Big push needed for survival of Trinidad and Tobago's energy sector

Geological Society

Most of us understand the criticality of the energy sector and its impact on the nation’s economy.

TT has a well-established energy sector, over 100 years, which spans many cycles of "boom or bust".

The advent of the natural gas sector in Trinidad through the late ’90s into the 2000s showed significant promise, with TT being one of the world’s largest exporters of LNG. The birth of Atlantic LNG has been a huge revenue earner for a country of this size, with four liquefaction plants, serving exports to all corners of the globe. This period is directly linked to the growth of the petrochemical sector and industrial growth in Pt Lisas.

Underpinning this has been the role of international oil and gas companies (IOCs) in the island, some of the world’s largest, who have invested significant amounts of money to find and develop the hydrocarbon resources which we hold.

Recent years have provided significant challenges to the upstream industry in TT. Global commodity prices are challenged and our nation has felt the economic ramifications through lower revenues. This is exemplified by recent news of petrochemical plant closures, Atlantic LNG supply issues, mixed results from both exploration bid rounds and exploration and production (E&P) drilling campaigns offshore. This perfect storm on the bedrock of our economy (~28 per cent GDP) combined with the global covid19 pandemic is a crisis that we all should appreciate and understand.

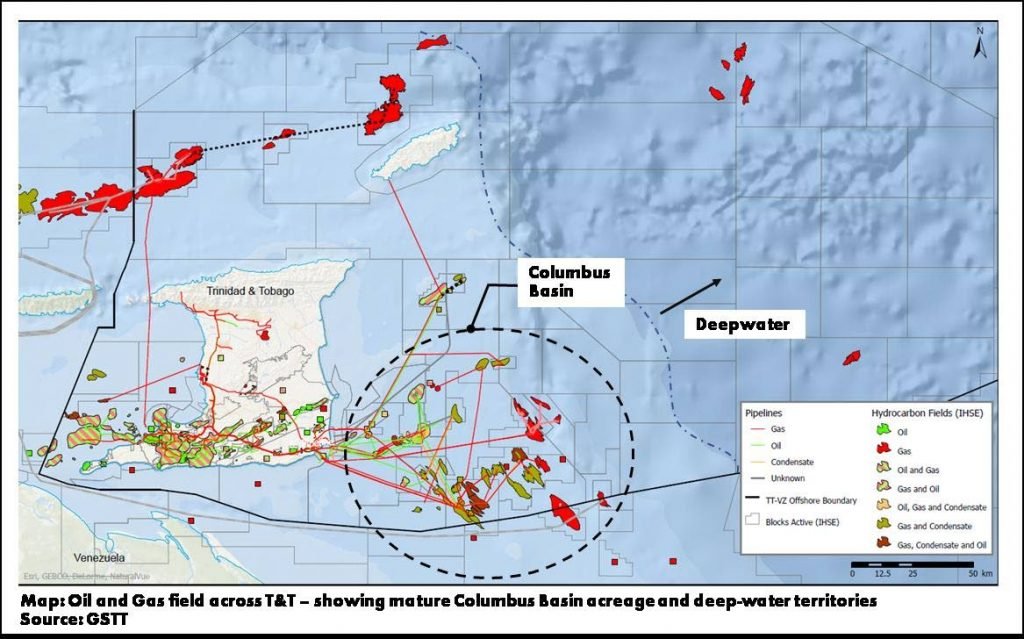

Gas supply has been something we take for granted in Trinidad. It seems a distant past when the Columbus basin (see map) proved to be a rich playground for finding hydrocarbons. There was a hugely successful patch in the 1990s with the advent of 3D seismic technology, which “changed the game” for professionals to get a picture of the hydrocarbon reservoirs and where to target. Significant developments have fuelled the conveyor belt of gas supply to domestic and LNG markets. In the last ten years there has been a steady decline in production from the highs of four bcf/d to 2.5 bcf/d. This production decline results greatly reduced revenues to our nation and needs to be halted or reversed.

Trinidad has seen a shift of activity into deep-water areas, where finding oil and gas reserves becomes technically challenging. Discoveries are required to be sizeable to meet economic thresholds and be monetised. The “low hanging fruit” have been picked from the different basins. With the juxtaposition of lower oil and gas prices, companies are challenged more than ever to make projects economically attractive (even though we are seeing somewhat of a rebound currently mainly as big nations move past covid19).

One has to keep in mind that for every molecule of gas removed from the ground, the incremental cost to extract a new molecule goes up. Imagine spilling some cooking oil on the road and trying to wipe it up with napkins – it takes only a little effort to wipe up the majority at the start, but the effort (and cost) required to recover the remainder just keeps rising.

The potential for material discoveries to be made is diminishing. For context, out of approximately 100 exploration wells in the Columbus basin up to 2020, there are approximately 35 discoveries. These were mainly in the shallow water areas offshore, where prospecting for resources is relatively easier than in the deeper-water areas, which are more challenging. This success ratio gets lower based on the geological challenges as we step further away from land.

New technologies, including advanced seismic techniques such as ocean bottom cable (OBC) and ocean bottom node (OBN) (think more detailed "ultrasound of the earth") have helped subsurface professionals understand the potential in the offshore acreage, but there is still the need for the different bits of a complex jigsaw puzzle to be joined up. Better IOC collaboration is a potential lever for this to be successful.

The hyper-competitive culture between the oil and gas majors in the past, driven by the race to secure lucrative contracts for both domestic and LNG markets may have been one of the key contributors to the dilemma today. Norway is an excellent example where companies maintain the balance of a competitive edge and yet still share data and collaborate to increase the overall chance of success on opportunities. This is purely legislative and forward thinking from the Scandinavians with a rich history of oil and gas success.

The government plays an important role, with contractual terms for the licenses/leases offshore needed to attract the right activity. Production sharing contracts (PSC) and other E&P terms need to be attractive enough for IOCs to invest, to fuel the next tranche of projects to keep our midstream and downstream sector afloat. There is the need for a balance of the relevant taxes which companies must pay and fiscal incentives to participate in E&P activity. The relationship between government and IOC is critical. We must treat the IOCs as partners to enable the future of the energy industry.

Added to the above, there is a crew change happening in the industry. Over 20,000 direct job losses have occurred in the last five to ten years in the TT energy sector. What’s lost is a gloomy reality where explorers and subsurface staff have fallen victim to capital constraints of companies. This mirrors a global trend in oil and gas expertise – the people that we need to find and develop our reserves are being laid off. Several professionals have been caught in the macroeconomic fallout of nearly every IOC on earth. Worryingly, the cuts now include mid-career and early career professionals. We can have all the ingredients (technology, acreage, commercial terms) but without chefs, how will the ideas get cooked?

This speaks to the challenges which need some thought and navigation.

There are glimpses of hope in TT. BHP’s recent deep-water discoveries are promising but need a line of sight to development and monetisation. An uptick in exploration activity between 2018 and 2020, with about 27 exploration wells drilled is good – the more wells the better for the sector. Large developments are being executed offshore by Shell, BHP and bpTT, which will alleviate some of the current production decline woes in the short term.

Keeping the conveyor belt going is essentially the dilemma our nation faces. The next time we ask, “where the oil money?”, it’s worth keeping some of this in mind.

Fingers crossed and here’s hoping for more success in the coming years.

The Geological Society of TT is a professional and technical organisation for geologists, other scientists, managers and individuals engaged in the fields of hydrocarbon exploration, academia, vulcanology, seismology, earthquake engineering, environmental geology, geological engineering and the exploration and development of non-petroleum mineral resources.

Comments

"Big push needed for survival of Trinidad and Tobago's energy sector"