TT keeps watch over HSF nest egg

JENSEN LA VENDE AND CARLA BRIDGLAL

The global stock exchange meltdown over the last three or four weeks, triggered by negative investor sentiment over the spread of coronavirus and its impact on international supply chains has hit home in a very real and tangible way: the nation’s nest egg – the Heritage and Stabilisation Fund lost approximately five per cent of its value, or about US$300 million (just over TT$2 billion).

The HSF is TT’s sovereign wealth fund. As per the legislation that governs the fund, all the money that is contributed comes from petroleum profits and consequent returns on investments. Specifically, Section 13 of the Heritage and Stabilisation Fund Act (2007) states that for each quarter if the actual petroleum revenue exceeds the estimated revenue by more than ten per cent then that (or rather, the US dollar equivalent since that is the fund’s legal denomination) must be withdrawn from the Consolidated Fund and deposited into the HSF.

The current value of the fund is just about US$6.5 billion. Because of dampened energy commodity prices for about the last half decade, it’s been a while since the country has actually contributed to the fund, so most of the appreciation comes from accrued interest. According to the HSF quarterly investment report, the fund is nearly 83 per cent invested in the US markets (stocks and bonds), with up to 21 per cent in US core domestic equities and 17 per cent in non-US core international equities.

During a post-Cabinet media briefing last month, the Prime Minister underscored the predicament for the nation as it grapples with international volatility because of coronavirus.

“There are some bigger issues here for us,” Rowley said.

“As we look at the (effect) the virus is having on the international trading community, we in TT have some serious exposure." The performance of the HSF is directly connected to the performance of international stock markets. So if they are doing well, then the fund is doing well. If they are doing badly, for whatever reason, then we have concerns there.

“This time more than ever, to have our Heritage Fund underperforming or threatened by a collapsing market is something that every citizen should be knowledgeable and concerned about,” Rowley said.

