Carbon-capture storage: What is it and why is it important?

GEOLOGICAL SOCIETY

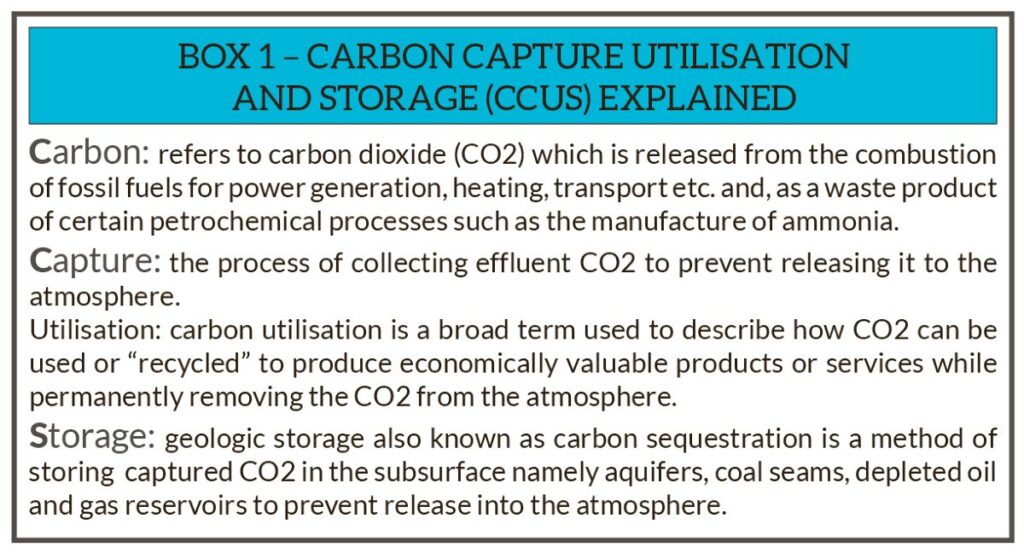

Carbon capture and storage (CCS) has been identified as one of the solutions, a critical component, of the technology mix needed to achieve the targets of the Paris Agreement. Although most readers here may be familiar with carbon capture utilisation and storage (CCUS), which is broader application than CCS, Box 1 provides a working definition for the acronym.

It has been widely recognised that global warming and its deleterious effects can only be kept in check by reducing CO2 emissions to maintain the average global temperature rise below 2°C.

Many are familiar with renewable energy being used to reduce CO2 emissions.

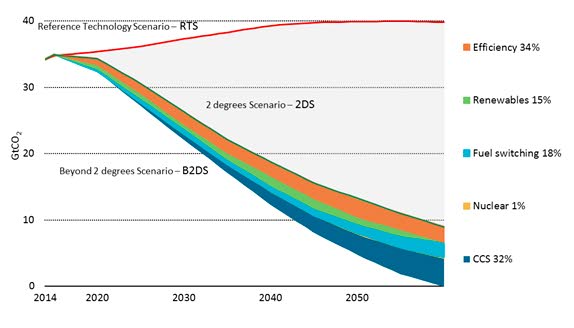

(Source: IEA GHG) -

However, Figure 1 shows that CCS will contribute more than double the reduction of global CO2 emissions reduction than renewables by 2060. The contribution of CCS is essential to achieve the two-degree scenario second only to energy efficiency.

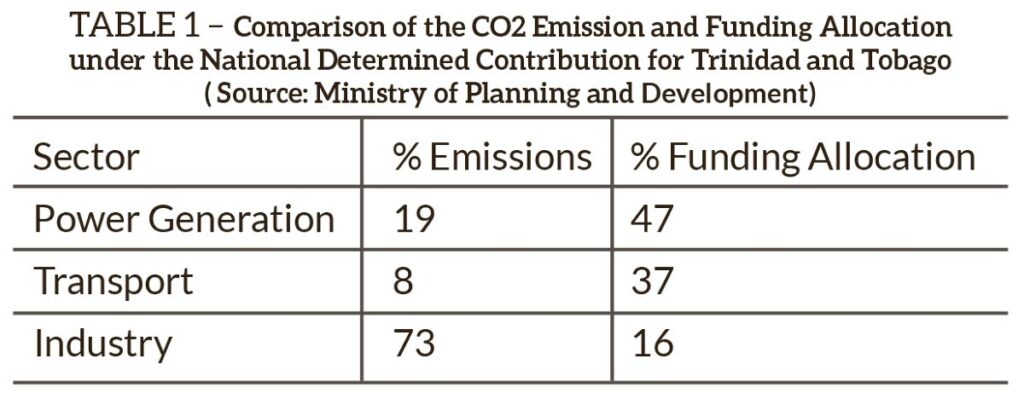

In TT, fuel-switching, energy efficiency and inclusion of renewable energy have advanced much further in planning and implementation than CCS. This is also reflected in funding allocation for the country’s nationally determined contributions (NDC) shown in Table 1.

Figure 1 also shows CCS is expected to gain momentum globally in the next decade and there is evidence that this may be true locally.

