are mostly offered onshore and in some shallow water acreage.

So how does the government earn revenues from E&P licences? Firstly, after a company acquires a licence, they are required to pay bonuses and financial obligations to the government. Bonuses are one-time payments to the government and can include a signature bonus, production bonus, environmental bonus and technical equipment bonus. Additionally, financial obligations are paid annually: scholarship contributions, training contributions, research and development contributions as well as lease rental for the acreage. Both bonuses and financial obligations can vary across licences and are independent of production with the exception of the production bonus which is paid when certain levels of production are achieved.

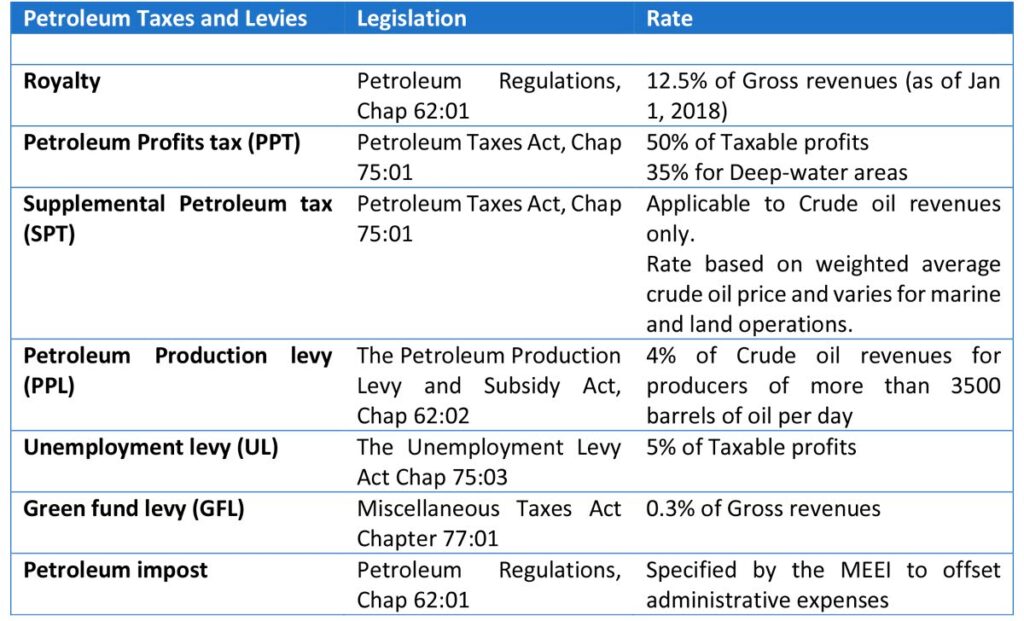

When production commences under an E&P licence, the government transfers title of the resource to the company after which the company pays royalties, taxes and levies to the government. In TT, these include supplemental petroleum tax (SPT), petroleum profits tax (PPT), petroleum production levy (PPL), unemployment levy (UL), Green Fund levy (GFL) and petroleum impost.

It is important to note that the SPT and PPL are only applicable to crude oil revenues. After the deduction of the applicable royalty and taxes, the remaining revenues are retained by the company. Table 1 provides a breakdown of the current TT petroleum taxes and levies.

The government also introduced various capital allowances, special allowances as well as investment tax credits to incentivise companies and encourage continued investments in the petroleum industry. Though these incentives may reduce government revenue in the short term by reducing the taxable income, the expectation is that the state may benefit in the long term from continued investment in exploration, development and production.

TT PSCs

The second type of fiscal system in TT is the production sharing contract (PSC). These are typically offered to marine areas which are further classified as shallow, average or deep-water. Under a PSC, the government gives an operator the right to explore for and produce the resources for a fixed time in a contract area.

For shallow and average water areas, the initial contract term is six years but may be extended to 25 years if a commercial discovery is made. On the other hand, the initial contract term for deep-water areas is nine years but may be extended to 30 years if a commercial discovery is made.

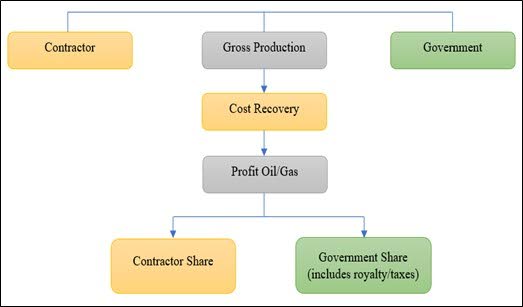

With a PSC, the government retains ownership of the resources while the contractor bears the exploration costs and risks in exchange for a share of the production. If the exploration phase is unsuccessful and no oil or gas is produced, the contractor does not receive any compensation from its initial investment and the government remains risk free.

If, however, the exploration phase is successful and a discovery is made, the contractor is allowed to recover its capital and operational expenses from the available petroleum revenues. This is referred to as cost recovery. Typically, a limit is imposed on the cost recovery so as to ensure that the government receives an early share of revenues. In TT, cost recovery limits are fixed at 50 per cent, 55 per cent and 80 per cent for shallow, average and deep-water areas respectively. Any unrecovered costs are carried forward and recovered in succeeding years. The remaining revenues is the profit petroleum which is then shared between the government and the contractor according to a percentage agreed during the bid round process.

Therefore, the government’s share of the profit petroleum is the main source of economic rent from TT PSCs and it is one of two biddable items during the bid round process.; the other being the Minimum Work Programme (amount of seismic, wells and other technical work to be done). Additionally, similar to E&P licences, economic rent is also obtained from financial obligations and bonuses.

A major incentive of the TT PSCs is that the government pays the contractor’s taxes and royalty from its share of the profit petroleum (operator gives profit share to MEEI, which pays Ministry of Finance the tax and royalty obligations). This provides fiscal stability to investors by safeguarding them from any abrupt changes by the government to the royalty or taxes during the contract term.

It should be noted that globally, PSCs are mainly used nowadays, and that all the contracts awarded in Guyana and Suriname are PSCs. Their mechanisms may be slightly different to TT’s but are essentially the same.

In summary, the government of TT has incorporated many fiscal instruments to earn revenue from the petroleum industry. Revenues from the E&P licences are mainly in the form of royalty, taxes, levies, bonuses and financial obligation payments while revenues from PSCs are the government’s share of the profit petroleum, bonuses and financial obligation payments.

Comments

"How does TT earn revenue from oil and gas?"