Touchstone exploration: an onshore success story

GEOLOGICAL SOCIETY

Touchstone’s share price was CAD$0.20 in January 2019; by January 2020 it had doubled to $0.40. But by January 2021, despite extenuating circumstances related to the covid19 pandemic, it was approximately CAD$2.50, over 12 times what it was worth two years prior. What caused this and why it is important to TT?

In 2011, CL Financial sold its oil producing subsidiary, the Primera Group, to Canada’s Touchstone Exploration Inc for approximately US$50 million. At the time, Primera had 16 oil and gas properties across southern Trinidad.

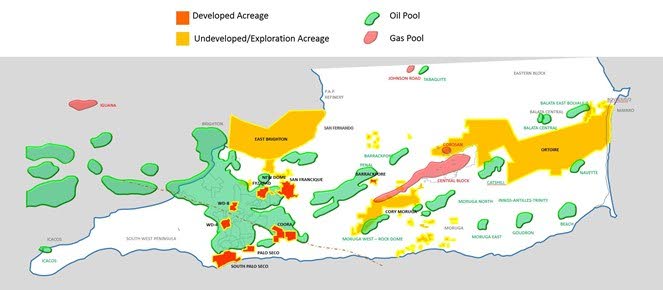

During 2020, Touchstone produced approximately 1,400 barrels of crude per day from nine onshore properties (in Fyzabad, Barrackpore, Palo Seco, San Francique, among others).

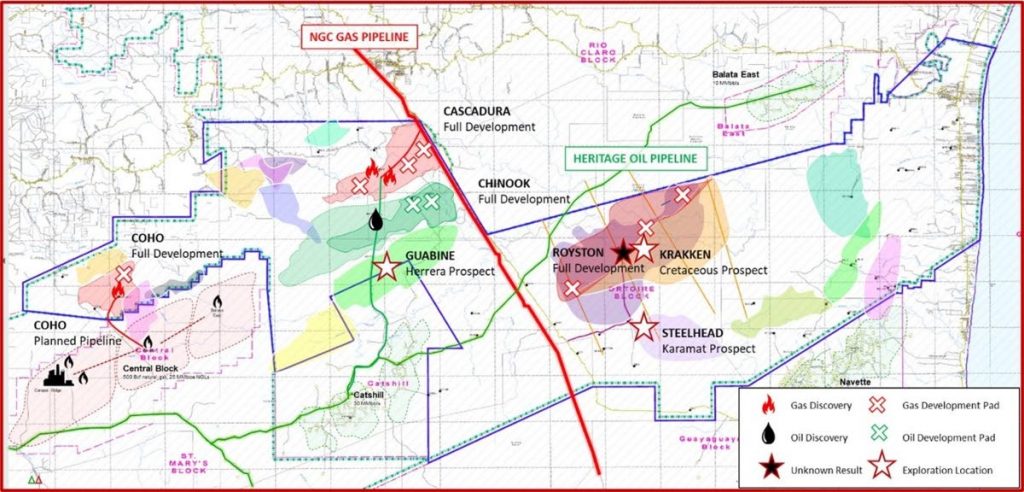

But what has really made Touchstone a phenomenon in the last few years has been their exploration success within the Ortoire Block. This was one of three onshore blocks signed by the Ministry of Energy in 2014, during the last successful bid round. Touchstone operates the block with 80 per cent interest, while Heritage took over Petrotrin’s 20 per cent. Ortoire is surrounded by several producing oil and gas fields (Baraka, Baraka East, Carapal Ridge, Catshill, Navette and Balata East). The block, at 184 sq km, represents less than five per cent of Trinidad’s land acreage, roughly covering a portion of south-east Trinidad from Tableland to Ortoire, Mayaro, with its southern portion ending in the Guayaguayare Forest.

Before going further about Touchstone, it is worth discussing a few facts that are relevant to this story.

Firstly, Trinidad has been commercially producing oil onshore for over 100 years. The land acreage has been well explored and developed with over 10,000 wells drilled. Many geologists had given up on major new onshore exploration finds and attention had gone towards the shallow offshore and more recently, the ultradeep, where BHP has made several gas discoveries. There were always a few geoscientists however, that remained faithful that the mature onshore basin could still provide a few surprises.

