Living in debt: Imbert gives grim outlook

Government's revenue for the first four months of fiscal 2021 was $2 billion less than expected. The State is now faced with a tough decision: save jobs and hold wages steady or increase wages and risk cutting jobs.

At a virtual press conference on Wednesday, Finance Minister Colm Imbert was clear.

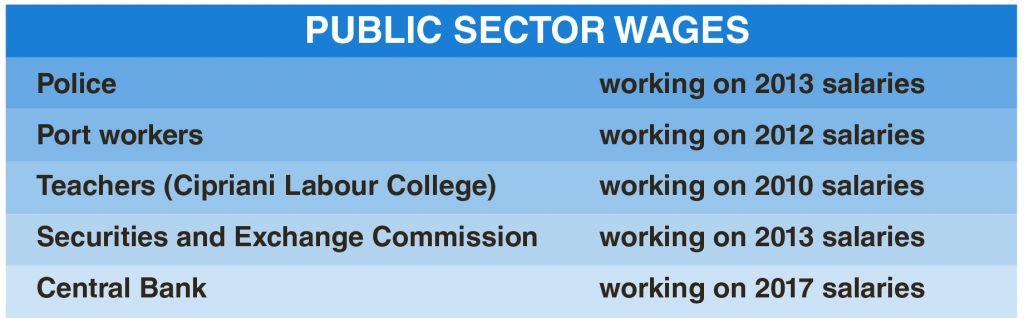

“As we move forward, our primary objective as a Government must be to preserve jobs and maintain essential government services. In this context, demands from trade unions for wage increases, with associated billions of dollars in backpay, are difficult to understand.

"If excessive wage increases continue to be a factor then the unemployment levels would have to be affected because the money is just not there.”

Newsday asked what percentage, if any, would be optimal for Government, so it would be able to do both – that is, preserve jobs and increase salaries. Imbert responded: "The point I am making is that any increase at all will have an effect on the overall balance of payments and the overall deficit. And we have reached a point as a country where we're into a zone now where we just can't continue to borrow money to finance what we call is recurrent expenditure. Salaries and wages is recurrent expenditure."

Imbert blamed the economic fallout from covid19 for the shortfall, which was especially sharp in the oil and gas sector – the country's main revenue earner.

He detailed the country's economic position from October 2020 to January this year.

Like most oil- and gas-based economies around the world, covid19 hit TT hard. Volatile commodity prices born out of reduced demand for fossil fuels started a chain reaction, including the shut-down of several plants in the downstream petrochemical sector and job losses in the wider private sector.

This year was supposed to be the start of a long recovery campaign with financial stimuli in the agricultural and construction sectors.

But as Imbert explained, covid19 continues to affect TT’s bottom line.

“The official budget estimate of revenue for the period October 1, 2020 to January 31, 2021, the first four months of the fiscal year, was based on all available information at the end of September 2020 and was $13.823 billion. However, primarily as a result of the adverse effects of the pandemic, the actual revenue collection for this four-month period was $12.02 billion, a negative variance of $1.803 billion, or 13 per cent less than the estimates,” Imbert said.

Revenue from taxes on income and profits was down by $436 million or nine per cent, and non-tax revenue was down by $1.43 billion or 35 per cent.

The oil and gas sector took the biggest hit, with taxes from oil companies missing their mark by 39.7 per cent or $268 million. As a result of depressed oil and gas prices and lower than expected production, revenue from royalties on oil and gas was down by almost half – $806 million or 49.2 per cent. Extraordinary receipts from oil and gas companies also took a nosedive, dropping by 98.2 per cent or $100 million.

Individual tax and international trade taxes (customs duties) were down 1.4 per cent ($27 million) and 4.8 per cent ($46 million) respectively, although Imbert said the relative low margins between expectation and reality were "a positive indicator." "This indicates that income tax remains more or less stable," he said. Profits from state enterprises dipped by $22 million (15.3 per cent) and the unemployment levy, a tax charged on profits from petroleum companies, went down by 56.7 per cent or $52 million.

