Mission to market TT's fine-flavour

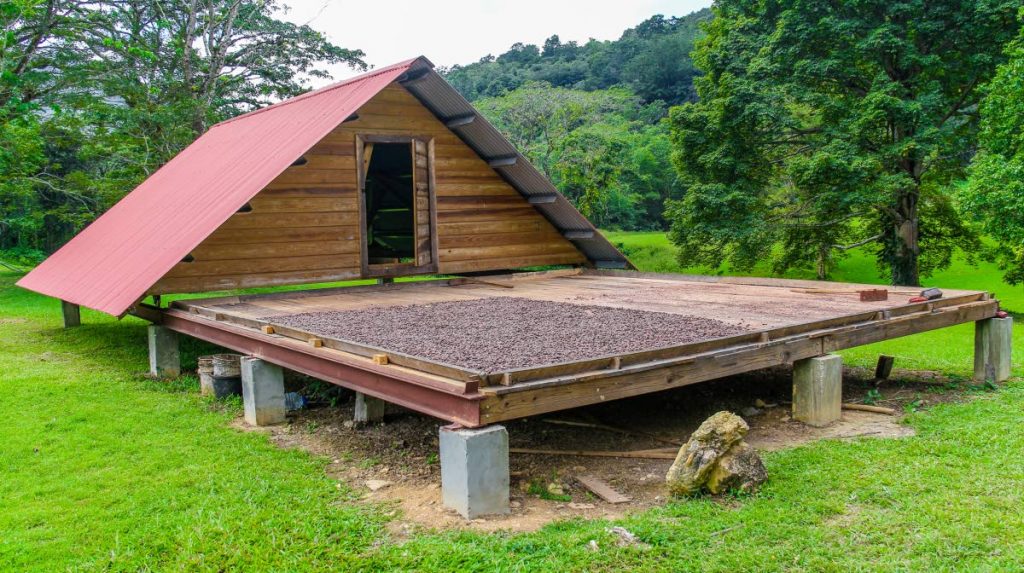

The production of fine-flavour cocoa is on the rise as farmers and farm owners are making use of training programmes, disease control campaigns, bulk transport from remote areas, and other facilities and services made available through the Cocoa Development Company of TT (CDCTT).

Recent data from CDCTT indicates that as of May 30, some 308 metric tonnes of fine-flavour cocoa has been produced in TT – well on course to cross last year’s total of 418 metric tonnes. In cocoa lingo, fine refers to the genetic make-up of the cocoa and flavour, the quality. Trinidad is unique among global cocoa producers in that 100 per cent of the country’s cocoa is classified as fine because of exclusive use of the Trinitario species of cocoa in commercial production. On average, an estate with 500 to 600 trees, typical of a local farmer, can in six months produce 400 kilogrammes of dry beans.

"Volumes are diminishing, however, as we are at the end of the usual crop season, although changing weather patterns are creating some harvests out of season,” said Gabriella Gonzales, CDCTT’s marketing, business development and communications manager.

Tamana, for example, in the Central Range, experienced heavier than normal rainfall for the dry season, she said.

Despite the weather – and several other challenges like staff shortages as well as being wholly dependent on a tight subvention from the government ($2.8 million in 2019) – the company reports improvement in the industry.

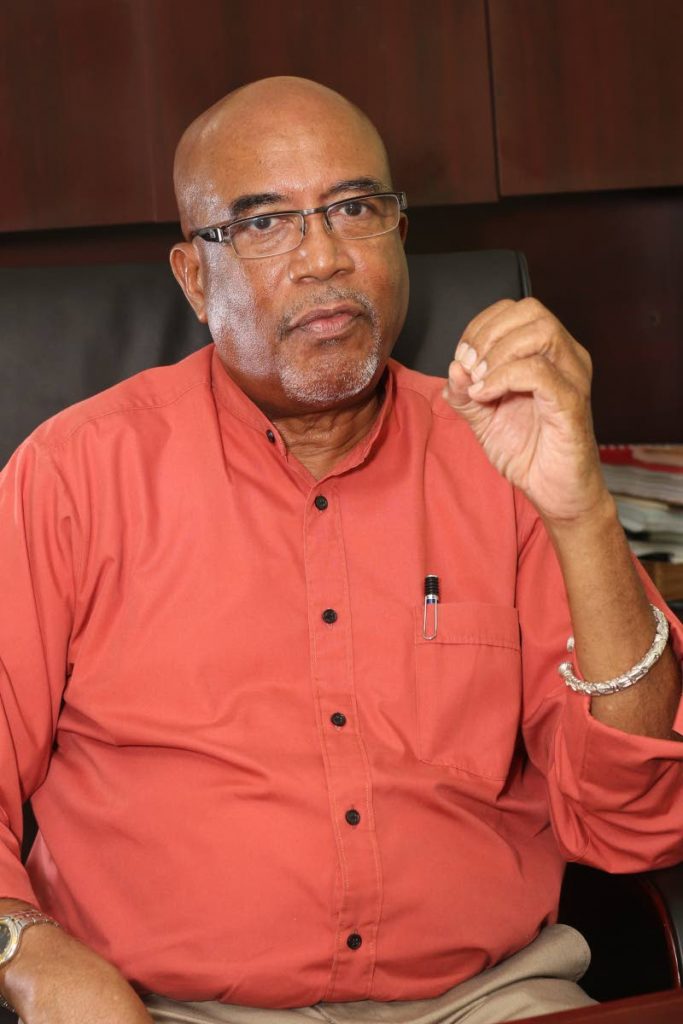

And while progress in the fine-flavour cocoa industry is welcome, TT remains a far cry from being the prominent player on the world market that it was a century ago. CDCTT chairman Winston Rudder offered reasons to feel optimistic about a potentially economy-saving industry.

