542 reports of skimming in PoS

POLICE are asking citizens to be vigilant when using automatic banking machines (ABMs) and point of sale machines, as several reports of ABM fraud have been made.

ASP Curtis Julien said, at the weekly police press briefing in PoS on Wednesday, there were 542 reports of ABM fraud from January to June this year.

“That was only in the PoS area,” Julien said.

He said the reports were divided among the major banks in TT.

He added there was a significant decrease in reports of ABM fraud since the inception of the ABM task force, an independent body tasked with focusing on catching card skimmers.

“Information has been coming to hand and based on that information we have been making arrests, causing the decrease.”

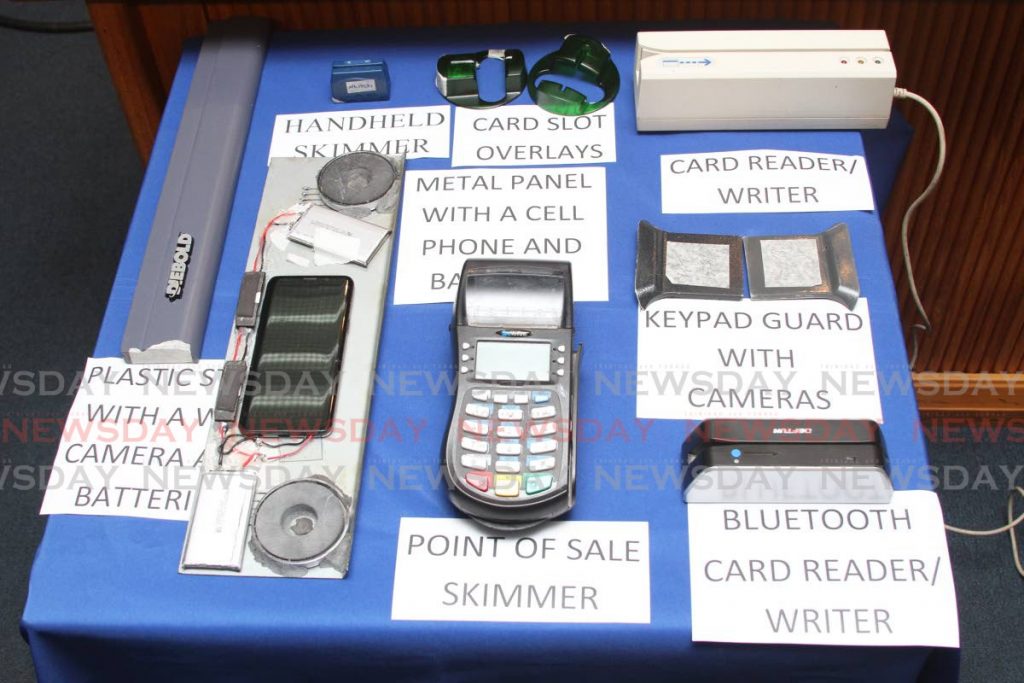

He advised citizens to keep an eye out for parts of card skimmers which are usually fitted to ABM machines. These include card slot overlays, which are outfitted at the card slots in ABMs, trick panels which are placed at the top of ABMs and outfitted with cameras and transmitting devices, plastic trimmings with hidden cameras and card readers which can clone any card with a magnetic strip.

“Up to Saturday we got some cards from Starbucks, Massy Stores and they make their own cards which are white and gold. The gold signifies information which they take from credit cards and the white signifies information they took from debit cards.”

He also highlighted the devices attached to point of sale machines.

“When you go to use a point of sale machine always keep your eyes on your card. Because from the time you take your eyes off the car people could use a miniaturised card swiper with a memory card that will take all your information.”

He advised to make physical checks of ABMs to ensure it is not outfitted with card-skimming technology, and warned that the skimmers now can steal your information from your cards in real-time, and later on remove the devices from the ABMs.

With regard to the point of sale machines, he said it is more difficult to identify when your card is being skimmed.

“Using the point of sale machine, they will tell you the transaction failed. It is a genuine point of sale machine but they rigged the machine with other components that will also capture all your financial information.”

He said any malfunction with the point of sale machine should be considered a red flag and the transaction should be stopped immediately. After which, he advised that people should contact their banks and cancel their cards.

Julien said police made a major breakthrough early in October by arresting a Canadian of Sri Lankan birth, whom they believe is one of the major masterminds behind the card skimming scheme.

“I say this because of the drastic drops of reports (since his arrest).”

The Canadian/Sri Lankan was not the only arrest made by the task force since its inception. Julien said, since the task force was re-introduced, they made 19 arrests. Of the 19 people only one was local.

Comments

"542 reports of skimming in PoS"