[UPDATED] Confusion over Colm mistweets

FINANCE MINISTER Colm Imbert on Tuesday released images of the legal orders approving the announced tax waivers for computers, four days after he announced the policy on Twitter.

On Friday night at 9.30 pm, following criticism earlier that day from Opposition Leader Kamla Persad-Bissessar that computers – including laptops and tablets – should be exempt from taxes, Imbert announced the waiver in a tweet.

"(On Thursday), based on a submission from the Ministry of Finance, in keeping with the commitment given in our PNM 2020 General Election Manifesto, Cabinet agreed to remove all taxes on laptops computers, notebook computers and tablet computers. This measure takes effect immediately," Imbert said.

He added in a second tweet that taxes were earmarked to be removed on devices including mobile and digital equipment, cell phones, software and accessories in the Finance Act of 2020, after the completion of the budget debate, in or around December.

There was, however, some confusion among sellers and consumers about the zero-rated status of devices. On Tuesday, Newsday reported that the spike in demand, driven by import costs, meant higher prices on devices brought in before the tax removal kicked in, despite Imbert's announcement. Some retailers said the measure would help reduce prices going forward.

Up to Tuesday afternoon, the Customs and Excise Division had not informed brokers on the particularities of the waivers because it had not received any directive via a legal notice, compounding confusion. Customs is an arm of the Ministry of Finance.

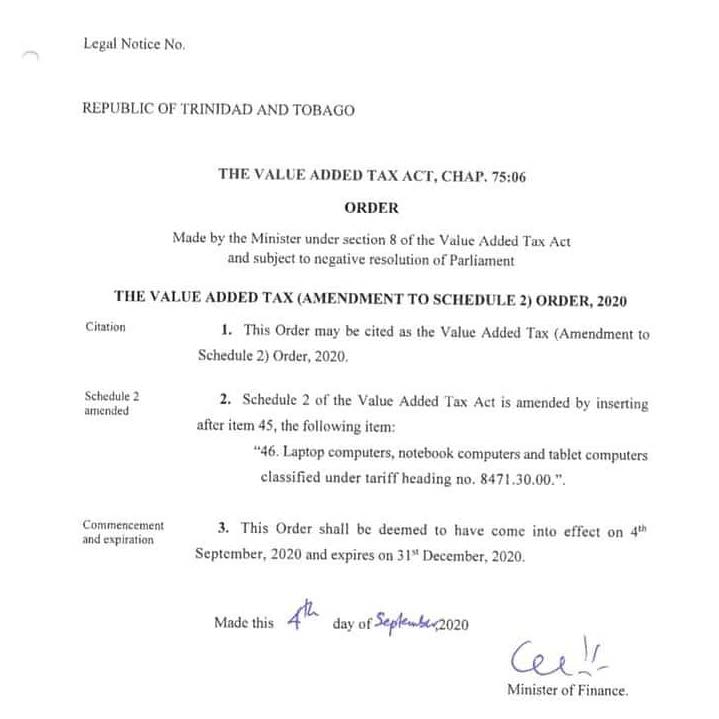

On Tuesday morning, however, a tweet from the PNM’s account included an image of a legal notice dated September 4 for the VAT waiver, as well as a comment from the Finance Minister. “From @ImbertColm: ‘Here is the Order I signed waiving VAT and OPT on laptops, notebooks and tablets. It is retroactive to September 4th. It turns out the Customs erroneously charged tax on some laptops that were imported using manual entries yesterday. Any such charges will be refunded,” the tweet said.

The minister later sought to clarify, via a statement from the Ministry of Finance, the status of regulations, noting that "the required legal orders for the zero-rating for Value Added Tax (VAT) and the remission (waiver) of Online Purchase Tax (OPT) on laptop computers, notebook computers and tablet computers have been signed by the Minister of Finance and the Secretary to the Cabinet, respectively, and are effective from Friday September 4, 2020."

He added that any VAT or OPT on these items that may have been inadvertently charged by the Customs and Excise Division as a result of a manual entry by an importer or an electronic entry that was already in the ASYCUDA (customs clearance) system before Friday but not yet imported as of that date, will be refunded. The waivers expire on December 31. He also posted images of the notices, but without numbers. And at 5.27pm, the minster tweeted the published legal notices, No 314 relating to VAT waivers and No 315 relating to the online purchase tax (OPT). Customs this evening confirmed it had received the notice. In updates to clients, courier companies also confirmed that they had received notice from Customs that the legal orders were issued.

Up to press time, a check to the e-gazette showed the notices were yet to be gazetted. The gazette, according the government information unit, contains official government information which, in many cases, must be published as a legal requirement.

Communication questions

In a statement, Opposition Leader Kamla Persad-Bissessar said Imbert was attempting to fool the population regarding the “immediate” removal of taxes on computers. She noted courier companies’ confusion and the lack of communication from Customs, which, since the notices were not yet published, continued to apply taxes on computers, contrary to the Minister’s first tweet. “This begs the question – was this nothing more than a PR stunt?” she asked. She credited her appeal on Friday for the removal of taxes for the minister’s “hasty” announcement on social media “without any proper process being followed.

