Panday: PNM, UNC failed on property tax

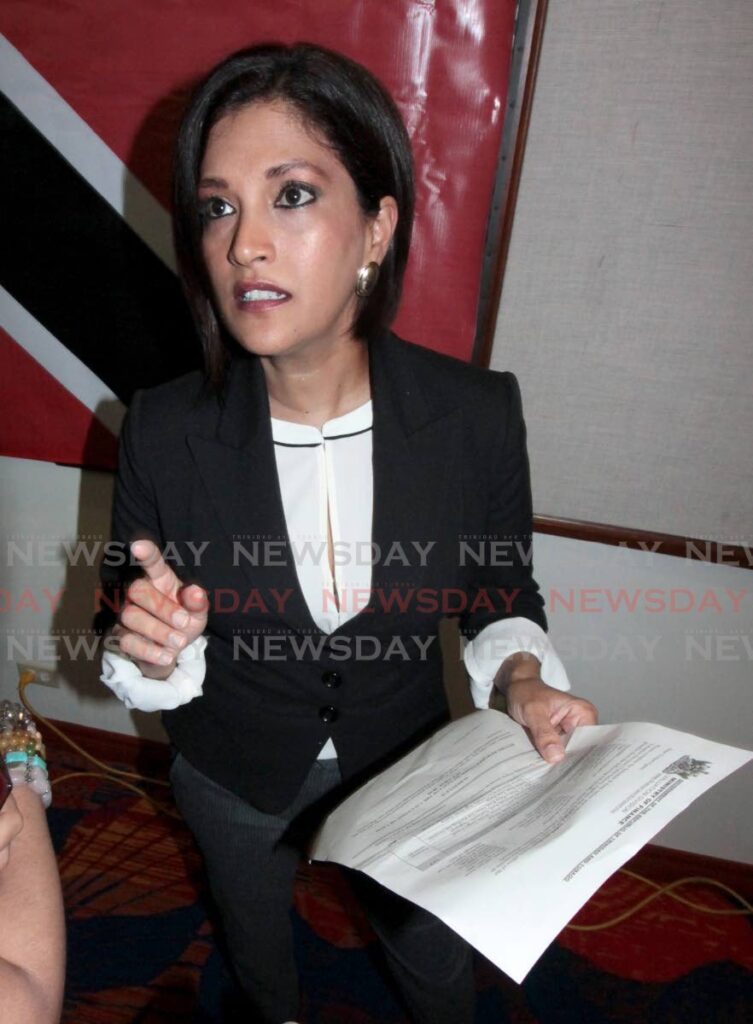

PATRIOTIC Front political leader Mickela Panday says the PNM and UNC have both failed when it comes to the implementation of property tax.

Panday, the daughter of former prime minister and UNC founder Basdeo Panday (deceased), made those comments in a post on her Facebook page.

“The PNM has never shied away from the fact they intend to implement the property tax, a bill they passed that became law on January 1, 2010, regardless of the additional financial burden on so many people struggling to make ends meet.”

She recalled the PNM was defeated in a snap general election on May 24, 2010, ushering the UNC-led People’s Partnership (PP) coalition into office, and one of the PP’s main campaign slogans was “Axe the Tax.”

Panday said, “But for five years they failed to do so. Why?”

Being in opposition, she continued, does not relieve political parties from taking responsibility for actions taken and not taken while in government.

Panday said 14 years later, “The fractured UNC, now an unrecognisable shell of its original self, is singing the same election song: They will get rid of the property tax if elected.

"I find that hard to believe when it was never their intention.”

Despite holding a constitutional majority of 29 seats in Parliament during its tenure, Panday said the PP did nothing to bring meaningful change to TT.

“Missed and wasted opportunities to bring real change to our country.”

She noted the challenges being faced now by the PNM to collect property tax, despite passing the legislation to do so in January 2010.

“They still haven’t been able to get their house in order, fumbling and stumbling as they try to find a way to get revenue without any vision or doing any genuine work.”

Panday asked whether there would be transparency and accountability on how the revenues gained from the collection of property taxes would be used.

She recalled the PNM’s local government campaign promise last August about regional corporations using the collection of residential property taxes to provide revenue.

“Will local roads be repaired and maintained? Will garbage collection improve? Will recycling be encouraged? Will local recreational parks be maintained? Will streets be lighted?”

Panday urged local government corporations to ensure there is transparency and accountability for all revenue generated from the collection of property taxes.

“They can begin by filing all their outstanding financial statements with the Auditor General.”

The Senate will debate the Property Tax (Amendment) Bill 2024 when it sits at the Red House on March 25 from 1.30 pm.

The bill was passed in the House of Representatives on March 18 by a vote of 20-15.

When he opened debate on the bill in the House on that day, Finance Minister Colm Imbert reminded MPs of the statement in the House on March 15 on the intentions behind this bill.

He made the statement after the public raised concerns about the suspension of property-tax payments and in the wake of complaints of the rental valuation of their properties being excessively high.

Imbert said the regulations published on March 15 allow indigent, elderly, or infirm people to apply to the Board of Inland Revenue (BIR) for a deferral of payments.

He also said an order to extend the time for people to object to valuations of their residential properties from 30 days to six months had been published.

Imbert said, that compared to other countries, TT was unique in the number of ways people could challenge valuations of their residential properties. They include raising concerns with the Commissioner of Valuations, the Valuations Tribunal, the BIR, the Tax Appeal Board and the High Court.

On March 15, Imbert reminded MPs of the September 2013 budget presentation of then-finance minister Larry Howai, under the UNC-led People’s Partnership government. He quoted an excerpt of what Howai said about property tax, also known as land and building tax.

“The land and building tax regime is a key pillar in all modern tax systems. The current land and building taxes meet all of the conditions of a good and fair tax.”

Howai, Imbert continued, outlined that the proper implementation of the tax required the “proper valuations of properties within a transparent framework. He said it was public knowledge in 2013, from Howai’s presentation, that the UNC had plans to implement the tax in three phases, from 2014-2017.

“They (UNC) thought they would still be there (in government) in 2017.”

The PNM won the general election of September 2015, to remove the PP from office and retained government after the August 2020 general election.

Imbert said the PP planned to implement property tax first on industrial properties, from July 2014. Commercial properties were to be taxed next and gricultural and residential properties last.

After noting that Opposition Leader Kamla Persad-Bissessar had been leading the UNC’s charge against the implementation of the tax, Imbert said video evidence from Parliament on September 9, 2013, told a different story.

“I looked at the video of that budget presentation and I saw that the Member for Siparia (Persad-Bissessar), who was prime minister at the time, was sitting next to the honourable minister of finance, Mr Howai, and was applauding this statement.”

Comments

"Panday: PNM, UNC failed on property tax"