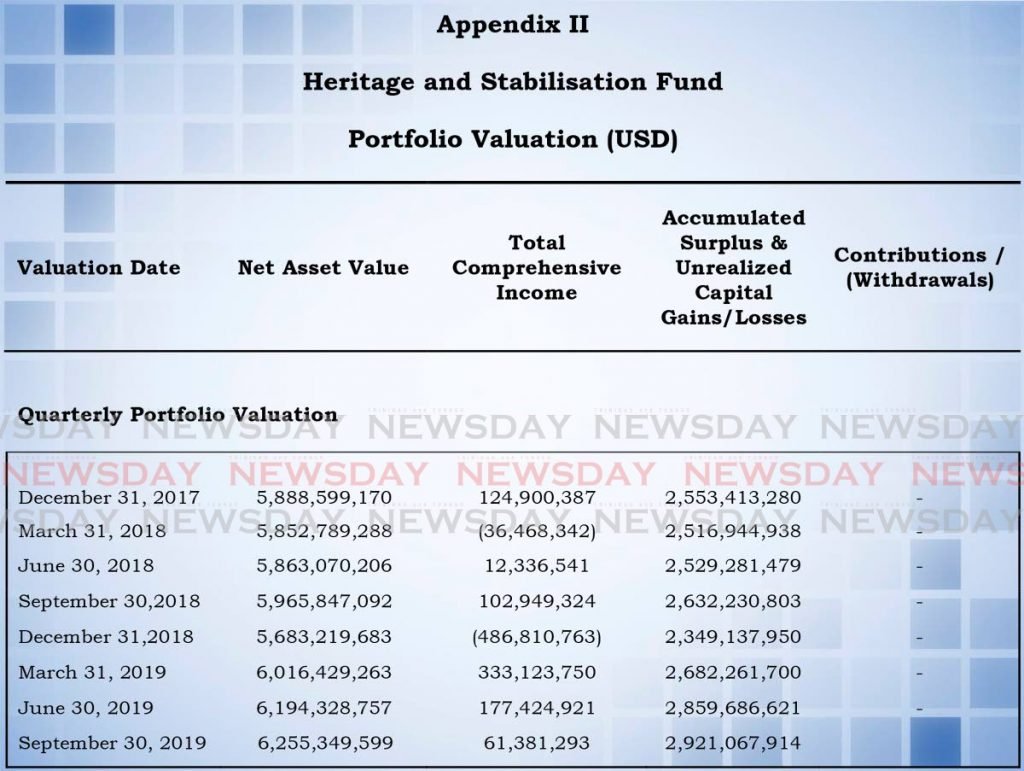

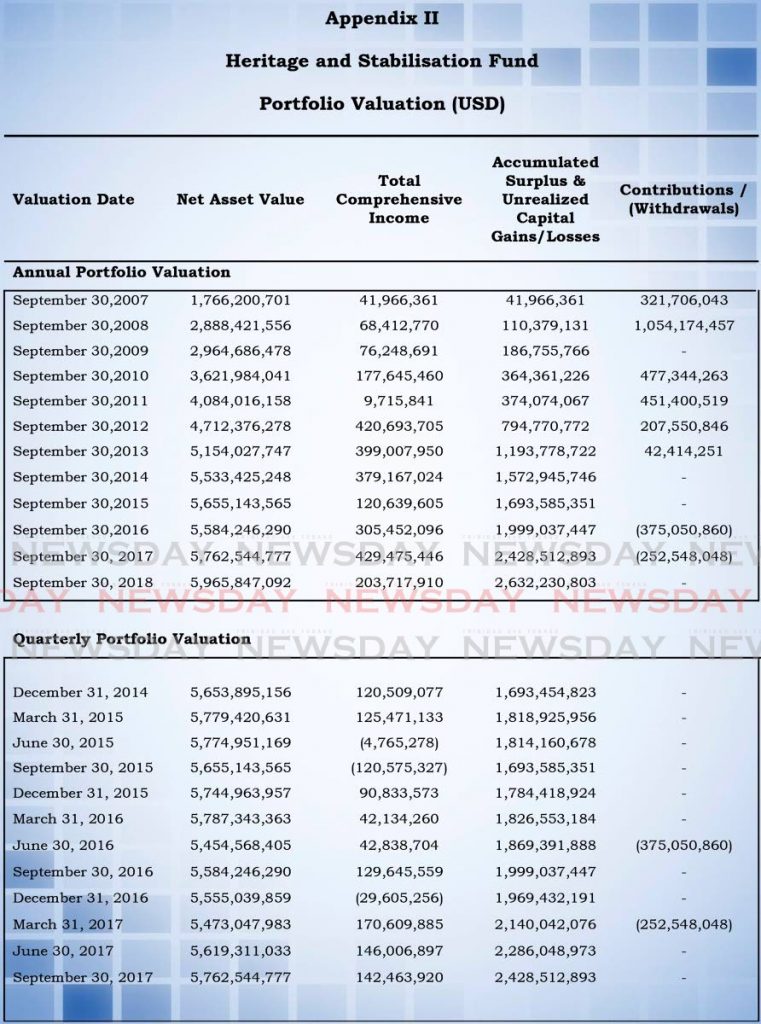

When the fund was started in 2007, the value was US$1.402 billion. During that fiscal year the government contributed a further US$321.6 million. In 2008, contributions amounted to US$1.054 billion. In 2009 there were no contributions. In 2010 there was no report (at least not available). In 2011, contributions were US$451.4 million; in 2012, US$207.5 million. 2013 was the last year contributions were made, amounting to US$42.5 million. So, in total, the Government has contributed just about US$3.48 billion to the fund.

Finance Minister Colm Imbert gave an update on the fund’s performance on Tuesday. He reassured the population that the fund is a long-term investment, and was doing “exceptionally well” before the market tailspin. Despite the volatility in the market, Imbert said: "I am reasonably comfortable the way it has been invested and the performance of the fund. I think the fund will be okay in the short to medium term."

Given the country’s tight economic environment, Government has, most recently in 2016 and 2017, dipped into the HSF to meet some of its obligations. Imbert has defended this by noting the fund’s role is to aid in the stabilisation of the economy when necessary. The now defunct Economic Development Advisory Board had even suggested among other things that the HSF be separated into two distinct entities – a heritage fund and a stabilisation fund.

Commodity prices also took a tumble on Monday when an oil price war between Russia and Saudi Arabia in an effort to undercut US shale produced triggered the biggest drop in oil prices since the Gulf War.

Government has now been forced to recalculate its budget with a downward projection of $3.5 billion in lost revenue. The budgeted price of oil has also been reduced from US$60 per barrel to US$40 per barrel, and natural gas is now pegged at US$1.80 per mmbtu from US$3 per mmbtu. This means the projected deficit will widen from $5 billion to about $9 billion. To close this gap, even as expenditure remains unchanged, Imbert acknowledged the government will have to look at its options, including loans, selling assets – and dipping into the HSF.

The benefit of taking from the HSF was two-fold. Firstly, public debt will not increase and the country will gain foreign exchange. The current debt to gross domestic product (GDP) ratio is approximately 65 per cent which amounts to $104 billion. The minister has said Government believes that it can take that threshold up to 70 per cent and still be able to reasonably manage the country’s debt.

But there are caveats. Since withdrawals from the HSF can only be done annually, the next time the minister can make a request to withdraw from the fund is in October, the start of the financial year. He did note, though, that there are plans to restructure the fund in an effort to make withdrawals easier. This will need parliamentary intervention with a simple majority to pass.

Imbert said he asked the management of the HSF to meet and discuss the way the fund currently operates. The team, which met Monday, was asked to look at the markets and the way the HSF is structured and how the funds are invested and whether there should be a shift from stocks to bonds, which are typically less volatile and thus considered a “safer” investment, even though the returns are usually lower than stocks.

Comments

"TT keeps watch over HSF nest egg"