“The effect of all this is that the Government has been seriously challenged in the first four months of the financial year to find the money necessary to keep the country running and to meet mandatory commitments and has had to resort to loan financing and withdrawals from the Heritage and Stabilisation Fund, to make up the deficit between income and expenditure,” Imbert said.

Borrowing to pay wages

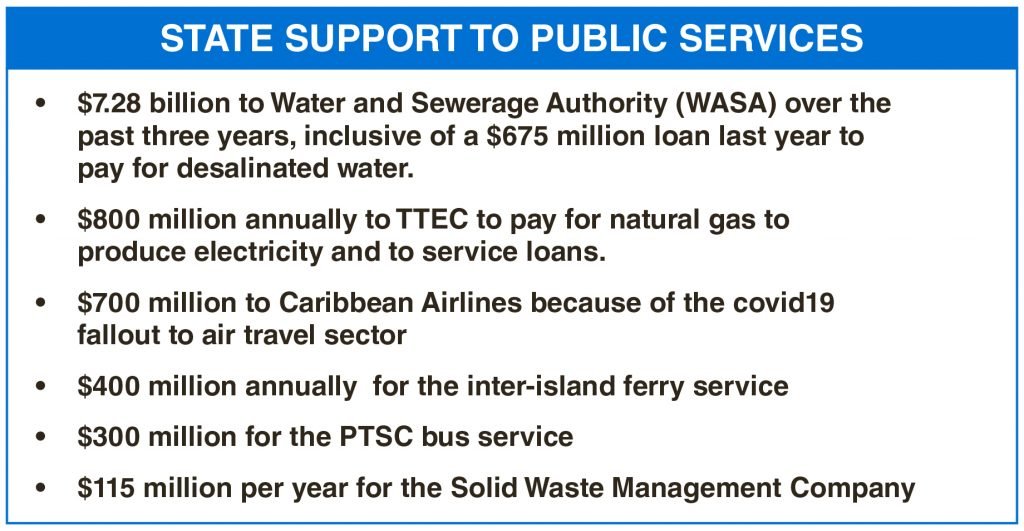

And the problems do not stop there. Government still has bills to pay. Imbert said Government has, so far, borrowed $3 billion for direct budgetary support and withdrawn a further $2 billion from the Heritage and Stabilisation Fund (HSF) just to pay salaries, wages and pensions, and keep both the primary and parallel healthcare systems functioning. He added that with the persistent budget deficit and uncertainty as to when the global and local economies might recover, government simply could not afford significant wage increases. Imbert said mandatory payments, which include payments of salaries and wages as well as financial support for regulated industries costs the country $3.5 billion each month.

“In order to make these essential payments, releases for goods and services have had to be reduced, which is creating its own problems as bills accumulate for rent, janitorial and private security services, among other things.”

If the trend of the first four months of the financial year continues, the country may lose up to $5 billion in revenue for fiscal 2021, primarily as a result of depressed production and low prices of natural gas, he said. Imbert said government intends to borrow additional funds and make more withdrawals from the HSF. “That approach (continued borrowing to meet recurrent expenditure) is not sustainable,” Imbert noted. “We must also move to control expenditure.”

This story has been amended to include additional details. See original post below.

Government's revenue for the first four months of fiscal 2021 was $2 billion less than expected. The State is now faced with a tough decision: save jobs and hold wages steady or increase wages and risk cutting jobs.

At a virtual press conference on Wednesday, Finance Minister Colm Imbert was clear.

“As we move forward, our primary objective as a Government must be to preserve jobs and maintain essential government services. In this context, demands from trade unions for wage increases, with associated billions of dollars in backpay, are difficult to understand. If excessive wage increases continue to be a factor then the unemployment levels would have to be affected because the money is just not there,” he said.

Imbert blamed the economic fallout from covid19 for the shortfall, which was especially sharp in the oil and gas sector – the country's main revenue earner.

The minister detailed the country's economic position from October 2020 to January this year.

Like most oil- and gas-based economies around the world, covid19 hit TT hard. Volatile commodity prices born out of reduced demand for fossil fuels started a chain reaction, including the shut-down of several plants in the downstream petrochemical sector and job losses in the wider private sector.

