Dragon gas lifeline

The signing of the Dragon gas deal with Venezuela and the award of deepwater blocks to a bpTT and Shell consortium has no doubt given TT's energy sector a lifeline.

On Thursday, the Energy Minister announced the award of three deepwater blocks to the consortium, a longed-for result since TT received just four bids in the 2022 deepwater bid rounds, the first since 2014.

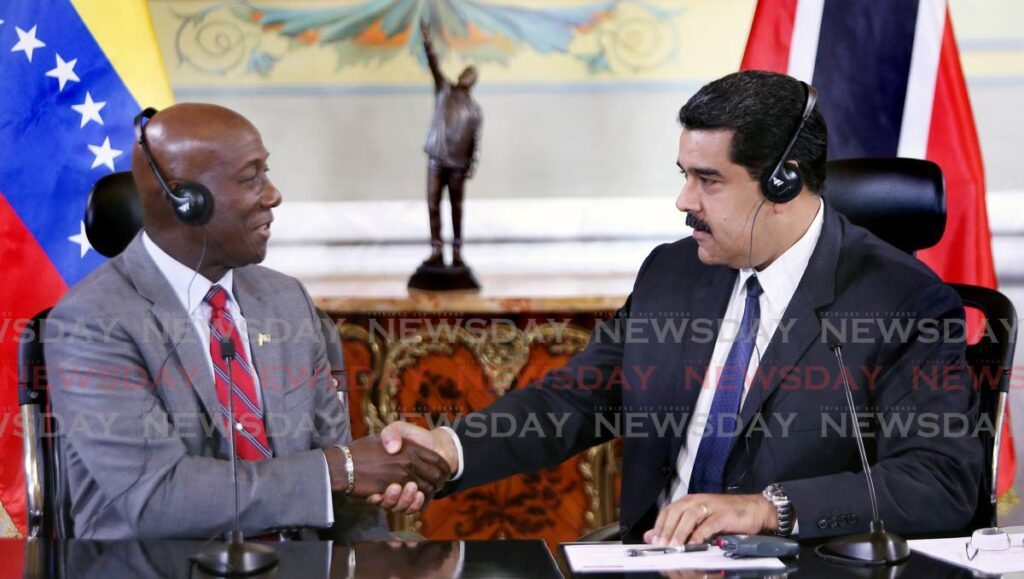

With exploration evidently only of interest to companies with existing investments in TT's petrosector, attention must turn to the potential offered by a successful conclusion to the five-year negotiations with Venezuela over the Dragon field. The Prime Minister first shook hands on the project with Venezuelan President Nicolas Maduro in August 2018 as a hopeful TT looked to a mutually beneficial partnership with its closest South-American neighbour in exploiting a rich and proven natural gas field capable of producing between 150-300 million standard cubic feet of gas per day (mmscf/d). If that sounds small compared to TT's September output of 2.5 billion standard cubic feet of gas per day (bscf/d), Dragon is one of four fields in PDVSA's Mariscal Sucre project which together are projected to deliver 1.2 bscf/d from a field a store of 4.2 trillion cubic feet of natural gas. TT had 11.5 trillion cubic feet (tcf) of proven natural gas reserves in 2016, a resource in steady decline since 2005.

At the current rate of natural gas consumption, TT's natural gas resources will dramatically decline in a decade.

In January, US President Joe Biden granted TT a waiver on 2019 Venezuelan sanctions allowing the Dragon deal to go forward, but the question of paying Venezuela for access to its sovereign asset remains. Even with the two-year waiver, TT cannot pay for Dragon access with cash. The PM has breezily dismissed this codicil, and presumably has an arrangement with Mr Maduro that satisfies the limitations of the US Office of Foreign Assets (OFAC) waiver.

Sanctions also ended plans to jointly exploit the Loran-Manatee cross-border field. Shell will develop the field for TT and deliver at least 150 mmscf/d to NGC from the 2.7 tcf of gas – roughly a quarter of the reserve – which lies within TT borders. First gas is expected in 2028.

The immediate benefit of access to the Dragon field is its proximity to the mature but active Hibiscus field off north-western Trinidad. The Dragon journey makes the Hibiscus connection across 18km of shallow water seem like a technical hop compared to the torturous politics that have beleaguered Dragon so far.

While exploration of the deepwater blocks continues, the rejuvenation of natural gas depends on successful and expedited exploitation of Loran-Manatee and Dragon.

TT must press home the incremental gains it has won regarding the field on terms that work within the limits of the OFAC licence. While sanctions on Russian petroleum products haven't been as effective as expected, global markets remain hungry for hydrocarbons from less problematic sources.

Comments

"Dragon gas lifeline"