Dear Finance Minister

BitDepth#1264

IN THE PNM manifesto for the 2020 election, these words were called out in large red type: "We will remove all taxes on computers, mobile and digital equipment, cell phones, software, and accessories."

I urge you to do so at the soonest possible opportunity and to go further by reversing the tax imposed on the importation of books into the country in January 2016.

Taxing computers was ill-advised, but including books in that cash trawl was an act devoid of conscience.

The PNM in governance is yet to put a definitive mark on the technology landscape, and this seems an excellent time to do so.

To that end, let me amplify my call for your reconsideration of import revenues to a consideration of the current lunacy at Customs and Excise that has thrown sand into the well-lubricated system of personal imports that the skybox system has established.

In March, the flow of goods through skybox channels completely tanked, according to Paul Pantin, chairman of the Express Logistics Committee of Amcham and director of eZone.

By May, with the slow and spotty resumption of cargo flights, business began to pick up and at eZone it is currently up 20 per cent on the basis of individual shipments in, the B2B segment of the import and export part of the business still largely dormant.

The Government has pushed hard to create TTBizLink to simplify government business, but Customs continues to resist the dozens of state agencies using the system with a parallel system, ASYCUDA. Sort of. The system has never been properly implemented in TT, updates to the software are long overdue and it currently has a limit of 500 packages per shipment in a business that routinely clears more than 700.

Pantin acknowledges that there's been fraud in a system that largely created itself in the 90s as a desire path for goods, but believes that there are solutions.

Shippers who demonstrate willingness to play by the rules should be allowed to create a C68 bond, a system that allows for self-clearance subject to arbitrary spot checks.

A noncommercial value limit of US$50, which Pantin has seen implemented in other Caribbean islands that eZone operates in, would allow more attention for higher-value items. Dominica has been doing it for years. St Lucia has introduced it.

The Government is completely misunderstanding online shopping. What you call forex leakage, I call just-in-time fulfilment.

For every pool table shipped in for a wealthy person's amusement, there are dozens of budget laptops for children.

Putting a heavy hand of governance on the free market by imposing a seven-per-cent tax on a functioning system and taxing cornerstones of a knowledge economy like computing goods and books isn't doing TT any good. It distorts the national capacity to adapt and manoeuvre in an environment of rapid change and sudden obsolescence.

Customs' interpretation of your desire for more revenue has become an exercise in power and brinksmanship. Goods are being left on the ramp out in the rain. Covid19 test strips are being denied temperature-controlled environments. A shipment of donated ventilators was stalled until Customs could be told who would pay the duty. Then they needed to know who would pay the VAT.

Losing tax revenue is always going to be a strategic decision.

Creating a regime for import that respects the wishes of local customers, serves agile businesses and rapidly evolving markets while encouraging purchases that promote a national agenda for technology development is where the Ministry of Finance should be putting its planning and efforts.

We are not there yet.

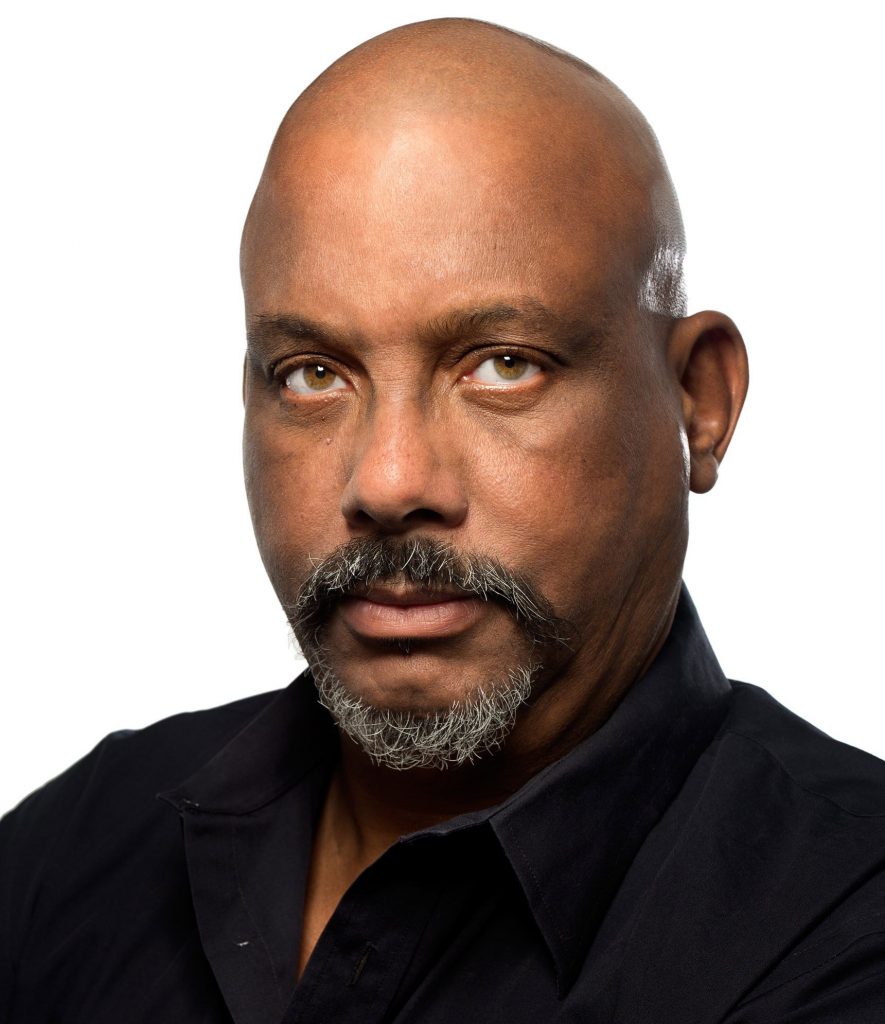

Mark Lyndersay is the editor of technewstt.com. An expanded version of this column can be found there

Comments

"Dear Finance Minister"