Secondly, almost all the hydrocarbon producing fields onshore Trinidad have been oil producing. The one notable exception is the Central Block field, operated by BG and now, Shell. In 2000, when the Carapal Ridge gas field was found, it was the largest onshore discovery in decades. Most peculiarly, the field was gas. It was long thought that additional gas fields might be present nearby. Unfortunately, most of the acreage surrounding the Central Block had been underexplored, even though older wells indicated the presence of hydrocarbons.

Lastly, we must make mention of the domestic gas situation and our downstream sector. The consumers of gas by percentage for 2021 are: petrochemical plants (40 per cent), power generation (nine per cent), Atlantic LNG (48 per cent) and other small manufacturers (three per cent). The Pt Lisas Industrial Estate is of course home to some of the largest ammonia and methanol plants in the world. Gas production has fallen tremendously (4.3 billion cubic feet per day in 2010 to 2.7 bcf/d in 2021) due to a combination of natural decline, exploration and production failure and unsatisfactory government regulation. This has resulted in the temporary and longer-term closure of several plants, impacting thousands of jobs and directly reducing the government tax take.

Back to land and Touchstone. We have established that onshore discoveries in Trinidad have been rare in the last 50 years, and that onshore gas fields are rarer still. Since 2019, Touchstone has drilled several prospects: Coho, Cascadura and Chinook. All three have been hydrocarbon discoveries, defying expectations.

Coho is the smallest field, expected to produce just under ten mmscf/d. Fortunately, the well is located just three kilometres from an NGC tie-in point. A very short pipeline is currently underway to bring Coho on production later in 2021.

Cascadura is now believed to be the largest onshore gas discovery in Trinidad’s history with gas in place estimated at 241 bcf on the low end, and as much as 571 bcf on the high end. This gas was found in three sandstone zones. The lowest zone (Cascadura Deep) was tested and found to be liquids rich, therefore able to produce both gas and valuable natural gas liquids (NGLs). Together, the first two wells at Cascadura are expected to bring on 60 to 70 mmscf/d, and at least four more wells targeting the various zones are planned.

Chinook discovered three hydrocarbon zones originally believed to be gas, but now is confirmed to be predominantly light sweet crude oil. Further testing is upcoming.

Touchstone is getting ready to spud Royston (June/July), their largest, deepest (target depth of 11,500 feet) and riskiest well yet. Simultaneously, they are acquiring 22km of 2D seismic, which will help detail Royston as well as nearby prospects.

One thing to note is these exploration wells have been drilled on the basis of old well data as far back as the 1950s, incorporating existing seismic and well data and some fresh geological models coming from the minds of Trinidadian and Canadian geoscientists.

Altogether, Touchstone has stated that these discoveries will total to production of over 200 mmscf/d. Most importantly, being onshore and close to existing NGC pipelines means that the development cost will be low and that the fields can be brought on production within two years of discovery (compared to five to ten years for offshore gas fields).

NGC and Touchstone already signed a five-year offtake agreement, worth between US$1.6 and 2.2 billion, where NGC will buy all gas Touchstone produces.

While 200 mmscf/d may not appear that significant (seven per cent of current daily production), the quick and relatively large volumes could be a game changer for the petrochemical plants at Pt Lisas, that have been starved for gas for years. For comparison’s sake, De Novo, a US$100 million investment, produces 80 mmscf/d from an offshore platform in the west coast. This gas is currently sufficient to run Proman’s M2 and M3 methanol plants. Therefore an additional 200 from Touchstone can certainly extend the lives of several plants, at a time when this is critically needed.

Touchstone has already identified several future prospects: Krakken, Guabine and Steelhead, which are three of a whopping 21 exploration targets in the block.

The GSTT wishes Touchstone continued safe and successful exploration and production activities!

bcf/d – billion cubic feet per day

mmscf/d – million standard cubic feet per day

bbl/d – barrels per day

The Geological Society of TT is a professional and technical organisation for geologists, other scientists, managers and individuals engaged in the fields of hydrocarbon exploration, academia, vulcanology, seismology, earthquake engineering, environmental geology, geological engineering and the exploration and development of non-petroleum mineral resources.

Comments

"Touchstone exploration: an onshore success story"