Society and business as partners

The Bocas Lit Fest recently launched its first UK tour of Caribbean writers at an official reception jointly hosted by our high commissioner in London, the deputy secretary-general of the Commonwealth Foundation and Bocas.

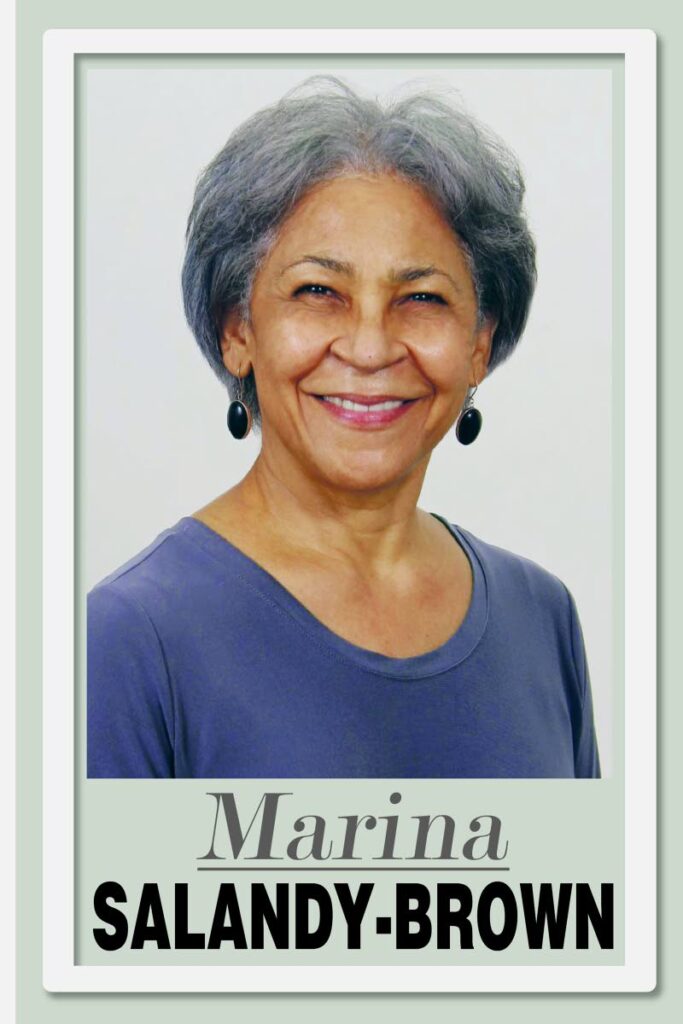

Standing at the podium to make a short welcome speech, I was moved by the physical presence of members of the marketing team and the president of the National Gas Company (NGC).

It was more than the fact that NGC has been the title sponsor of TT’s annual literary festival for the last 11 years, it was sponsorship in action and even more than that, it was a living example of the cumulative effect of responsible investment in society that all companies can make to the benefit of its citizens at home and abroad.

Corporate social responsibility (CSR) is a term known to most of us who tap into companies’ desire and duty to use their profits for the good of society by investing directly in or supporting initiatives by others that deliver benefits to citizens.

The new-ish buzzy acronym, ESG, meaning environmental, social, and governance criteria in business, is not quite the same. These are non-financial factors investors use to measure an investment or company's sustainability and encourage them to act responsibly in regard to the hot issues of our day, predominantly: air and water pollution; deforestation; high carbon emissions; green-energy initiatives; waste management; and water usage.

It might appear that CSR is morphing into ESG, but it is not actually doing so. According to Lexology, “While CSR aims to make a business accountable, ESG criteria make such business' efforts measurable.”

CSR, then, is about a company’s impact with regard to environmental and social issues, while ESG criteria focus on quantitative results that help investors make better decisions about the risks and ethics of particular companies.

It signifies that companies, therefore, must consider how issues such as environmental damage and public outrage can harm their reputation and interests.

ESG is interesting because it feels like something ordinary investors can get their shoulder to, and we have seen it at work during the Russian assault on Ukraine. Companies were forced to cease operations in Russia by activists’ protests mounting pressure on shareholders and CEOs.

According to a Yale School of Management study, by May 2022, just three months after the invasion, due to the ferociousness of the dissent, about 1,000 of the 1,200 or so companies tracked in the study had withdrawn from Russia, some high profile, such as Estée Lauder and McDonalds.

Given the nature of commerce, though, and the essential need to yield shareholder profit, one has to wonder, like the ending of slavery and indenture, about the role of self-interest. Do companies and CEOs really believe in fighting authoritarianism or in saving the planet, or rather, in saving themselves?

The answer does not matter, because activists and demonstrators, who could once be sidelined cannot now be silenced. Thanks to new technology, even at COP27, where the Egyptian hosts were determined to contain and hush the protesters, they failed to stop the loud dissenting voices making world news. CEOs have to listen, and not just them, because it is more than mere risk management.

The cynicism of the fund managers and bankers was exposed when, as The Economist cites, a whistleblower in Germany caused the largest asset manager to be raided by the authorities for “greenwashing”; similarly in Britain, where the watchdog banned HSBC, the bank, from making “misleading” environmental claims.

Investors are obviously taking ESG seriously. The magazine reports that the greener the fund, the more investors stuck with them during recent short-term stock-market losses, notwithstanding the hiked energy profits arising from the Russian-Ukraine war. Investors were undeterred because they take the long view.

The shifting of citizens’ priorities is not insignificant, given the difficult situation we find ourselves in, on almost all fronts. Everyone senses that the ground is moving beneath our feet – and the young vote with their feet, so the movement will intensify.

In London, I stayed with friends who surround themselves with people in their 30s, all lawyers and entrepreneurs, and everyone a sort of eco-warrior, earnestly attempting to minimise their carbon footprint, from vegan clothes to abandoning aeroplanes. Recycling necessitates two rubbish bins in each of the three kitchens of the rambling house, and the local council dutifully runs a detailed, unbreakable collection schedule.

I doubt the UK is an exception to what is almost definitely commonplace within the EU, with its strict laws on such matters as the environment and sustainability.

In TT’s largely state-run energy economy, with only about 35 companies listed on our stock exchange, and where citizens protest over more bread-and-butter issues, companies feel little ESG investor pressure.

Nevertheless, our companies exist in an integrated world and are susceptible to shifts in the relationship between business and wider society. Companies like NGC, with green agendas and active support of the arts and sport, obviously understand that business works best when it works for society, financially, socially and morally.

Comments

"Society and business as partners"