Banking in a virtual world

Banks around the world have transitioned many of their transactions to the online realm and there are even some banks in the US, Europe and Asia that are 100 per cent online. These are virtual banks and are completely branchless with digital features such as cheque deposits via smartphone and much, much more. But how are customers in TT faring? Business Day shares the answers of three banking groups – with a global and local outreach – which are on their way to the virtual world.

RBC's global reach

The Royal Bank of Canada (RBC) has over 86,000 employees, serves 16 million clients in Canada, the US and 34 other countries including TT. David Hewick, RBC’s senior director for channels, said it’s all about being a digitally-enabled relationship bank. “There is no question that we have an advantage being a global bank.” Hewick, based in Toronto, says the bank spent a lot of time analysing the Caribbean market.

“In Canada we’ve been adopting digital arguably over the last 20 to 25 years, with mobile and app being introduced in a substantial way in the last ten to 12 years.

"RBC only began its digital journey in TT about four years ago. We started later but we are moving faster. The smartphone adoption rate here is also faster than it was in Canada. The adoption of the technology in TT and the Caribbean at large has been at a more rapid rate. There are 1.7 phones per person in the Caribbean. More than is typical in Canada.”

When it came to adoption, Hewick remembers a bit of a contradiction. “At first, I was hearing that the adoption would be tricky because people still wanted to go into the bank and join the line and yet the biggest complaint from people was having to join the line.”

He said a lot of energy and resources were put into building their banking capability and systems so it was robust and reliable. “So that when you tell people that it’s 24/7 anywhere, anytime and from any device, that it actually was that, and it would work. We’ve had to really understand what some of the fears with adoption were because people have no trouble using Facebook or WhatsApp but are a little bit more sceptical when it comes to banking, so we put a lot of energy into our security.”

RBC is fully functional online. “We have the choice for customers to use whatever device they want. iPhone, Android, tablet, desktop or laptop and no matter which you use, you can have access to all the features and functions. You don’t get less of an experience on some devices. It’s full functionality across all devices. We also support our complete range of customers, from our retail customers with one debit card and one account, to our business customers from small and medium businesses to very large corporations who may have many hundred users. All of them can use our platform equally well.”

As for the operations of the bank itself, Henwick said technology is critical. “Just like every other business on the planet, we are competing in a new world with higher expectations and lower margins and customers expect things to be faster and cheaper. We have to compete in that world and banking is not immune to the transition that you see everywhere else. Nobody would have thought of Amazon ten years ago and now people would wonder why you would open a bricks and mortar store when it is so much easier to go online.”

Henwick said the bank’s internal operations are heavily reliant on a large array of digital products and services. “Everything from how our HR works to our payroll, procurement to our benefits to our legal and even to our ability to have social network interaction between our employees. We invest a lot of energy into those kinds of systems, and this is one case where all of those large investments that RBC makes at a global level benefit the staff in places like TT. If we were a very small company, we would not be able to make those investments.”

Republic plugs in online

With a history in TT that spans more than 181 years, Republic Bank has plugged into the world of online to improve its operations. Michelle Palmer-Keizer, general manager, group marketing and communications, said the bank is continuously identifying ways in which its processes and procedures can be improved. “Technology has been helpful in all of these areas. It has allowed the bank to modify its service offerings so that customers can access the services they need, when they need them and through the channels they prefer. The bank has also used technology to streamline its internal processes so that staff can serve customers with greater speed, efficiency and accuracy.”

Republic offers both online and mobile banking to its customers who can view account statements and balances, pay credit card and utility bills, transfer funds and more. Applications for other banking services such as loans and mortgages can also be submitted online. As for the uptake, Palmer-Keizer said its increasing daily. “Customer uptake for online and mobile banking has been increasing steadily and is especially good among millennial and Gen X customers. Almost all new customers sign up for online banking right away.”