“In his haste to appear magnanimous, Imbert has once again hoodwinked the nation, as none of the changes needed to ensure the taxes are indeed removed were instituted. The public is reminded that these taxes were introduced by the PNM in 2016 as increasing taxes was, and still remains their only plan for revenue,” she said.

This is not the first time Imbert has used Twitter to announce updates from his ministry via his personal account. He regularly updates his feed with posts relating to the government’s covid19 interventions, including an update on Tuesday regarding Salary Relief Grants: “SRG Update - the MOF has so far paid 74,549 Salary Relief Grants with a total value of $112M, comprising 28,948 for April, 24,836 for May and 20,765 for June. Resolution of queried SRG applications continues and applications will soon be re-invited from recently affected sectors.”

He also critiques media reports, particularly those critical of the ministry’s performance or else otherwise erroneous. He has recently commented on the CPL and the performance of the Trinbago Knight Riders. Imbert is also notorious for blocking certain people from following him, thus preventing them from being able to see his tweets, regardless of national importance. He has previously responded to this criticism saying his tweets are retweeted by the ministry’s official twitter account. That still would not allow those blocked to see them, though. Given Imbert's personality, however, his tweets are often newsworthy and thus covered as such.

Newsday asked Minister in the Office of the Prime Minister with responsibility for communications, Symon de Nobriga, about the process for disseminating government information, given the confusion created by Imbert’s tweets. De Nobriga said he would not want to answer right now as he was preparing a release outlining tax waivers that would address all concerns.

This story was originally published with the title

"Imbert: Legal orders for laptop tax waiver signed" and has been adjusted to include additional details. See original post below.

FINANCE MINISTER Colm Imbert on Tuesday released images of the legal orders approving the announced tax waivers for computers.

On Friday night at 9:30pm, following criticism earlier that day from Opposition Leader Kamla Persad-Bissessear that computers – including laptops and tablets – should be exempt from taxes, Imbert announced the waiver in a tweet.

"(On Thursday), based on a submission from the Ministry of Finance, in keeping with the commitment given in our PNM 2020 General Election Manifesto, Cabinet agreed to remove all taxes on laptops computers, notebook computers and tablet computers. This measure takes effect immediately," Imbert said.

He added in a second tweet that taxes were earmarked to be removed on devices including mobile and digital equipment, cell phones, software and accessories in the Finance Act of 2020, after the completion of the budget debate, in or around December.

There was, however, some confusion among sellers and consumers about the zero-rated status of devices.

On Tuesday, Newsday reported that the spike in demand, driven by import costs, meant higher prices despite Imbert's announcement.

The minister sought to clarify, via a statement from the Ministry of Finance, the status of regulations, noting that "the required legal orders for the zero-rating for Value Added Tax (VAT) and the remission (waiver) of Online Purchase Tax (OPT) on laptop computers, notebook computers and tablet computers have been signed by the Minister of Finance and the Secretary to the Cabinet, respectively, and are effective from Friday September 4, 2020."

He added that any VAT or OPT on these items that may have been inadvertently charged by the Customs and Excise Division as a result of a manual entry by an importer or an electronic entry that was already in the ASYCUDA (customs clearance) system before Friday but not yet imported as of that date, will be refunded. The waivers expire on December 31.

This story was originally published with the title "Imbert: Legal orders for laptop tax waiver signed" and has been adjusted to include additional details. See original post below.

FINANCE MINISTER Colm Imbert on Tuesday released images of the legal orders approving the announced tax waivers for computers.

On Friday night at 9:30pm, following criticism earlier that day from Opposition Leader Kamla Persad-Bissessear that computers – including laptops and tablets – should be exempt from taxes, Imbert announced the waiver in a tweet.

"(On Thursday), based on a submission from the Ministry of Finance, in keeping with the commitment given in our PNM 2020 General Election Manifesto, Cabinet agreed to remove all taxes on laptops computers, notebook computers and tablet computers. This measure takes effect immediately," Imbert said.

He added in a second tweet that taxes were earmarked to be removed on devices including mobile and digital equipment, cell phones, software and accessories in the Finance Act of 2020, after the completion of the budget debate, in or around December.

There was, however, some confusion among sellers and consumers about the zero-rated status of devices.

On Tuesday, Newsday reported that the spike in demand, driven by import costs, meant higher prices despite Imbert's announcement.

The minister sought to clarify, via a statement from the Ministry of Finance, the status of regulations, noting that "the required legal orders for the zero-rating for Value Added Tax (VAT) and the remission (waiver) of Online Purchase Tax (OPT) on laptop computers, notebook computers and tablet computers have been signed by the Minister of Finance and the Secretary to the Cabinet, respectively, and are effective from Friday September 4, 2020."

He added that any VAT or OPT on these items that may have been inadvertently charged by the Customs and Excise Division as a result of a manual entry by an importer or an electronic entry that was already in the ASYCUDA (customs clearance) system before Friday but not yet imported as of that date, will be refunded. The waivers expire on December 31.

Comments

"[UPDATED] Confusion over Colm mistweets"