Finance professionals: Economic confidence down

The latest global economic conditions survey (GECS) shows declining economic confidence for the second consecutive quarter

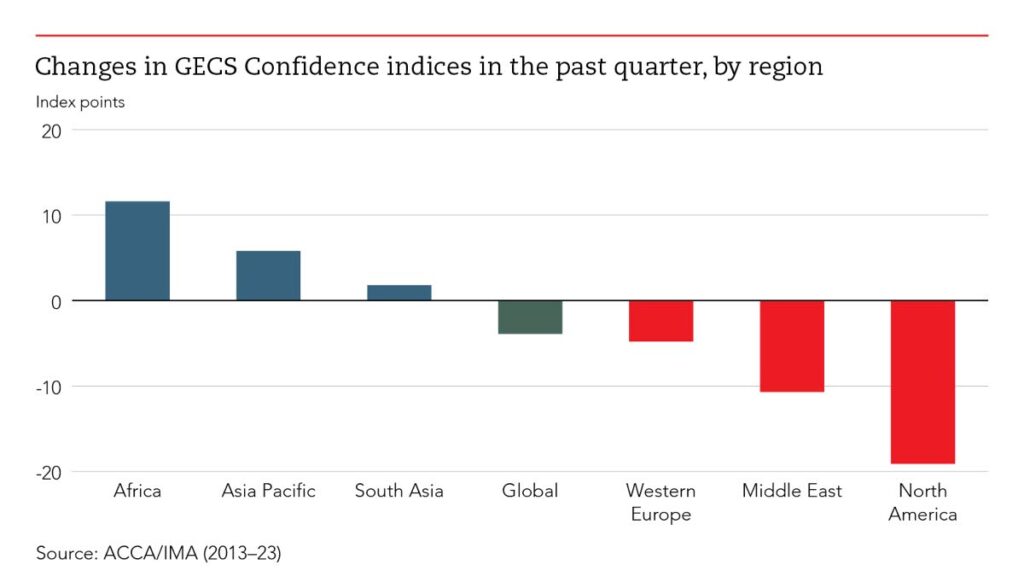

Changes in economic confidence vary across the globe with a notable reduction in North America while, in contrast, confidence in Africa rose materially for the second successive quarter.

The survey from ACCA and IMA – which was done before the outbreak of war in Israel and Gaza on October 7 – showed that while confidence did decline modestly, it remains higher than a year earlier, and only slightly below its long-term average.

The indices – new orders, employment and capital expenditure – all saw modest declines, but only the last is below its average.

The decline in confidence in the US was not as marked as North America’s overall fall of almost 20 points.

Elsewhere Asia Pacific saw a modest improvement – perhaps reflecting tentative signs that policy easing is leading to some improvement in the Chinese economy.

Sentiment fell again in Western Europe and is down sharply in the last two quarters, likely reflecting the weakness in the euro area and UK economies.

The fall in confidence in the Middle East was somewhat surprising, given the sharp rise in oil prices in recent months.

Confidence in South Asia edged higher, but is down sharply over the past year. This is surprising, given the general resilience in the Indian economy, although Pakistan has experienced significant difficulties.

The GECS’s survey standard cross-check on the economic outlook is the two "fear" indices, which reflect respondents’ concerns that customers and/or suppliers may go out of business.

Concerns about customers going out of business ticked up slightly, but fears about suppliers declined to the lowest since 2019. Neither series looks alarming by historical standards.

Nevertheless, given that monetary-policy-tightening works with a lag, and government bond yields have risen sharply since the summer, it would be surprising if there isn’t some deterioration in these indices over the coming quarters.

ACCA chief economist Jonathan Ashworth said: "Overall the GECS survey remains consistent with some further loss in global economic momentum, although it does not suggest that a downturn is imminent. That said, the risks to global growth are heavily stacked to the downside. These risks include the lagged impact of past monetary tightening, soaring government bond yields, rising oil prices, the Chinese economy, and geopolitics. Accountants should advise their firms or clients to plan accordingly."

One focus for accountants will be inflation. Concern about increased costs edged back slightly again in the latest quarter. And although cost pressures seem to have peaked, they remain well above the average recorded over the survey’s history. This suggests that central banks could still have more tightening to do than markets currently expect. The sharp rise in oil prices over recent months will make their job even trickier.

IMA senior director of research and thought leadership Dr Susie Duong said: "The fall in confidence in North America of almost 20 points stands out. While the fall in the US of nine points was not quite as marked, the Federal Reserve’s aggressive policy tightening clearly appears to be having an impact."

Comments

"Finance professionals: Economic confidence down"