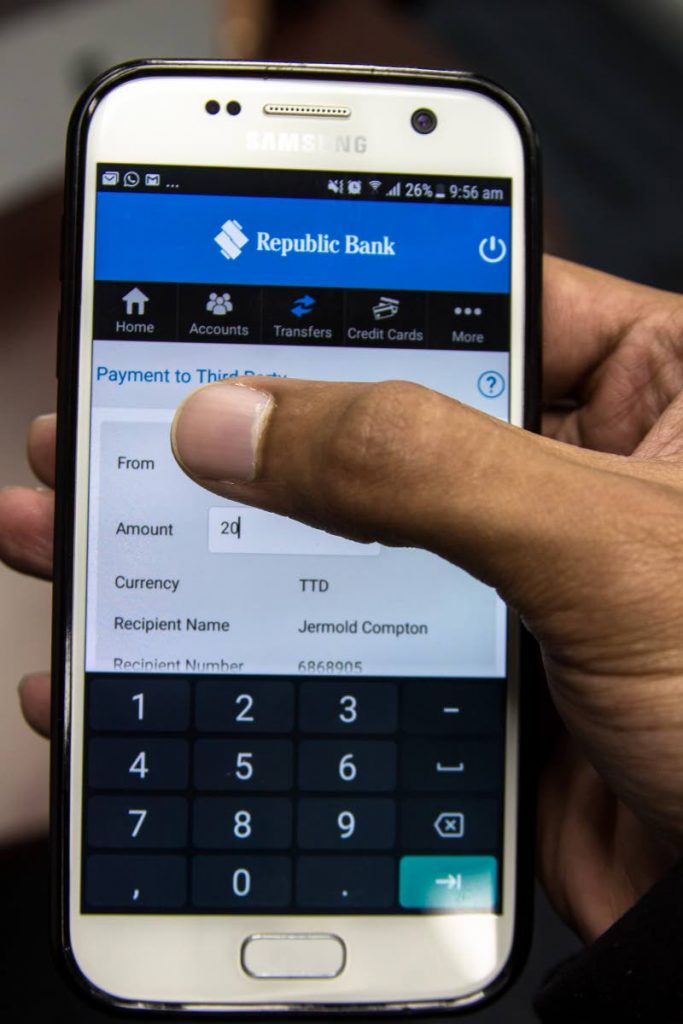

One of Republic Bank Ltd's (RBL) RepublicMobile application customers is seen here using the bank's new Cardless Cash service , which allows RBL customers to send up to $500 a day to either themselves or someone else, using a Transaction ID and Cash Code sent via text message. PHOTO BY ENRIQUE ASSOON. April 13, 2018.

Social media is also a digital channel that is important to Republic. “Social media is a powerful communication tool. It has allowed the bank to engage its customers in deeper and more meaningful ways and in real time on the platforms they are comfortable with. Customers can now communicate with the bank faster and easier. These clear, open lines of communication have helped the bank to better understand its customers and to build stronger relationships with them,” said Palmer-Keizer.

As for the digital uptake, it’s increasing, she said. “The increase in uptake for online and mobile banking services is a direct result of customers' growing awareness of the ease, convenience and security that digital processes deliver. As customers become increasingly digitally-enabled, they are coming to expect these services as part of the banking experience.”

JMMB expands beyond Jamaica

The JMMB Group began operations in 1992 as the first money market broker in Jamaica, The bank now serves more than 200,000 customers in Jamaica, the Dominican Republic and TT. Karryl Whitehall-Morren, marketing manager at JMMB Trinidad, confirmed that the bank offers online banking to both retail and business clients. “As a matter of fact, it is offered upon account opening. Our online banking platform offers you the comfort of banking wherever you are. Our system is both mobile and PC compatible and allows the user access to some unique features including the transfer of funds domestically between other local banks and internationally (wire transfers). To create standing orders, send stop cheque requests, order cash in local currency for pick-up at any branch, order cheque books, real-time transaction processing and updates and more."

JMMB currently enjoys 40 per cent online penetration when it comes to its total customer network. ‘Our online banking platform is one of our most frequently visited pages on our website. I would say that the local market is utilising this service more and more. JMMB Bank no longer provides paper bank statements as clients can easily access statements through our online portal. Our clients have embraced the change, and most appreciate the convenience that online baking provides. In particular, our millennial clients love using the portal,” said Whitehall-Morren. When it comes to the operations of the bank itself, she said the bank relies heavily on its digital processes. “Our internal back-end is supported by a mostly digital system and we are constantly upgrading those systems to ensure process efficiency. From our human resource portals that allows team members to manage leave and vacation schedules, to our internal communication systems that allow us to speak via soft phones or our own messenger system, we rely quite a bit on our digital processes.

“Clients usually are quite amenable to our digital services and adopt and adapt to them with deliberate guidance on our part. In fact our recent addition to the JMMB Group, JMMB Express Finance, has a digital portal which allows clients to complete their loan applications online. They do not have to come into the physical space and clients truly appreciate being able to send in their application anytime and from anywhere.”

Comments

"Banking in a virtual world"