UNC: Government addicted to borrowing

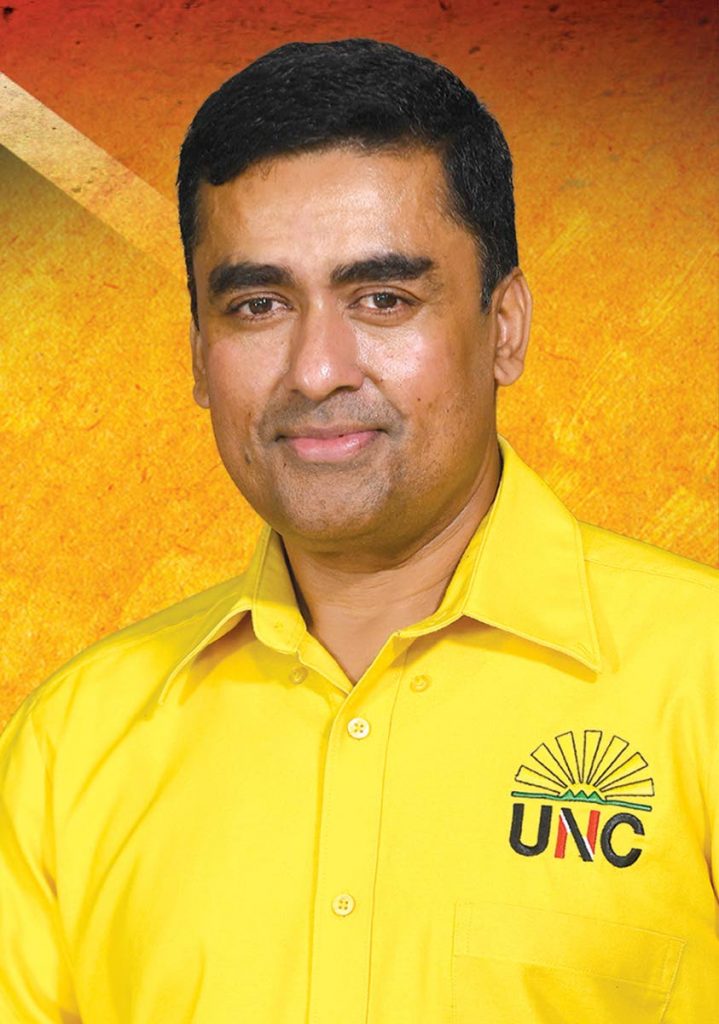

UNC MP for Oropouche West Davendranath Tancoo said the government has demonstrated an addiction to borrowing money and has depleted the resources of the Heritage and Stabalisation Fund (HSF) as well as the Consolidated Fund.

Tancoo was speaking during the UNC's weekly press conference on Sunday.

The HSF is a sovereign wealth fund and its primary objectives are to save and invest surplus petroleum production revenues to support public expenditures during periods of revenue downturn.

Tancoo said the Governor of the Central Bank Dr Alvin Hillaire recently launched its financial stability report which said the economy is very strong and resilient.

“The fact is that Trinidad and Tobago is in economic crisis,” he said. “We have a government that is fully dependant on the HSF for its foreign exchange (FX) holdings

He said this is problematic as the Government still has to find ways of paying back the money borrowed in foreign exchange.”

He said the Government has increased net public debt by 62 per cent from $77.3 billion to $125.3 billion in six years.

Tancoo added that what "is even worse than the excessive borrowing, is that a lot of it is foreign borrowing." He said this does not include the $1.4 billion loan signed by the Government in May.

Tancoo said with all the money borrowed, there has been no significant, revenue-generating streams. “Having borrowed billions, this Government has nothing to show for how they have spent it.”

He said Minister of Finance Colm Imbert said he took from the HSF because the covid19 pandemic affected income streams, but in 2015, he said Imbert withdrew over $600 million.

“This is not a bottomless pit,” he said, adding that rating from global credit-rating firm Standard and Poor’s (S&P) was based on the confidence that TT has the HSF has a nest egg. “It is ironic that this is the same nest egg being reduced by government-borrowing.”

He said S&P also looked at the Consolidated Fund where all revenue from the government goes.

“The HSF is basically our fixed-deposit. The Consolidated Fund is our savings account. The minister has drawn down on the Consolidated Fund that the fund is in crisis.”

Tancoo said the Government was borrowing to pay recurrent debt.

Also on Sunday, Tancoo accused Imbert of allowing TT's global credit rating to drop significantly

“We are here today in an economy which ahs collapsed under Minister Colm Imbert,”

“It is that confidence in the economy that (attract) investors. They use S&P to determine if they want to invest…Within three months (of Imbert taking office) Standard and Poor's went from an A rating to a negative outlook for TT.

“From then to now, we have fallen every year from 2015 to June. S&P has given TT a failing grade.”

On Saturday, Opposition Leader Kamla Persad-Bissessar accused Central Bank Governor Dr Alvin Hilaire of mismanagement at the bank.

She said at Thursday's launch of Central Bank's Financial Stability Report 2020, Hilaire had said he was optimistic about the state of the economy.

However, she believes TT's current economic situation does not reflect that optimism.

"Given the severity of our economic crisis, one wonders what inspires this 'optimism' expressed by the Central Bank Governor. He either clearly doesn't read how own reports or wishful thinking has replaced data-driven monetary policy at the Central Bank," she said.

According to the Central Bank's Monetary Policy Report of May 2021, Persad-Bissessar noted, "Domestic economic activity contracted in the fourth quarter of 2020 primarily due to sharp declines in the energy sector and indicators point to continued weak activity in early 2021."

In a tweet on Sunday, Imbert said, “The Opposition Leader has recklessly criticised the Central Bank (CBTT) for being too close to the PNM. The CBTT is responsible for managing interest rates, reserves, money supply, inflation etc. It is doing this well. What does she want instead – Devaluation, a UNC governor, or Mayhem?”

Comments

"UNC: Government addicted to borrowing"