First, he said, there needs to be a clearer understanding of the CDCTT and its mandate.

"The CDCTT, though incorporated as a state entity, is essentially a development organisation and it is not a commercial entity," Rudder told the Public Account (Enterprises) Committee of Parliament in February.

The company has been able to provide direct assistance to farmers, entrepreneurs along the cocoa value chain in specific communities. It has been working, he said, to staunch the decline in domestic cocoa production.

The CDCTT has since restored some confidence in the cocoa industry and has "also been able to build a very robust network across the stakeholder divide, not only focusing on farmers, but all the important, critical elements along the value chain.”

TT remains recognised by the International Cocoa Organisation (ICCO) as among the ten countries, which produce 100 per cent fine-flavour cocoa, the market for which is relatively small, highly specialised, extremely lucrative, and in fact growing.

While TT only produces about 400 tonnes of cocoa per annum – less than one per cent of total world output – it is one of the top producers of fine-flavour cocoa. And even though cocoa commodity prices are damp because of excess supply, TT cocoa can fetch almost twice the price of regular beans. Business Day was told that while the average price of a tonne of cocoa beans is US$2,400 per tonne, just by name recognition alone, TT’s cocoa can fetch as much as US$5,000 per tonne.

The CDCTT was established in 2014 as the successor to the Cocoa and Coffee Board. Along with the name, its mandate changed.

The former company was one which directly involved itself in the trade of cocoa, by purchasing and selling fine-flavour cocoa for and on behalf of farmers.

The newer company took on a mandate to facilitate trade by creating links for the farmer to the buyer, promote the industry through advertising, and provide services (and sometimes products) to farm owners, chocolatiers and other links in the value-added chain.

"Over the past four years that the CDCTT has been in operation, we have been part and parcel of a mechanism, flowing from the development of a national strategic plan for the cocoa industry that took place and was delivered by a committee commissioned by the minister around May 2017. This formed the basis for the CDCTT forming its own strategic plan," Rudder said.

Another part of its strategic plan is to provide training for farmers specific to cocoa.

Last year, for example, the CDCTT trained labourers who graduated from the CEPEP programme on cocoa-specific field activities to assist in forming a skilled labour pool from which farmers can draw.

He also agreed with recent comments made by Agriculture Minister Clarence Rambharat, who suggested farm owners utilise a new potential labour force in Venezuelan migrants, some of whom have indicated their willingness to work on the farms.

"Fast forward to the current reality, which is that for a multiplicity of reasons, the agricultural (sector), not only cocoa, in the country has not been able to be attractive enough to pay for labour and the price of labour has largely been dominated by the development of oil and gas and manufacturing sectors in TT, so not many want to pay high prices for labour, although in order to live a (certain) lifestyle in an economy like ours, workers require a decent wage."

The company currently employs 14 staff, although its organisational chart, set in the draft strategic plan, outlines positions for 21 members of staff, which was one of the reasons it said it moved to a larger building in Chaguanas (although the increased rent from $17,250 to $72,000 caused some alarm by committee members.)

"We failed to increase staff due to a lower government subvention than was requested in our budget proposal for fiscal 2018/2019,” Gonzales said.

Some of key vacancies include research officer, assistant to the production and quality manager, and quality auditor.

"Although hiring staff would have assisted us with being able to have more resources to fulfil our programme of work, we did not receive the budget to be able to support additional salaries. We are engaging some on the job training (OJT) candidates in the interim to help out with the workload."

Added to its challenges, according to Rudder, are the publicly aired misconceptions people have of the company’s purpose and mandate, which still gets confused for that of its predecessor.

He issued a statement in May to address this. “(The CDCTT) is the state entity charged with driving the development of the cocoa industry in TT, collaborating and coordinating with related support agencies to ensure the success of the local fine-flavour industry… (It) is not itself a buyer or trader of cocoa beans or products, but facilitates marketing and trade, by accessing and providing information to the relevant stakeholders.”

The number of cocoa farmers in TT range from 600 to 1,400 registered farmers, although some are inactive. The CDCTT works with some 660 of those active farmers, many in remote areas, providing assistance in terms of transport, training and trade. One secret they try to share – diversify. It might be good for the economy, but it’s also good in cocoa. Cocoa is a long-term crop – it can take up to five years for trees to start producing pods. The CDCTT recommends that on an estate about one hectare of land (just about 2.5 acres), cocoa farmers plant one acre with cocoa, one with small commercial crops, like lettuce, and the rest with other commercial trees like avocado and citrus, to help with viability.

One fundamental challenge though is that cocoa farmers are a dying breed. A CDCTT staffer, who chose to remain anonymous, told Business Day that among the farmers he has to interact with, most of them are in their 60s, with some even in their 80s. Many of these are landowners who are retired and fairly secure, so the impetus isn’t there for them to increase production. They also can’t work the fields as well as they used to and just don’t have the time, inclination or labour force to ramp up production. Many of them also have children who are not eager to join the family agriculture business.

“In order to make money (as an industry) you have to increase production. For young people especially, there needs to be a case made for this being a profitable venture that could provide a good life for an entrepreneur. The business model then needs to make cocoa farming not only innovative but it needs to make (financial sense.)”

Comments

"Mission to market TT’s fine-flavour"