CCS recently gained a boost in Trinidad and Tobago with the introduction of an allowance for actual expenditure invested in CCS projects effective January. Additionally the government has established a CCUS steering committee towards implementation of this technology.

Putting the technical aspects of CCS and CCUS aside, let us briefly consider the emerging trend of applying environmental, social and governance (ESG) standards to investment, financing and operational decisions in the energy sector.

The ESG criteria were first introduced about two decades ago to create a preference in the marketplace for sustainable development. This is similar to products stamped with “100 per cent recycled,” “organic,” “recycled materials” or “fairtrade.”

ESG standards are now being used increasingly by professional asset managers to screen projects for investment and financing. In 2012 these funds accounted for 11 per cent of funds and have more than doubled in the last decade.

Projections show that this increasing trend will result in almost US$35 trillion, 50 per cent of professionally managed funds, being allocated on the basis of ESG criteria. Hydrocarbons produced and processed without CCUS will not meet the environmental criteria and hence are omitted from ESG-approved investing and financing.

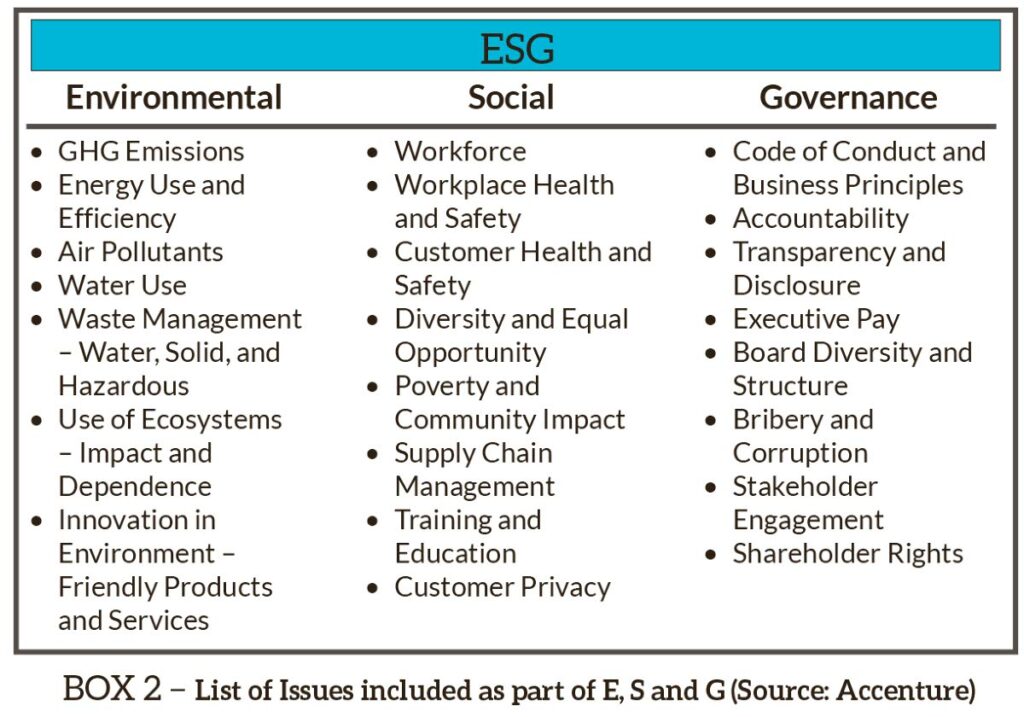

So, what does an ESG criterion look like? Investment firms typically set criteria based on their own priorities. Box 2 gives a general list of issues contained in ESG standards.

ESG standards are an expansion of business best practices for evaluating and approving investments. The major international energy companies operating in TT all provide ESG statements and reports on their global operations. Several local companies have publicised general ESG statements on their operations and social outreach, though reports on performance have not been made public.

ESG standards cannot be ignored. They are driving international financial institutions and fund managers to exclude the fossil-fuel sector from their investment portfolios and to embark on divesting their fossil-fuel holdings, regardless of their profitability.

The Economic Intelligence Unit has given TT an overall low-risk rating in its assessment of how the government, society and businesses affect the country’s sustainability. The environmental aspect, however, has a high-risk rating, while social and governance ratings are both low.

Comparatively, Guyana and Suriname have both been given moderate-risk ratings.

In the case of Guyana there is high environmental risk and moderate risk for social and governance criteria. Suriname also has high environmental risk, but low risk for social and governance criteria, for an overall moderate risk rating for the country.

In the same way that not all consumer products on the market may be recycled or organic, every hydrocarbon producer may not be able to implement CCS. Nations, operators and downstream processors will need to implement innovative solutions for carbon-utilisation and carbon-offsetting applications to meet their stated ESG commitments.

Dr Lorraine Sobers is a Fulbright scholar and Society of Petroleum Engineering (SPE) certified engineer. She currently lectures in the Petroleum Studies Unit of UWI, St Augustine.

Sobers has a BS in chemical engineering from Texas Tech University, where she also earned her MS in petroleum engineering. She also has a PhD in petroleum engineering from Imperial College London, and 19 years’ experience in the energy sector specialising in CO2EOR and carbon storage.

Comments

"Carbon-capture storage: What is it and why is it important?"