Playing to pan's strengths

The experience of the Panland steelpan manufacturing company, highlighted in last week’s Business Day cover story, is instructive. Though some of the country’s greatest pan tuners have plied their trade at the company and its instruments have journeyed all over the world, it has still experienced challenges in moving beyond small scale, niche market operations and breaking into a wider, more secure marketplace. This, even with an entrepreneur of the year award in 1998.

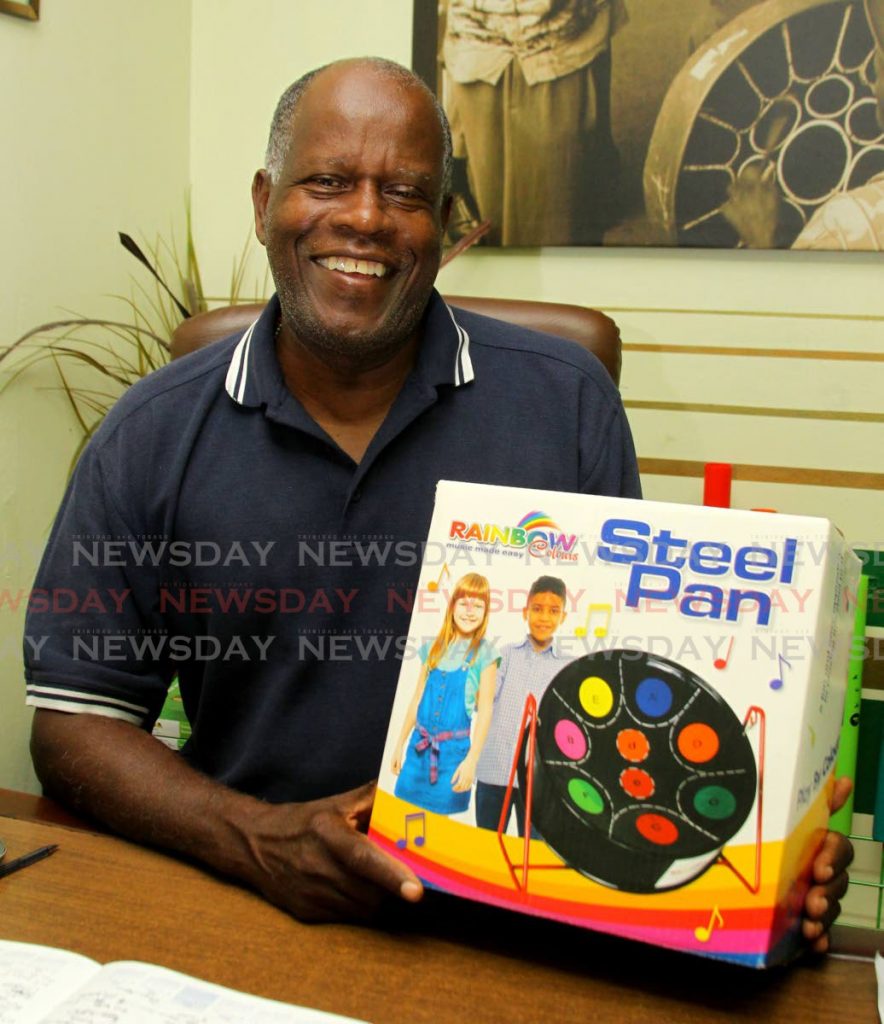

We applaud the company for its endurance, despite many ups and downs. As told by Panland president Michael Cooper, those ups and downs have been as varied as they have been complex, ranging from finding capital, experimenting with scale, surviving the loss of built-in markets, as well as the 2008 global economic recession. At one point, the company was forced to retrench. Staff shrank from 80 to fewer than ten.

“We still here,” Cooper said defiantly. “We owing plenty people but we still here.”

And yet for every Panland, there are dozens of similar firms that have not been as lucky. The company embodies the fact that more needs to be done to nurture the seeds of enterprise. How could it be that, notwithstanding our status as the inventor of steelpan, a company like Panland has been forced to focus on supplying the children’s toy market?

The competition may have something to do with it. There are companies all over the world that hold themselves out as pan manufacturers. There are about two dozen in the US alone, and others in the UK, Switzerland, The Netherlands, Japan, Germany, Canada, and even Australia. A few of these entities have ties to Trinidad, though they may not necessarily remit income. In such a crowded marketplace, Panland has been resourceful in focusing its attention on smaller products that also serve as training tools for up-and-coming tuners.

Still, all of this raises deeper questions about just who gets access to capital and funding. Why have we not been able to leverage our unique status to make a more dominant statement on the world stage?

Panland’s commitment to Laventille also marks it out as a company that has a social vision, in as much as it is clearly concerned with the business of its own survival. That sets the right tone.

There is some merit in the notion that the risk-averse attitude of the private sector has resulted in a shying away from bigger investments. But what explains this when funding comes from the State, where culture should be understood in more holistic terms? The recent $5 million grant is a welcome intervention.

But grant aside, the State has to remember pan is more than just Panorama. Does the steelpan manufacturing industry not have the potential to develop? We urge the state to build on this grant by doing more to make steelpan manufacturing attractive. This means reforming Pan Trinbago, and incorporating pan as a pillar of our budgetary diversification strategy.

Comments

"Playing to pan's strengths"