This year was supposed to be the start of a long recovery campaign with financial stimuli in the agricultural and construction sectors.

But as Imbert explained, covid19 continues to affect TT’s bottom line.

“The official budget estimate of revenue for the period October 1, 2020 to January 31, 2021, the first four months of the fiscal year, was based on all available information at the end of September 2020 and was $13.823 billion. However, primarily as a result of the adverse effects of the pandemic, the actual revenue collection for this four-month period was $12.02 billion, a negative variance of $1.803 billion, or 13 per cent less than the estimates,” Imbert said.

Revenue from taxes on income and profits was down by $436 million or nine per cent, and non-tax revenue was down by $1.43 billion or 35 per cent.

The oil and gas sector took the biggest hit, with taxes from oil companies missing their mark by 39.7 per cent or $268 million. As a result of depressed oil and gas prices and lower than expected production, revenue from royalties on oil and gas was down by almost half – $806 million or 49.2 per cent. Extraordinary receipts from oil and gas companies also took a nosedive, dropping by 98.2 per cent or $100 million.

Individual tax and international trade taxes (customs duties) were down 1.4 per cent ($27 million) and 4.8 per cent ($46 million) respectively, although Imbert said the relative low margins between expectation and reality were "a positive indicator." "This indicates that income tax remains more or less stable," he said. Profits from state enterprises dipped by $22 million (15.3 per cent) and the unemployment levy, a tax charged on profits from petroleum companies, went down by 56.7 per cent or $52 million.

“The effect of all this is that the Government has been seriously challenged in the first four months of the financial year to find the money necessary to keep the country running and to meet mandatory commitments and has had to resort to loan financing and withdrawals from the Heritage and Stabilisation Fund, to make up the deficit between income and expenditure,” Imbert said.

Borrowing to pay wages

And the problems do not stop there. Government still has bills to pay. Imbert said Government has, so far, borrowed $3 billion for direct budgetary support and withdrawn a further $2 billion from the Heritage and Stabilisation Fund (HSF) just to pay salaries, wages and pensions, and keep both the primary and parallel healthcare systems functioning. He added that with the persistent budget deficit and uncertainty as to when the global and local economies might recover, government simply could not afford significant wage increases. Imbert said mandatory payments, which include payments of salaries and wages as well as financial support for regulated industries costs the country $3.5 billion each month. (See box)

“In order to make these essential payments, releases for goods and services have had to be reduced, which is creating its own problems as bills accumulate for rent, janitorial and private security services, among other things.”

If the trend of the first four months of the financial year continues, the country may lose up to $5 billion in revenue for fiscal 2021, primarily as a result of depressed production and low prices of natural gas, he said. Imbert said government intends to borrow additional funds and make more withdrawals from the HSF. “That approach (continued borrowing to meet recurrent expenditure) is not sustainable,” Imbert noted. “We must also move to control expenditure.”

All metrics to measure and assess debt to GDP ratios should have gone out the window because of covid19, he said. "Even the IMF said it was a time to borrow." TT can still borrow, he said, but there will come a point where the country will have to slow it down. "And we are getting close. Our debt to GDP ratio is over 80 per cent."

He said by next month the retail fuel sector should be fully liberalised (the gas subsidy fully removed), freeing up as much as $7 billion for the country. The Regulated Industries Commission is also expected to make an adjudication on appropriate levels of water and electricity rates, and ministerial teams have also reported on proposals for restructuring WASA for greater efficiency, as well as for the introduction of a private operator at the Port of Port of Spain to increase revenue and reduce costs where feasible.

“These reports are currently being reviewed,” he said. The HSF balance, according to the budget read last October, was US$5.73 billion as at September 2020. “The fund is growing from, believe it or not, the performance at the stock market over the last six months. It has done very well.

“We took about a billion (TT) dollars over the last 12 months or so, and the value of the fund dropped by a couple hundred million. It grew through returns from the stocks bonds and equities that it is built on. It is earning between $300 million and $500 million a year," he said.

Comments

"Living in debt: Imbert gives grim outlook"