Customer obsession

THE MOST successful companies are singularly focused on what their customers want and organisations in TT need to become "customer-obsessed."

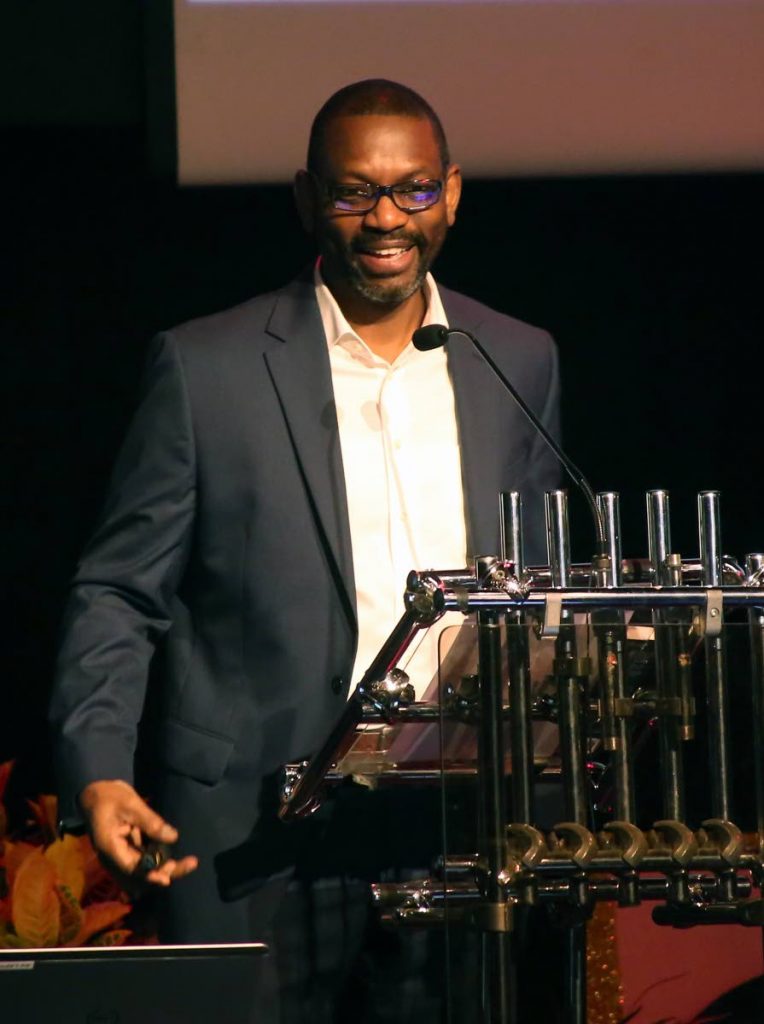

This was the advice of Richard Dick Solomon, international business consultant and author of The Signature Service Strategy, in his feature address at the Office of the Financial Services Ombudsman breakfast meeting held on July 5 at Central Bank Auditorium, Port of Spain.

He said some organisations think they can tell customers what they must do but that is absolutely changing.

"Customers will tell you what they want and it is you to decide if you want to go there. And if you don't, then suffer the consequences."

He said Amazon and its founder and chairman Jeff Bezos have launched an airline (Amazon Air) to move packages quicker to customers and are piloting drone systems to deliver to customers' backyards.

"Why is Jeff Bezos doing this? Well he figured out very early on that if you figure out what your customers want they keep paying you and they will pay you more. It's actually the best business strategy."

He said the 21st-century customer is busy and demanding and has less disposable income, and therefore will focus on "what's in it for me?" and "what's the return on my investment?" He stressed customers want speed, higher quality and better value.

"Customers don't want to wait any more. They are impatient. We want it our way and want it now."

Solomon said some organisations may have the attitude "where else will they go?" He recalled TSTT used to say that before Digicel came into TT and brought competition.

He reported statistics show that two thirds of customers leave a business for a service problem, 85 per cent are willing to pay more for a better service and 95 per cent say organisations do not exceed their service expectations.

"These are startling statistics."

He said 70 per cent of customers will do business with an organisation again if their problem is solved in their favour and that figure jumps to 95 per cent if the problem is solved on the spot.

"Long before it gets escalated to a supervisor, manager, CEO up to the Ombudsman's Office, if you solve the problem they will do business with you again. The faster you can solve the problem, the more likely they will do business with you."

He said, however, this requires empowering employees to make good decisions.

"There is money in focusing on the customer. Ninety per cent of customers consider service when doing business with an organisation."

He added that the happier the customer is, the more likely they are to buy more from the organisation and this helps with cross-selling.

He said organisations that want to improve service usually have a customer service training programme.

"No. It does not work. I'm not saying we shouldn't train our people; we have to. But if your systems are not aligned, if your decision-making is not aligned, if you are not clear about what's really important, if you're not empowering your people, if you're not hiring the right people et cetera it doesn't work. So what happens is you get a bump for a month or three weeks or five weeks and then you go back to the norm."

He added: "(It) doesn't matter what business you are in, you only need strategic focus on your customer. That is your overarching strategy. And what you should be doing is back flips to align everything else to where the customer needs to go."

Solomon cautioned that after a while organisations will not be able to compete on product but only in terms of service.

"If you are better than the guy next door then you stand a better chance."

He said the customer is not always right but the more organisations focus on what a customer needs then the more the customer wins.

"So it's either you're customer-obsessed or you're waiting to be made irrelevant by somebody who is."

Financial Services Ombudsman Dominic Stoddard, in his address, said the financial sector is one of the most important, vibrant and robust sectors of the economy and, as with any dynamic sector, it is in a constant state of flux.

"The most notable development in the recent past is the unrelenting drive towards digital financial services which has the desirable effect of increasing the speed and lowering the cost of financial transactions. There are also other benefits such as increasing access to financial services by the 'unbanked' through digital financial challenges."

He said, despite these advantages, many are left behind as digitisation has also brought in significant reduction in the number of touch points for direct interface with the public.

Comments

"Customer obsession"