Ugly side of state companies

Whether falling under the Exchequer and Audit Act or Company Act, too many of this country’s state-funded companies now appear persistently to be failing in expected performance and wasting taxpayers’ money.

Last week’s exchanges between the parliamentary Public Accounts (Enterprises) Committee (PAEC) and the National Entrepreneurship Development Company (Nedco) provides another ugly example, especially with the company’s failure to submit its annual reports from 2018-2021, as legally required.

And this, as the PAEC discovered, was in the face of $66 million in bad loans (2016-17).

Before, at its 2017 meeting, PAEC found that Nedco had a “bad loans” loss of $94 million in the 2008-2014 period; that was 80 per cent of Nedco’s loan portfolio.

The then auditors, PWC, concluded that Nedco was “not sustainable” – running at a $150 million deficit.

Nedco changed auditors. A new board was appointed in 2015 “to do better.”

The diligent Minister of Finance must not allow his ministry to appear to be a “freeness bazaar.”

At the 2017 PAEC meeting, Nedco's then CEO, Albert Chow, said that Nedco’s rent for 100 staff members at 12 offices cost $5 million a year.

Again, there are taxpayers’ questions over Nedco “grants” to people in "challenged areas.” A grant is a virtual gift, with no collateral or strict accountability. Further, given the huge “non-performing loan” losses, Nedco’s promise to provide “skills and training” to recipients seems to have failed.

Nedco chairman Clarry Benn, a reputable banker, could not say when the outstanding reports would be completed by the auditors. The auditors are paid almost $336,000, with $299,000 owed.

How many of the country’s state companies have properly submitted their annual reports in the time legally stipulated? It is overdue for the Minister of Finance to take a no-nonsense approach and, as a start, publish the list of such companies and the extent of bad loans, annual losses, etc.

Since it is the minister as “treasury” and the government that appoint such companies, it is the minister and government who must not merely note the faults in company expenditure or performance but, more seriously, appear prepared to take action against such defaulting companies. Government benevolence, whether through political expediency or not, cannot be through the persistent abuse of public money.

Now above all these troubling details, an overriding taxpaying question arises: Why was such financial auditing for government expenditures moved from under the constitutional jurisdiction of the independent Auditor General and put under such state companies?

The Exchequer and Audit Act states: “The Auditor General is empowered to provide for the control and management of the public finances of TT… for the audit of public accounts…for the control of powers of statutory bodies.”

Further, the act states the Auditor General “shall examine and inquire into and audit the account of all accounting officers and receivers of revenue and also call upon anyone for explanations.” (sections 4, 5)

The policy allowing such state companies to select auditors should be urgently reviewed. Expand the Auditor General’s staffing and return auditing of state bodies to the Auditor General. Help save these state bodies from themselves.

No wonder, in a fit of apparent frustration, PAEC chairman Wade Mark last week declared: “Move with post haste and have these accounts completed, including 2021, as soon as practically applicable. I don’t want to take action.” He asked: “Why a small company like Nedco cannot produce its financial audited accounts in time?”

Some government members entered to soften the company’s delinquency.

Why? Two things here:

(1) A lot of taxpayers’ money is involved, in fact wasted – “bad debts” amount to $66 million, with another $20 million coming from the Ministry of Finance this year for “grants.”

(2) What kind of “action” can PAEC take against Nedco?

What was said last Wednesday in Parliament gives the ugly impression that this company appears more of a “charity house” than anything entrepreneurial. Real or perceived, such “grants” cannot appear to be “disguised dependency.”

Mr Benn promised to do a survey to assess how well Nedco grants served the purpose.

But this is not only about Nedco. Joint select committees also heard about the financial irregularities and outstanding reports from several other state companies. The ugly impression is now intolerable.

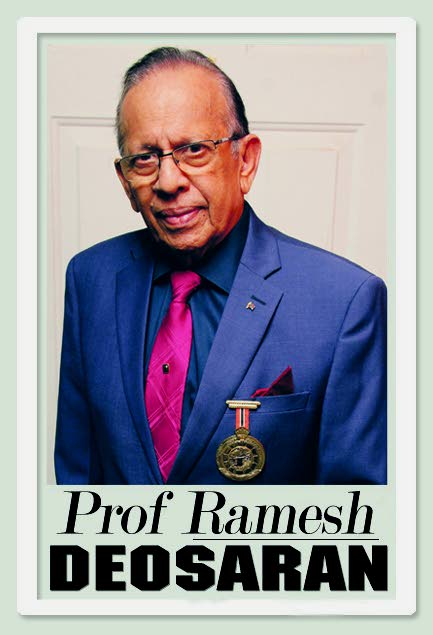

(Prof Deosaran is a former chairman of the JSC to inquire and report on Service Commissions and Municipal Corporations.)

Comments

"Ugly side of state companies"